BlackRock is not only the largest asset manager in the world, but also a financial industry giant that indirectly influences the market, the political scene and even the economy of a given country. The company was founded in the late 1980s and started off as a small risk-management firm, eventually transforming into the protector of trillions of dollars in investments worldwide. Today, the company’s influence is felt in a wide array of areas including Wall Street, governments, and international institutions which puts it in a very rare and therefore exceptional position in global finance.

The risk and data-theology combined with the company’s advanced risk management capabilities leading to its Aladdin system, which is a short for Asset, Liability, Debt and Derivative Investment Network. It is an analytics power house that gave BlackRock an unparalleled and deep insight into the global markets which in turn allowed the firm to better predict and manage the risks than its rivals.

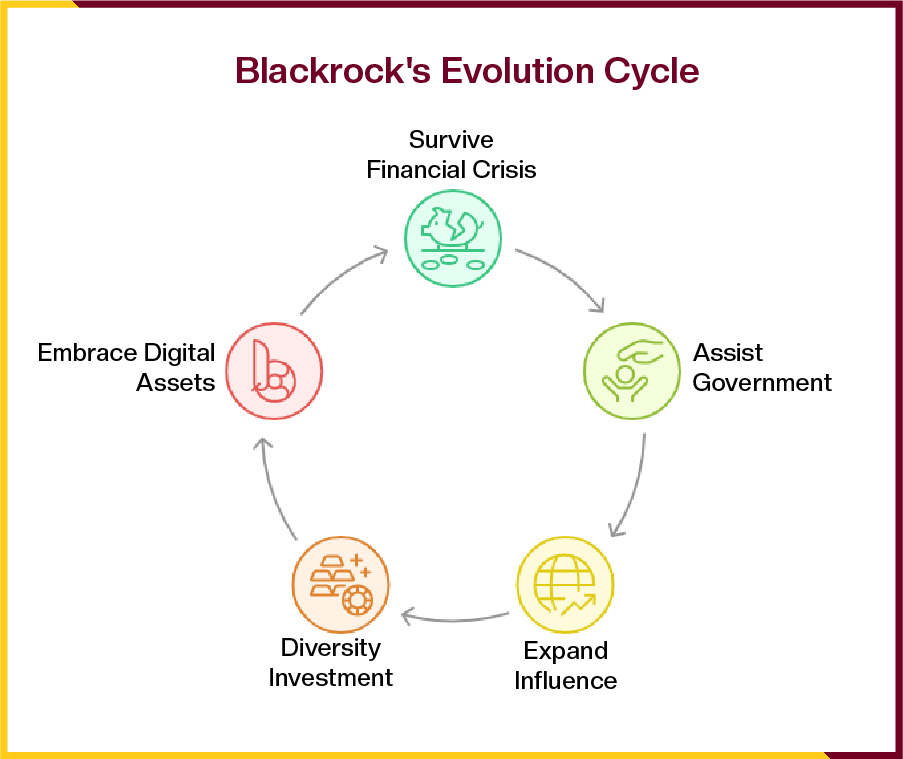

The financial crisis of 2008 was not only the period when BlackRock proved its claim of being an invulnerable player; it also earned the right to be called a rescuer. It was the firm that governments turned to when they needed help in getting rid of the toxic assets, and the trust that was built around such a scenario further established BlackRock’s reputation as the crisis-favored firm.

As a new era of finance development characterized by the digital aspect begins to unfold, BlackRock is again at the forefront of change. The company’s increasing interest in Bitcoin, blockchain, and tokenization is a clear signal that the crypto market is becoming relevant even in the case of the world’s most conservative financial institutions. BlackRock, whether it is through the approval of a Bitcoin ETF or the study of digital asset infrastructure, is positioning itself to be at the helm of the finance that already has one foot in the past and the other in the future.

How BlackRock Became a Financial Giant

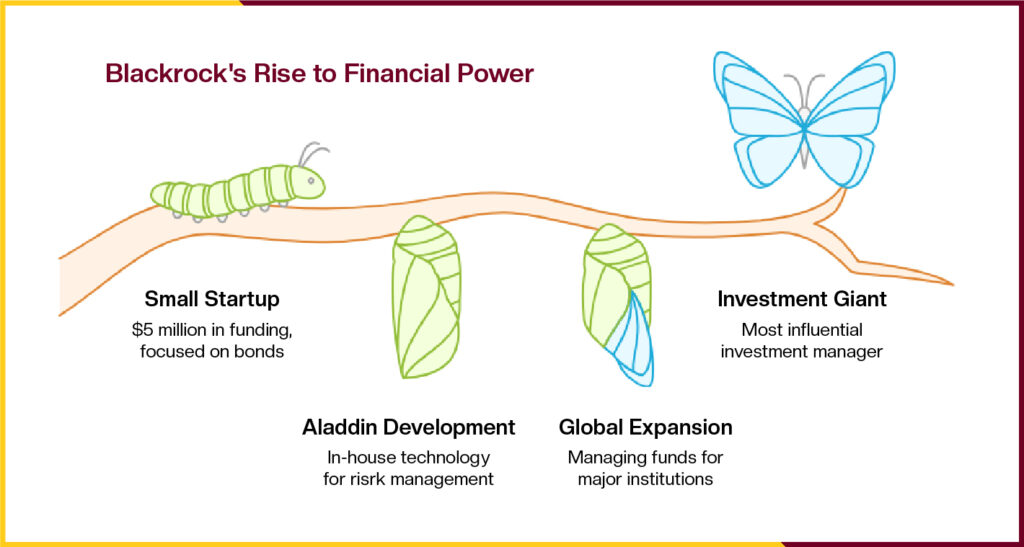

BlackRock began in 1988 as a small firm founded by Larry Fink and a group of partners who believed that risk management could reshape the investment world. Fink, who had previously worked at First Boston and learned painful lessons from a major trading loss, wanted to build a company that used data and technology to understand and control financial risks. Starting with just $5 million in seed funding, the firm focused on fixed-income investments “bonds” rather than stocks, giving it a stable base in a volatile market.

The turning point came when BlackRock developed Aladdin. This in-house system was designed to track and analyze massive amounts of financial data in real time. What started as an internal tool soon became one of the most powerful financial analytics platforms in the world, helping BlackRock, and eventually many other institutions, identify risks before they turned into disasters. Aladdin became the brain behind nearly every decision the firm made, earning BlackRock a reputation for precision and discipline.

By the late 1990s and early 2000s, BlackRock’s focus on transparency and data-driven management paid off. The company expanded globally, managing assets for governments, banks, and major corporations. Each year, it grew stronger not through flashy trades, but through trust institutions relied on BlackRock to handle their money safely. That foundation of credibility and smart risk management turned a once-small startup into the most powerful investment manager in modern finance.

From Crisis Powerhouse to Digital Pioneer

It was during the 2008 global financial crisis that BlackRock’s renowned status as a financial titan was firmly established. Most of the banks went bankrupt because of their exposure to high-risk mortgage assets, but BlackRock remained unscathed. The firm’s Aladdin system gave it the power to assess and control the most intricate portfolios in the market when only a few others could manage them. The U.S. government and the Federal Reserve requested BlackRock’s assistance in disposing of the financial trash when the situation deteriorated. The firm operated the major bailout programs, evaluated the bad assets, and consulted with the top decision-makers. This episode switched BlackRock from a well-respected asset manager to the world’s trusted financial stability expert.

In the aftermath of 2008, the company’s impact grew even further. It became a silent partner to central banks and the biggest companies all over the world providing the dual service of financial management and risk analysis. BlackRock, under Fink’s leadership, made the company even more diverse by entering into new markets with such investments as environment, technology-driven funds, and pension management globally. With trillions in control and clients almost everywhere in the world, the firm got the nickname of “the company that owns everything.” Its size and diversity brought it both admiration and condemnation, a representation of the power concentration in modern capitalism.

Just like that, BlackRock is changing again as the financial world moves to digital assets and blockchain. It is a profound change for the company to adopt the use of Bitcoin and tokenization, which is a total opposite of its previous conservative stance.

BlackRock and the Crypto Revolution

The connection between BlackRock and crypto was not established suddenly. For many years Fink was among the most vocal adversaries of Bitcoin, labeling it as a means for speculation and money laundering. However, eventually, he came to that conclusion due to the growing participation of institutions and the maturing of the market. The watershed moment soon came when BlackRock came to the conclusion that digital assets were no longer just an experiment at the outer edges, but slowly becoming a part of financial systems across the globe. The company then started to look at the blockchain not as a menace, but as an enabling factor to revamp the way value is kept and exchanged.

In the year 2023, BlackRock got a lot of attention when it submitted the application for a Bitcoin spot ETF, a step which significantly influenced the whole industry. Not long after, the U.S. Securities and Exchange Commission (SEC) gave the green light to the application which allowed mainstream investors to step into Bitcoin using traditional markets. Regulator’s approval not only gave Bitcoin’s price a boost; it also helped in removing the stigma around crypto on Wall Street. A lot of analysts considered it to be the most important move in the direction of combining traditional finance with digital assets.

BlackRock has not stopped ultimately extending its reach in the blockchain arena after that. It has looked into the locking up of real-world assets converting bonds, real estate, and other such traditional securities into digital tokens on the respective blockchain networks. Fink has gone ahead to say that tokenization could “revolutionize the way financial markets operate,” speeding up, cutting down the cost, and making it all the more transparent. BlackRock, alongside the likes of Google, Amazon, and Apple, is now helping to decide the future of crypto not by directly challenging it through the outside, but rather, acting as a passage between old finance and the digital economy using its scale, reliability, and technological strength.