Optimism drove the market on Wednesday morning, but it faded fast by the end of the day. The U.S. Federal Reserve delivered the widely anticipated interest rate cut yesterday, giving investors exactly what they had hoped for. But the mood shifted quickly when Fed officials signalled something more troubling: a labour market showing deeper signs of strain than many had realized. By the end of the day, the optimism had faded, and so had the market’s early gains.

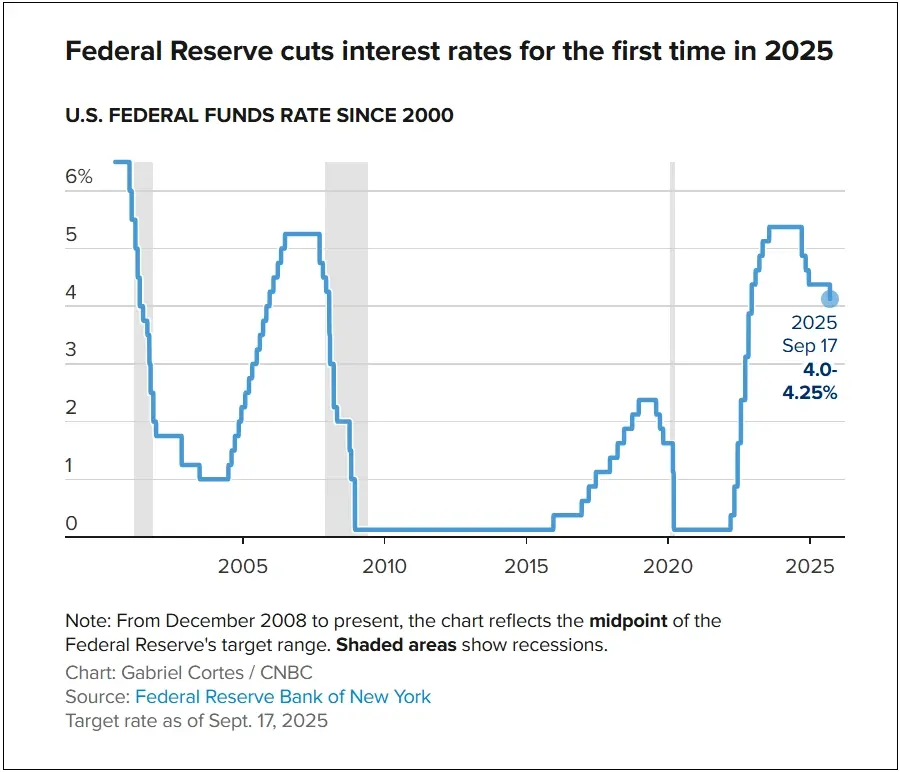

The Federal Reserve’s policy-making committee voted 11 to 1 to reduce interest rates by 0.25 percentage points — a move that makes borrowing cheaper for everything from mortgages to business loans. The cut brings the Fed’s key interest rate down to a range of 4% to 4.25%, marking the first time since December that the central bank has lowered rates in an effort to support economic growth by encouraging spending and investment.

But post this, Wall Street’s initial euphoria quickly faded as Fed Chair Jerome Powell characterized the move as a “risk management cut,” tempering expectations for aggressive future reductions. The comment sent mixed signals through trading floors, with investors caught between celebrating lower borrowing costs and worrying about underlying economic weaknesses.

Key U.S. market indices ended the day with a mixed performance. U.S. market indices ended the day with a mixed performance. The S&P 500 inched down 0.1% to 6,600.35, while the Nasdaq Composite slipped 0.3% to 22,261.33, dragged lower by declines in major technology stocks as investors weighed concerns over the economic outlook. But the Dow Jones Industrial Average stood apart from the pack—rising 260 points, or 0.6%, to 46,018.32 after hitting a record high earlier in the session.

The day’s standout performer came from the small-cap sector, where the Russell 2000 climbed 0.18%. This index, which tracks roughly 2,000 smaller U.S. companies, often serves as a barometer for how these businesses — more sensitive to interest rate changes due to variable debt — might benefit from cheaper financing. The Russell even touched its first record high in nearly four years before pulling back, reflecting cautious optimism among investors.

Some of the biggest tech companies, like Nvidia, Oracle, Palantir, and Broadcom, saw their stock prices fall as investors cashed out to lock in recent profits. In contrast, the interest rate cut benefited sectors that are more sensitive to borrowing costs — like banks and retailers — which saw renewed investor interest.

Crypto Markets Diverge with a Bullish Breakout

The crypto market surged after the Fed Rate Cut. At the time of the announcement, the global crypto market cap stood at $3.93 trillion, rising to $4.04 trillion at the time of writing—a gain of 2.76%. Bitcoin edged past the $118,000 mark, while Ethereum rose nearly 2% to exceed $4,600. Altcoins like XRP and Dogecoin also posted notable gains, hinting at capital rotation beneath the surface. ETF inflows and rising institutional demand fuelled this rally, reinforcing optimism among traders and long-term investors.

Despite initial volatility, Bitcoin moved steadily upward, suggesting that the market had partially priced in the rate cut. Analysts believe Bitcoin could regain momentum toward $120,000 if key catalysts align. However, caution remains. Traders continue to assess Fed Chair Jerome Powell’s comments, while upcoming central bank meetings could dictate the next big move. Overall, investor sentiment appears cautiously bullish in this evolving policy landscape.

The Fed’s next policy meeting begins end October, with another scheduled for December. Markets now face the daunting challenge of interpreting economic data through the lens of a central bank that appears increasingly data-dependent and less committed to a predetermined path driven by the interests of some.

Industry experts expect this measured approach to keep both equity and crypto markets in a wait-and-watch mode. Long-term investors remain optimistic, viewing rate cuts as a supportive backdrop for risk assets, but they also warn that sustained momentum will depend on inflation trends, employment data, and global macro stability.