The distinction between traditional banking and the cryptocurrency industry has become increasingly hazy. The U.S. federal regulators have permitted traditional banks to act as go-betweens in digital currency deals, a move that signals Washington’s growing comfort with crypto.

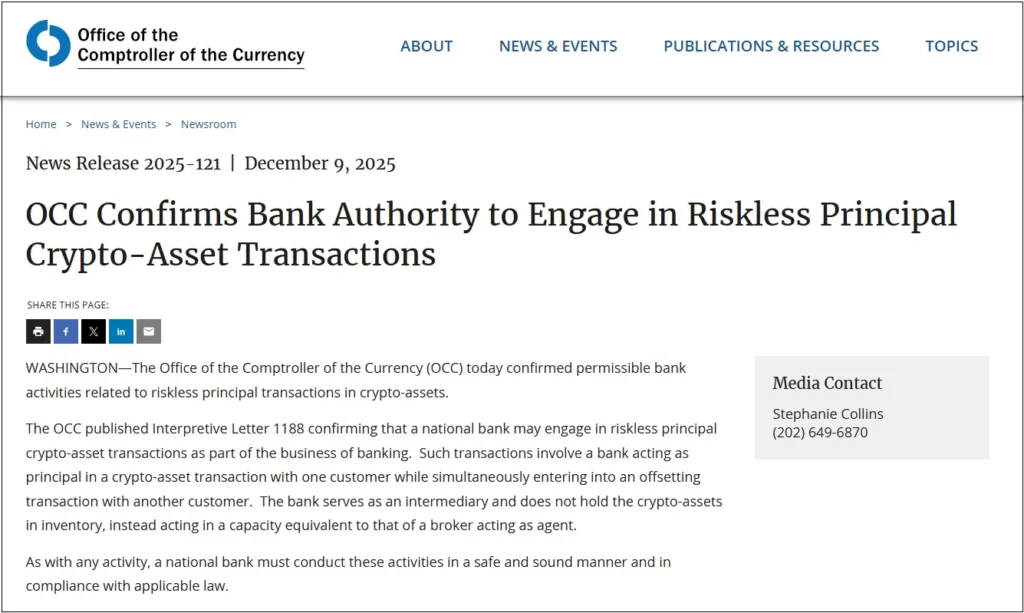

The U.S. Office of the Comptroller of the Currency (OCC) — the main regulator for national banks — said on Tuesday that banks can handle what regulators call “riskless principal” transactions with digital assets. In plain terms, banks buy crypto from one customer and immediately flip it to another. They don’t keep any cryptocurrency on their balance sheets—except in rare cases—which keeps their risk exposure minimal.

This latest announcement wraps up an amazing year where regulators have really eased up on crypto rules. Back in March, the OCC dropped the requirement for banks to get special permission upfront before getting involved in crypto activities like custody or stablecoins.

Those tougher rules had been put in place after the big crypto crashes in 2022 and 2023, which scared regulators into being extra cautious. Now, things are loosening up again.

The Federal Deposit Insurance Corporation made similar moves in March, telling banks that they no longer needed pre-approval for certain digital asset work. The Federal Reserve went further, shutting down its Novel Activities Supervision Program entirely. That program had treated crypto as something exotic that needed special monitoring. Now the Fed says it understands digital assets well enough to oversee them through regular channels.

Banks Making Use of the Opportunity

In a sign of traditional finance’s accelerating embrace of digital assets, SoFi became the first nationally chartered U.S. bank to offer cryptocurrency trading directly to retail customers last month. On November 11, it launched SoFi Crypto, enabling everyday users to buy, sell, and hold assets such as Bitcoin, Ethereum, and Solana seamlessly within its app, funded straight from their bank accounts.

A few weeks later, on December 9, PNC Bank followed, starting direct spot Bitcoin trading for its clients through its Private Bank platform. Powered by a partnership with Coinbase, this allows wealthy customers to purchase and hold Bitcoin without leaving their PNC accounts, marking PNC as the first major U.S. bank to introduce such integrated access for private banking clients.

However, not everyone’s celebrating. Critics say linking traditional banks with cryptocurrency’s wild price swings could destabilise the broader financial system. But the Trump administration has made it clear: crypto is here to stay, and banks need to adapt.