South Africa’s Reserve Bank just dropped a huge “not yet” on their home-grown CBDC (Central Bank Digital Currency).

In a research paper released on Thursday, the South African Reserve Bank (SARB) say there is no “strong immediate need” for a retail CBDC, even though building one would be technically possible tomorrow if they wanted to.

Instead, the bank wants to modernise the existing payments system and opening the national payment highway to more non-bank players.

Why Isn’t the South Africa Reserve Bank Jumping on the Retail CBDC Bandwagon?

The central bank believes projects like PayShap, real-time clearing upgrades, and wider financial inclusion efforts are already doing most of the work.

A retail CBDC would have to beat physical cash at its own game like offline payments, rock-solid privacy, zero cost, universal acceptance, and dead-simple usability,

With roughly 16% of South African adults still unbanked, a half-baked CBDC could do more harm than good.

“While the SARB does not currently advocate for the implementation of a retail CBDC, it will continue to monitor developments and will remain prepared to act should the need arise,” the paper stated.

Instead of chasing a CBDC for everyday people, the bank is shifting gears toward wholesale CBDC experiments and making cross-border payments faster and cheaper.

While cooling on retail CBDC plans, the SARB isn’t easing up on private digital money.

Just days before the CBDC paper, the bank flagged crypto assets and stablecoins as emerging risks, warning they’re being used to sidestep South Africa’s strict Exchange Control Regulations.

The Global CBDC Race Loses Another Sprinter

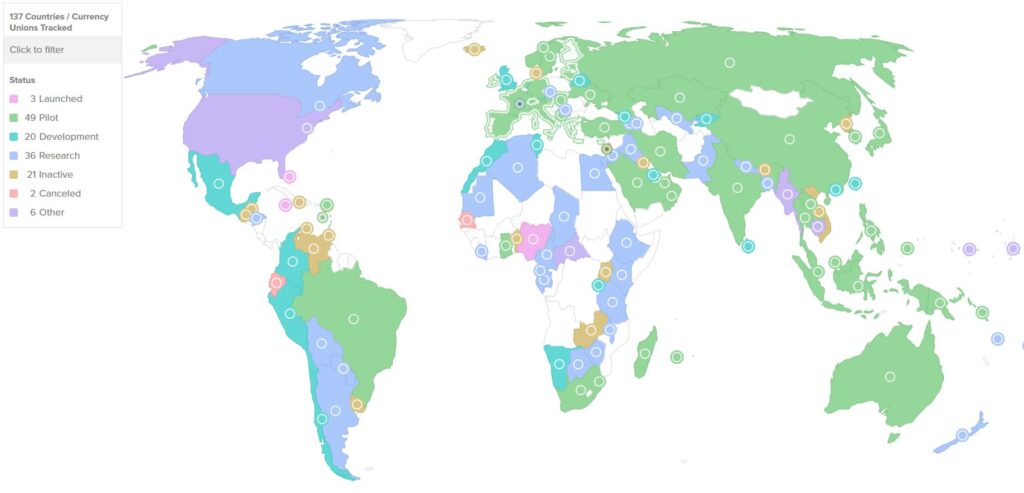

Globally, the CBDC frenzy has slowed down drastically with only Nigeria, Jamaica, and the Bahamas having fully launched retail versions.

Another 49 countries are piloting, 20 are actively building, and 36 are still in the research phase, according to the Atlantic Council’s tracker.

Meanwhile, the United States has quietly shelved any CBDC ambitions under the Trump administration.