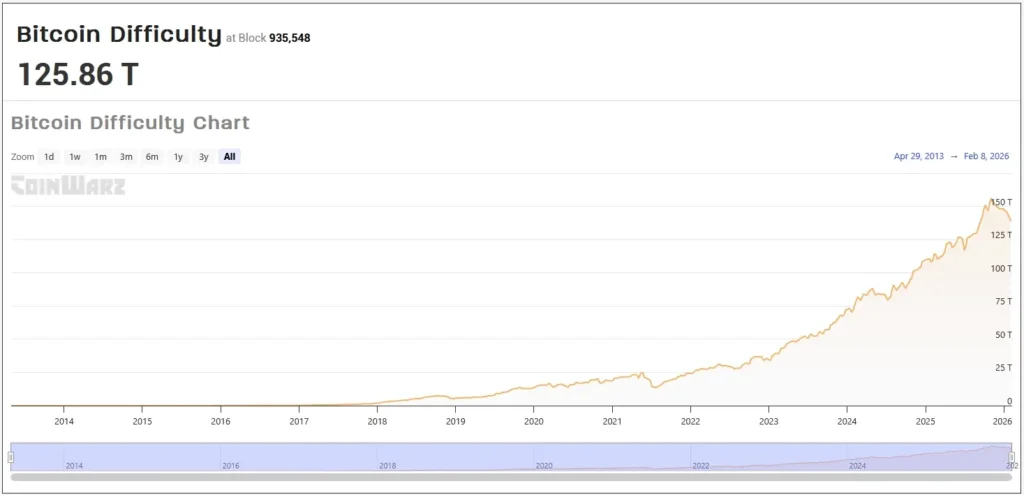

Bitcoin’s mining difficulty crashed by 11.16% on February 7, and this is the steepest single-period decline the network has seen since China banned cryptocurrency mining in July 2021. The adjustment, occurring at block height 935,424, caused the difficulty to drop from 141.67 trillion to 125.86 trillion, a drop that has sparked significant discussion within the industry.

The plunge marks the 10th largest negative percentage adjustment in Bitcoin’s entire history and shows just how much pressure miners are under right now, according to data from blockchain explorer Mempool and Bitcoin developer Mononaut.

Depending on the perspective, the difficulty drop presents two distinct narratives. For most of the industry, it is bad news: Bitcoin’s price has gone down from over $126,000 down to the $69,000-$70,000 range, and that’s made mining unprofitable for many operators. Many miners have been forced to shut down their machines due to narrow margins, power outages caused by storms, and rising costs. The decline in total mining power shows the extent of the sector’s pain.

But what about the miners who have managed to keep their rigs running through all this? Right now, they are in an advantageous position. Difficulty level decreasing means easier mining conditions, and better profits. This will be true at least until the next adjustment cycle that will take place in a couple weeks.

Price Collapse and Winter Storm Hit at Worst Possible Time

Two events occurred simultaneously, significantly impacting the hashrate—the total computing power that all Bitcoin miners worldwide are using to process transactions and secure the network. Firstly, the price of Bitcoin plummeted sharply, plummeting more than 45% from its October peak above $126,000. It reached a low point near $60,000 on February 5 before gradually rebounding to around $70,000. The selloff got worse because of rising Treasury yields, steady outflows from U.S. spot Bitcoin ETFs, and investors pulling back from risky assets across the board. U.S. spot Bitcoin ETFs actually became net sellers in 2026, which tells you something about sentiment right now, according to SoSoValue data.

Then Winter Storm Fern came along in late January in the U.S. and made everything worse. Operations across multiple U.S. power regions had to shut down to help keep residential grids from collapsing under the strain. The storm knocked about 200 exahashes per second (EH/s) offline, and mining giant Foundry USA got badly affected—its hashrate dropped roughly 60%, falling from nearly 400 EH/s down to about 198 EH/s before it managed to recover to over 354 EH/s.

Economics of Mining Hit Rock Bottom

The network’s total hashrate has fallen roughly 20% over the past month, with 11% of that drop happening just in the past week. It is now at around 863 EH/s, which is way down from the near all-time highs above 1.1 zettahashes per second we saw back in October. Average block times had stretched out to about 11.4 minutes before the retarget, well above where the protocol wants them at 10 minutes.

Hashprice—basically what miners expect to earn per unit of computing power—hit an all-time low of $33.31 per petahash per second per day on February 2. Most people in the industry say $40/PH/s/day is the line where miners really have to think hard about whether it’s worth keeping their machines on.

Right now, only the newest Antminer S23 series machines used for Bitcoin mining are helping miners make a bit of money. Older models like the Whatsminer M6 series and Antminer S21 units are either barely scraping by or actually losing money with every block they mine, based on Antpool data. The difficulty adjustment gives the miners still standing some relief, though it won’t last long—projections show difficulty bouncing back up 5.63% to 132.96 trillion when the next adjustment hits on February 20.