Pakistan is charging full speed into $2 billion asset tokenization, teaming up with global crypto giant Binance.

The $2 billion in government-owned treasures includes sovereign bonds, treasury bills, oil, gas, and metals.

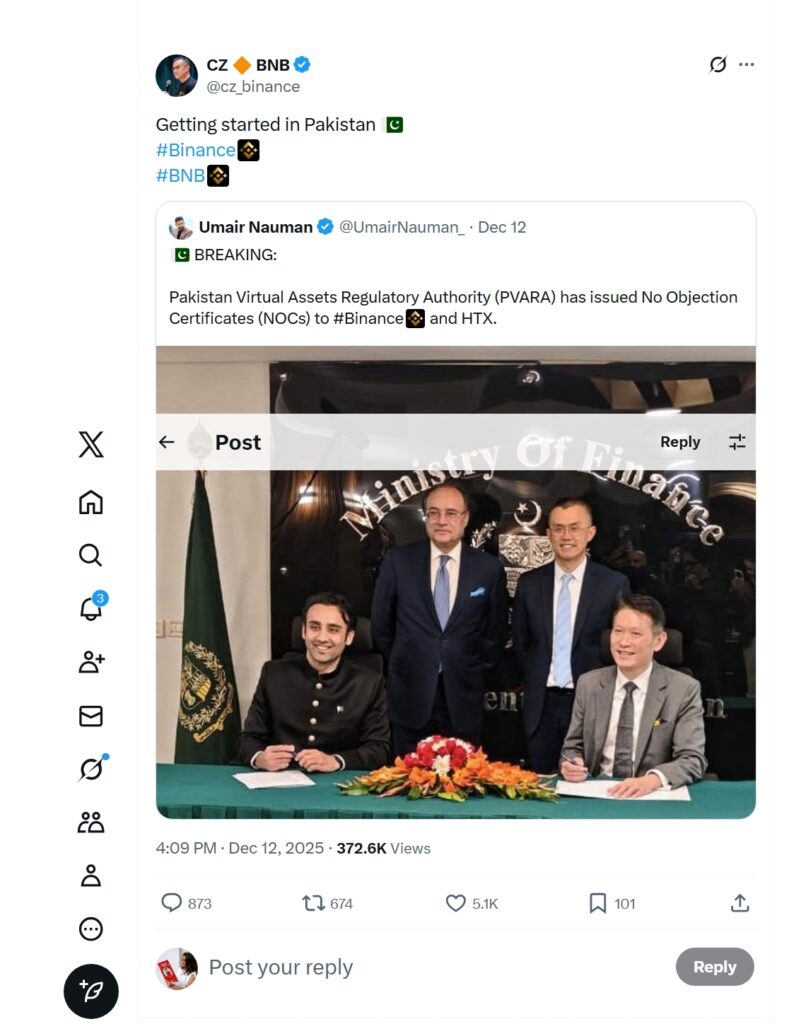

This exciting partnership kicked off with a fresh memorandum of understanding (MoU) from the finance ministry, where Binance steps in as the expert guide on blockchain-powered ways to distribute these assets.

Finance Minister Muhammad Aurangzeb couldn’t hide his enthusiasm about the asset tokenization, calling the deal a clear sign of Pakistan’s reform drive and the start of a lasting alliance with Binance.

“We’re all in on execution now, delivering fast and flawlessly,” he said.

Even Binance founder Changpeng “CZ” Zhao, advising the Pakistan Crypto Council, hailed it as a massive win for the country and the worldwide blockchain scene.

However, remember that the MoU isn’t binding yet, as it needs solid agreements in the next six months and all the regulatory green lights to move forward.

Pakistan’s National Stablecoin on the Horizon along with asset tokenization

Building on this buzz, Pakistan Virtual Assets Regulatory Authority (PVARA)’s Bilal bin Saqib recently confirmed at Binance Blockchain Week in Dubai that a sovereign stablecoin is absolutely coming.

He pitched it as a smart way to back government debt, alongside a central bank digital currency trial.

“Why lag behind when we’ve got the youth, the adoption, and the drive to lead in financial tech?” Saqib challenged.

Pakistan’s been sprinting ahead, launching the Crypto Council in March, PVARA in July, and even exploring asset tokenization with World Liberty Financial back in April through a letter of intent. Then in May, they unveiled a strategic Bitcoin reserve and dedicated 2,000 megawatts of power for Bitcoin mining and AI hubs.