The Australian regulator, ASIC, has locked in new exemptions that make it dramatically easier for businesses to distribute stablecoins and wrapped tokens without drowning in red tape.

Yes, you heard that right! Australia’s securities watchdog revealed it’s handing out “class relief” to intermediaries handling the secondary trading of certain stablecoins and wrapped tokens.

Put simply, companies can now forego costly individual licenses and transition to efficient omnibus accounts, provided they maintain impeccable records.

This rather bold step from the Australian regulator builds on earlier stablecoin carve-outs and scraps the old rule that forced intermediaries to hold separate Australian Financial Services (AFS) licences, just to touch these assets.

Australian Regulator sets far friendlier playground for everyone involved

“Today’s announcement from the Australian regulator finally levels the playing field for stablecoin innovation here,” said Drew Bradford, CEO of homegrown stablecoin issuer Macropod.

“Both startups and big players now get clearer rules, especially around reserves and asset management, which cuts the friction and gives the whole sector the confidence to build big.”

Bradford didn’t hold back on the impact.

“This kind of smart, measured clarity is precisely what we need to scale real-world payments, treasury management, cross-border transfers, and on-chain settlement.”

He went on to add that this move shows the “Australian regulator wants Australia to punch above its weight globally while still keeping the guardrails institutions and everyday users expect.”

The old licensing maze was a nightmare with costly, slow, and massive headaches while the country waited for full digital-asset laws. Now, thanks to the Australian regulator’s latest move, those barriers are crumbling.

Angela Ang, head of policy and strategic partnerships at TRM Labs also added that “Things are looking seriously bright for Australia right now.”

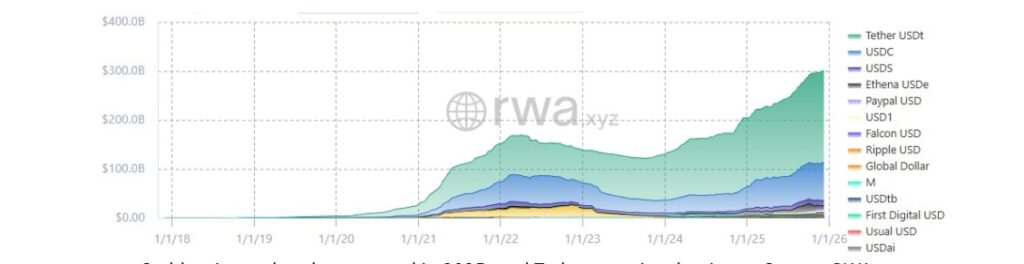

The global stablecoin market cap has smashed past $300 billion (a new all-time high, per RWA.xyz), up a massive 48% since January.

Stablecoins globally – courtesy RWA

Tether still rules the roost with 63% market share, but with the Australian regulator clearing the path, local players finally have a real shot at grabbing a bigger slice of this exploding pie.