Israeli authorities say two people, including a military reservist, have been arrested and indicted for allegedly leveraging secret intel to make savvy Polymarket trades on whether Israel would strike Iran.

The crackdown came from Israel’s Defense Ministry, Shin Bet internal security, and police, who announced Thursday that a reservist who was actually working with Shin Bet snagged classified details and used them to inform Polymarket trades tied to potential military action against Iran. A civilian accomplice reportedly got in on the action too.

Prosecutors are going ahead with charges, including serious security violations, bribery, and obstruction of justice. Officials warn that Polymarket trades fueled by leaked secrets create genuine threats to national security and IDF operations.

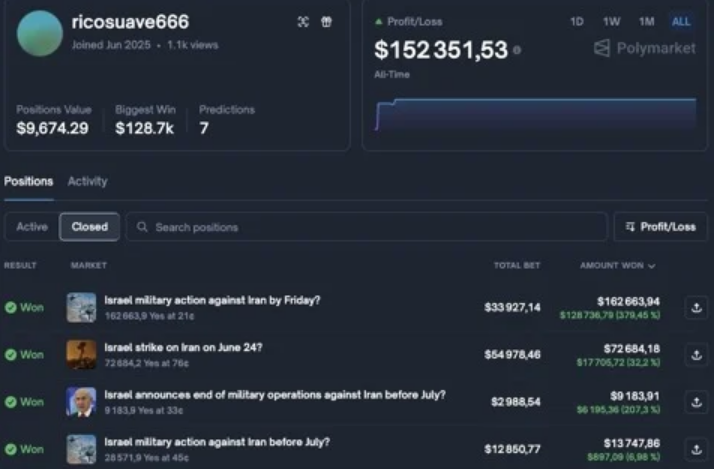

Back in June 2025, Israel’s state broadcaster Kan flagged suspicious activity on Polymarket. One user, “ricosuave666,” took out massive Polymarket trades on super-specific markets like “Israel strike on Iran on June 24” and “Israel military action against Iran by Friday.”

That last one alone cashed in over $128,700, pushing the account’s total profits past $152,300. Whether the arrested duo ran that account remains unclear, but the timing and precision raised red flags.

This isn’t Polymarket’s first brush with controversy this year

In Venezuela, a trader scored around $400,000 betting Nicolás Maduro would get ousted right before U.S. forces nabbed him. Insider edges in Polymarket trades keep sparking scandals, shaking confidence in these platforms.

Lawmakers globally are sounding alarms about Polymarket trades

World lawmakers say that when people exploit non-public info for Polymarket trades, it undermines fair play, distorts odds, and chips away at trust.

Israel’s Defense Ministry says these kinds of leaks pose “real security risks” to military ops and the nation as a whole. They vow to keep hunting anyone who crosses that line with classified info.

The reservist’s lawyer, speaking to Bloomberg, called the indictment “flawed” and noted that the national security harm charge got dropped. Still, the case highlights how prediction markets, for all their crowd-wisdom appeal, can turn dangerous when insider knowledge creeps in.