Venezuela’s stablecoin use is seen skyrocketing as citizens and the government alike turn to digital currency to navigate their economic hurdles.

The South American country is currently ravaged by sanctions, hyperinflation, and looming war threats. To defeat their enemy Venezuelans are making love to stablecoins like Tether (USDT) in everyday transactions.

This week after the U.S. Department of Defense positioned its aircraft carrier in the Caribbean close to Venezuelan waters, Venezuela’s stablecoin use has gained fresh momentum.

Why is there tension between the United States and Venezuela?

Now President Donald Trump has voiced intentions for military action against drug cartels he blames for America’s opioid crisis. Venezuelan President Nicolás Maduro has rejected the accusations, urging Trump to avoid conflict.

However, such geopolitical tensions directly amplify Venezuela’s stablecoin use which was originally triggered by triple-digit inflation, which erodes savings overnight.

As do other South Americans citizens like Bolivians against inflation.

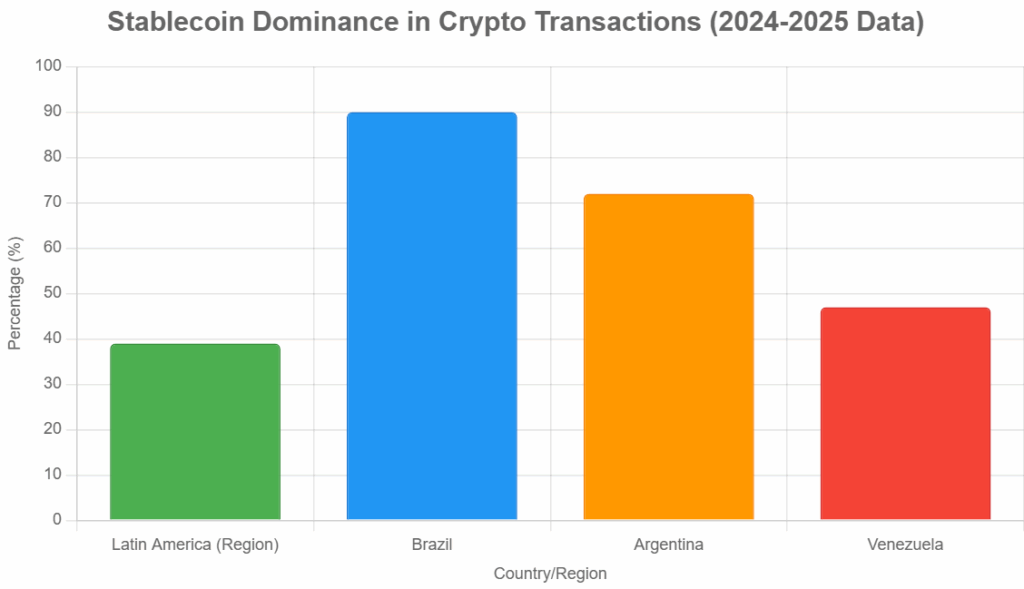

Stablecoin use in general has hit a major high in Latin American Countries.

Why has Venezuela’s Stablecoin use skyrocketed?

Stablecoins, often dubbed “Binance dollars” locally have evolved into a lifeline for payments and remittances. With physical U.S. dollar reserves scarce, Venezuela’s stablecoin use ensures that hard-earned money retains value.

In fact, as the war rhetoric escalates and sanctions persist, Venezuela’s stablecoin use could deepen further to foster greater economic stability for individuals and the state.

Crypto analytics are of the opinion that Venezuelans embracing stablecoins is not just a survival mechanism for everyday commerce but a move of great resilience.

The New York Times recently highlighted how Maduro’s administration has ingeniously “rewired” the economy around these assets. As a matter of fact, stablecoins now comprise up to half of the legal hard currency flowing into the nation.

Even political figures embrace the trend! The Venezuelan government leverages Venezuela’s stablecoin use to streamline oil trades with allies like Russia. Meanwhile, opposition leader Maria Corina Machado relies on Bitcoin to protect her assets from being seized. Her story mirrors that of nearly 8 million Venezuelans who have emigrated since 2013, fleeing shortages and unrest.

Luckily for Venezuela, all this positions the South American nation as a pioneer in managing public finances via crypto.