- What is Bitcoin and how does it work?

- How is Bitcoin different from other currencies and why is it revolutionary?

- What are the main risks of investing in bitcoin?

Bitcoin is the world’s first cryptocurrency and works on a public blockchain network. It allows you to send value to and from anyone in the world using nothing more than a computer, an internet connection and a wallet.

Bitcoin was introduced in 2008 by an anonymous entity known as Satoshi Nakamoto, and its software implementation was released in 2009.

The system is maintained by thousands of networked computers (nodes), each holding an independent copy of a public, distributed ledger called the blockchain. This blockchain ensures a permanent, transparent record of all transactions, prevents double spending, and makes alteration of past transactions extremely difficult.

Bitcoin is a revolutionary asset because it can be sent and received without any middleman like banks, brokers or payment handling corporations. The lack of any corporation in between means that Bitcoin is the world’s first public digital payments infrastructure.

What Is The History of Bitcoin?

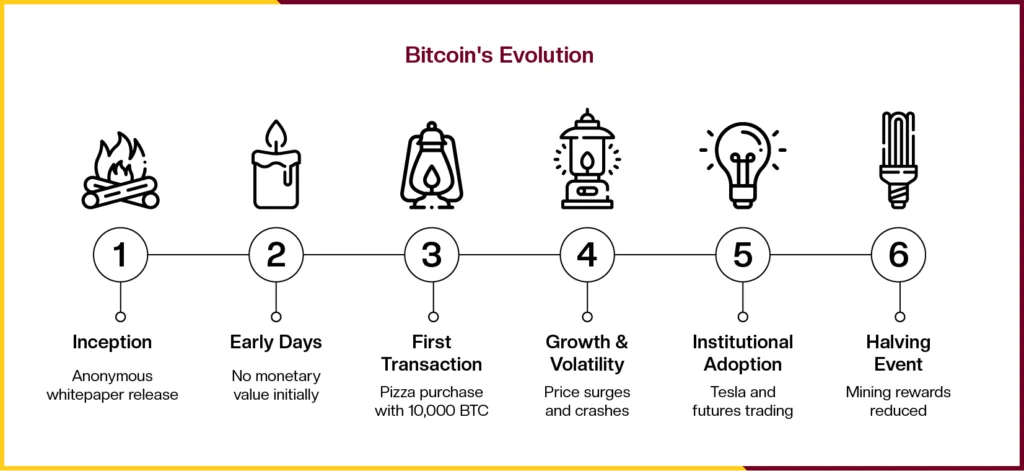

Bitcoin’s origins trace back to the global financial crisis of 2007-2008, which highlighted vulnerabilities in traditional banking systems. In October 2008, an anonymous individual or group using the pseudonym Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlining the concept of a decentralized cryptocurrency.

In its early years, Bitcoin had no monetary value. By October 2009, the New Liberty Standard Exchange established the first Bitcoin-to-dollar exchange rate at 1,309.03 BTC for $1.

The first real-world transaction happened in May 2010, when programmer Laszlo Hanyecz paid 10,000 BTC for two Papa John’s pizzas, now famously worth millions.

The 2010s saw rapid growth and volatility. In 2013, Bitcoin crossed $1,000 amid hype but fell sharply after regulatory crackdowns in China.

In 2011, the Silk Road (online dark web marketplace that used BTC to buy and sell illicit items) boosted Bitcoin’s notoriety. It coloured the very position of Bitcoin in the global market. Critics often cited Silk Road as evidence of Bitcoin’s “dark side,” fueling debates about its legitimacy, yet it arguably accelerated mainstream awareness and innovation in blockchain technology.

In 2014, the biggest and most prominent exchange for trading Bitcoin abruptly halted withdrawals and filed for bankruptcy after revealing a massive hack that resulted in the loss of approximately 850,000 Bitcoins

The 2017 bull run propelled it to nearly $20,000, driven by initial coin offerings (ICOs) and mainstream interest, followed by a “crypto winter” in 2018. Institutional adoption accelerated in 2020-2021, with companies like Tesla buying Bitcoin and the launch of Bitcoin futures on major exchanges, pushing prices above $60,000. The 2022 bear market saw declines due to inflation and scandals like FTX’s collapse, but recovery began in 2023 with U.S. ETF approvals in January 2024.

In 2025, Bitcoin underwent its fourth halving in April 2024, reducing mining rewards to 3.125 BTC per block, and its price has fluctuated amid geopolitical tensions and regulatory shifts.

Today, it’s integrated into payment systems, with over 19.7 million BTC in circulation, and remains a symbol of financial innovation. And it has become the world’s fifth largest asset.

How Does Bitcoin Work?

Introduction to Bitcoin Blockchain

Bitcoin works on a decentralized ledger called blockchain. It uses an advanced cryptography technique – SHA 256. It is Bitcoin’s cryptographic algorithm, generates a unique 64-character hash, ensuring data integrity and linking blocks securely.”

You can check hashing on andersbrownworth

When any data is added to the block in the blockchain above and mined, it generates a hash. This hash is computed using SHA – 256. This process transforms input data into a fixed-length, 256-bit (32-byte) hash output, represented as a 64-character hexadecimal string. Hashing links blocks in the Bitcoin blockchain, ensuring immutability and chain integrity.

Hashing In Bitcoin

In Bitcoin, hashing is the fundamental building block that ensures the security and integrity of the entire network. Its primary purpose is to create a unique “digital fingerprint” for each block of transaction data. Hashing is one of the mechanics of Bitcoin’s working process. It is combined with proof of work.

Proof of Work – Bitcoin’s Consensus Mechanism

PoW is the process that allows the decentralized network to agree on a single, correct version of the blockchain without a central authority. Miners are the key participants in the bitcoin blockchain network. The miners compete on the blockchain to mine the next block. To mine a block the miner needs to find a hash that is closer to the mining difficulty. Mining difficulty is a self-regulating mechanism in the Bitcoin network that ensures blocks are added to the blockchain at a consistent, predictable pace.

Mining difficulty is a measure of how hard it is to find a hash that meets the required criteria. The “puzzle” for miners is to find a hash for a new block that is below a specific target number.

Without this feature, the block-finding process would be chaotic. As more powerful computers and more miners join the network (increasing the total “hash rate”), blocks would be found much faster than every 10 minutes. This would mess up Bitcoin’s issuance schedule and could make the network vulnerable to certain attacks. Conversely, if a lot of miners left the network, block times would get too slow, slowing down transactions.

Bitcoin Mining

So why do miners mine Bitcoin? Well, miners receive the transaction fees as reward for using computational power to add transactions in a block. The sender essentially pays this fee while making the transaction. Additionally, miners also receive more fees if the user wishes to send a transaction at a faster speed. Miners also have the option to pick and choose these transactions from the mempool. Usually miners pick transactions that offer a better fee.

Bitcoin Halving

Bitcoin mining becomes more competitive and its profitability does come down. But why? Well, Bitcoin halving is one of the major reasons.

Bitcoin halving is an event that occurs approximately every 4 years or after the chain has reached 210,000 blocks. After this event the block reward remitted to miners is halved. On April 20, 2024, the fourth Bitcoin halving occurred, reducing the mining reward to 3.125 BTC per block.

What Makes Bitcoin Different?

Bitcoin is fundamentally different from other currencies because it is the world’s first decentralized digital money. This distinction is not just a technological quirk; it’s what makes it a revolutionary concept in finance. Bitcoin operates on a peer-to-peer network, meaning it is not controlled by any single entity, such as a government or a bank. All transactions are verified and recorded by a network of computers around the world. Also, they cannot be tampered with.

The maximum supply of Bitcoin (BTC) is 21 million coins. This hard cap is coded into Bitcoin’s protocol, ensuring no more than 21 million BTC will ever exist. This contributes to Bitcoin’s deflationary status. Besides this, Bitcoin is not controlled by any entity or organisation which makes the asset truly decentralized. Bitcoin was originally created by an anonymous individual or group of individuals called Satoshi Nakamoto.

What Are Some Common Misconceptions of Bitcoin?

Bitcoin and crypto currencies share some common misconceptions. In this section we will look at the different Bitcoin myths.

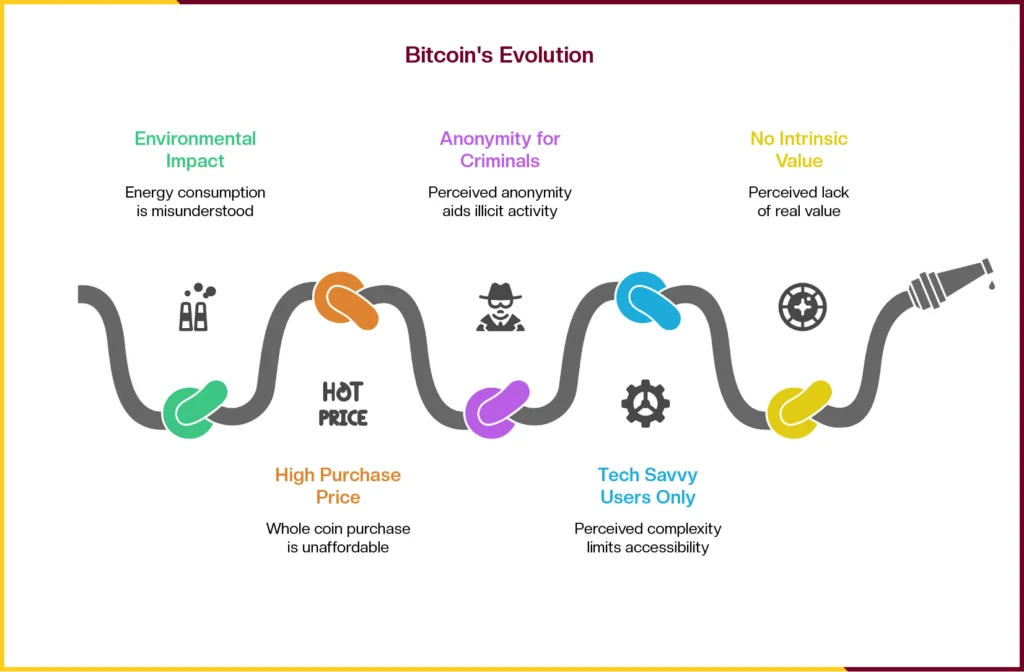

Bitcoin is bad for the environment

The belief that Bitcoin is inherently harmful to the environment largely comes from its energy-intensive mining process. However, comparisons of Bitcoin’s energy use to traditional financial systems or household appliances are often misleading.A 2021 Galaxy Digital research report found that the energy consumption of data centers operated by the top 100 global banks is more than twice that of the Bitcoin network.

You Need To Buy One Whole Bitcoin

A common misconception about Bitcoin is that you must buy a whole Bitcoin to invest or participate, leading many to believe it’s unaffordable due to its high price, which will exceed $60,000 in 2025. In reality, Bitcoin is highly divisible, with the smallest unit, a satoshi, equaling 0.00000001 BTC. You can buy BTC on any exchange even with just $25 Some exchanges even allow you to buy crypto with just $10.

Bitcoin Is Anonymous and Perfect for Criminals

People think Bitcoin offers full anonymity for criminals. But transactions remain pseudonymous, not anonymous. Wallet addresses lack names. The blockchain records every transaction publicly. Transparency hinders criminals. Law enforcement uses analytics to track crimes and secure prosecutions.

Bitcoin Is Only for Tech-Savvy Individuals

People view Bitcoin as complex for non-tech users. But wallets and exchanges now feature simple interfaces. User-friendly products and guides grow. Anyone can access crypto regardless of experience.

Bitcoin Has No Intrinsic Value

Critics claim Bitcoin lacks real value. But it serves as decentralized, borderless money. Limited supply, censorship resistance, and store-of-value potential add worth. People and institutions recognize these traits. Bitcoin’s value grows clear.

Bitcoin Is Only for Criminal Activities

Early Silk Road links tied Bitcoin to crime. But transparency exposes users. Criminals fail to hide. Agencies trace and prosecute offenders worldwide.

What Are The Main Risks Involved In Investing In Bitcoin Today?

While investing in Bitcoin has its pros but it definitely isn’t free from risks. Investing in Bitcoin carries a set of risks. In this section we will look into the main risks

- Price Volatility: Bitcoin’s value fluctuates sharply. Market swings can lead to significant losses, despite maturing markets reducing some volatility.

- Regulatory Uncertainty: Governments may impose strict regulations or bans. Changes in laws could limit Bitcoin’s use or affect its value.

- Security Risks: Hacks on exchanges or wallets can result in stolen funds. Private key mismanagement also risks loss, as no central authority recovers assets.

- Market Manipulation: Large holders (“whales”) or coordinated groups may influence prices. Pump-and-dump schemes or insider trading can harm retail investors.

- Liquidity Issues: During extreme market conditions, selling Bitcoin quickly at desired prices may be difficult, especially on smaller exchanges.

- Regulatory Concern: While Bitcoin is borderless it doesn’t mean that every country out there is welcoming. Some countries are still unclear on how to regulate Bitcoin.

How To Buy Bitcoin?

Bitcoin can be purchased from any regulated cryptocurrency exchange. Some of the most trusted crypto exchanges include Coinbase, Binance, OKX, Bybit and Kucoin.

To choose the ideal crypto exchange for yourself consider asking the following questions:

- How old is the exchange and how many people use it?

- Is it famous and friendly towards customers?

- Do they have a social media presence?

- Are the founders known or are they active on social media?

- Is the exchange complaint in your region/country?

- Verify if the exchange publishes its proof of reserves and transparency report. This is a must.

- Confirm if the exchange has a customer protection fund or insurance for customer funds.

- Review the liquidity, trading volume, and buying and selling fees.

- Investigate the exchange’s history. Has it ever been hacked? If yes, how did they handle it? The best example is Bybit. They were hacked, yet the exchange was back in action in less than 24 hours.

- Ensure the exchange offers the cryptocurrencies you’re interested in trading or investing.

- Evaluate the UI and customer service reviews to ensure they are reliable and user-friendly.

- Confirm the exchange offers reliable on- and off-ramp options for buying crypto.

- Check if the exchange supports your preferred payment options.

You can invest in cryptocurrency via a centralized crypto exchange or you can also invest in crypto via on-ramp crypto service providers.

Wrapping Up

Bitcoin is the investment currency of this generation and you mustn’t ignore it. From its inception in the wake of the 2008 financial crisis to its current status as a global financial instrument, The asset has demonstrated remarkable resilience and an ability to challenge traditional financial systems.

Its decentralized, secure, and transparent nature, underpinned by blockchain and Proof of Work, addresses many of the vulnerabilities inherent in centralized currencies.

As it continues to mature, its role in the global financial landscape is becoming increasingly undeniable, solidifying its place not as a fleeting trend, but as a potentially transformative force for the future of finance.

Bitcoin was invented by an anonymous person or group using the pseudonym Satoshi Nakamoto.

Frequently Asked Questions

Who created bitcoin? +

Bitcoin was invented by an anonymous person or group using the pseudonym Satoshi Nakamoto.

Which bitcoin to buy? +

Bitcoin is listed on major exchanges with the OG ticker symbol $BTC. Please note that Bitcoin Gold, Bitcoin Cash and Bitcoin SV are different cryptocurrencies.

Where Did Bitcoin Come From? +

Bitcoin originated from ideas in cryptography and the cypherpunk movement, which emphasized privacy and decentralized systems. It was conceptualized amid the 2008 financial crisis as a peer-to-peer electronic cash system to bypass traditional banks. Satoshi Nakamoto integrated prior concepts like Hashcash and digital signatures to create it, publishing the whitepaper on October 31, 2008, on a cryptography mailing list.

Will Bitcoin Crash? +

Bitcoin is highly volatile and has experienced multiple crashes in the past, such as drops of over 50% in previous cycles.

Are Bitcoin ETFs a good investment? +

Bitcoin ETFs can be a convenient way to gain exposure to Bitcoin's price without directly owning the cryptocurrency

Can bitcoin reach 1 million? +

According to Arthur Hayes, Bitcoin could hit $1 million by 2028.

When bitcoin started? +

The Bitcoin network officially started on January 3, 2009.