Ethereum isn’t just a digital coin. You could think of it as the engine behind a whole new type of internet economy. Bitcoin was built mainly to send and store money, but Ethereum was designed for more than that. It’s a massive network of computers where people can build apps, launch their own tokens, or even create financial systems that don’t rely on banks or middlemen. The fuel that keeps it running is called Ether, or ETH, that’s what investors actually buy when they say they own Ethereum.

On the other hand, there are ETFs or Exchange-Traded Funds. The name may sound complicated but the concept is straightforward. An ETF is a fund that is traded in the stock market like a share. Some ETFs have a combination of assets, such as stocks, bonds, or commodities, while others concentrate on one, like gold or Ether.

Put those two together, and you get an Ethereum ETF. It’s basically a fund that tracks the price of Ether and trades on normal stock exchanges, the same way you’d trade Apple or Tesla shares. You don’t need a crypto wallet or private keys, just your regular brokerage account. In a way, Ethereum ETFs make the crypto world a little more accessible, giving traditional investors a safer and more familiar door into blockchain technology.

What is an ETF?

The term “Exchange-Traded Fund” might sound like something only stock market pros would get, but the truth is, it’s much simpler than it sounds.

Imagine walking through a grocery store. You could pick every single ingredient to make your own soup vegetables, spices, broth, one by one. Or, you could just grab a ready-made can from the shelf that already has everything blended together. That’s what an ETF does, but in the world of investing.

Instead of buying individual stocks or assets yourself, which takes time and research, a financial company builds a single fund that holds many different investments. It could include the biggest companies in the S&P 500, a group of tech firms, or even commodities like gold. By buying one share of that fund, you’re basically owning a small piece of all those assets at once.

And the best part? You don’t need any special tools or crypto apps to access it. ETFs are traded on the same stock exchanges as everyday companies like Apple or Tesla, you can buy or sell them through any regular brokerage account.

What is an Ethereum ETF?

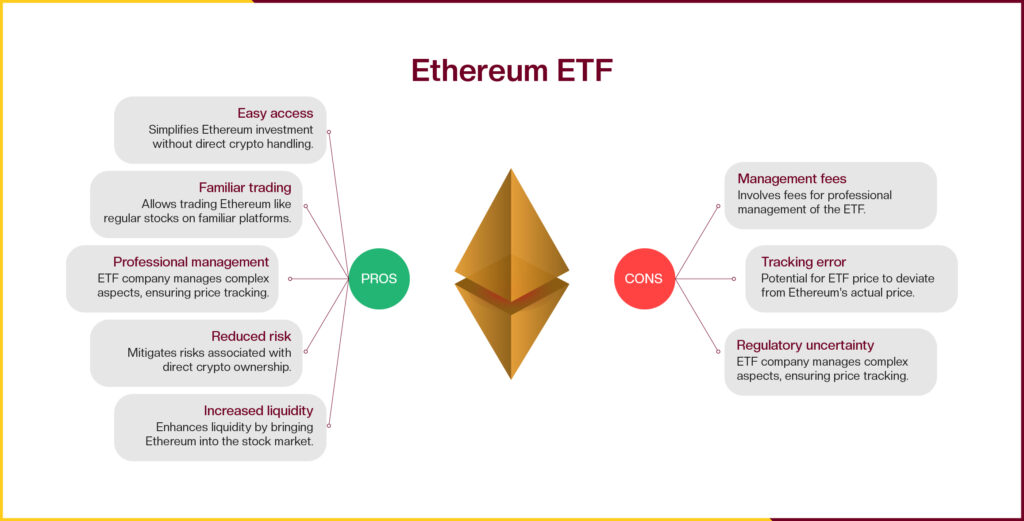

An Ethereum ETF is, in simple terms, an easier way to invest in Ethereum without touching the crypto world directly. Instead of buying Ether and figuring out wallets or exchanges, you just buy shares of a fund that moves with Ethereum’s price. When the value of Ether goes up, the ETF usually goes up too. It feels like trading a regular stock rather than digital coins.

The company behind the ETF handles everything complicated. They decide how to match the price of Ether, sometimes through futures contracts, sometimes by holding the actual asset. You don’t have to deal with security steps, storage, or crypto platforms. You just see a price on your stock app and trade it like anything else.

This setup is what makes Ethereum ETFs interesting. They bring a digital asset into a familiar space, the stock market. For many people, it’s a safer door into crypto, one that doesn’t require deep tech knowledge or the risks that come with holding real coins. It’s finance meeting blockchain in a way that finally feels accessible.

What Are the Most Famous Ethereum ETFs?

Ethereum ETFs are starting to make real noise in global markets. A few of them have already become well known for their size, timing, or the institutions behind them. Here are some of the top names and what makes each stand out:

- VanEck Ethereum Strategy ETF (EFUT) – One of the first U.S. funds to give investors exposure to Ether futures. It became known for opening the door to Ethereum-based investing through traditional markets.

- ProShares Ether Strategy ETF (EETH) – Gained attention for being launched by the same company that introduced the first Bitcoin futures ETF in the U.S., building early trust among cautious investors.

- Bitwise Ethereum Strategy ETF (AETH) – Praised for its focus on regulated futures contracts and its strong reputation within the crypto-tracking fund space.

- Purpose Ether ETF (ETHH) – The world’s first spot Ethereum ETF, launched in Canada. It’s famous for directly holding Ether instead of using futures.

- iShares Ethereum Trust (BlackRock) – Backed by the world’s largest asset manager. It drew headlines because of BlackRock’s growing interest in digital assets.

- Grayscale Ethereum Trust (ETHE) – Started long before ETFs became mainstream. It’s well known for giving early investors access to Ethereum through a traditional financial structure.

- Fidelity Ethereum Fund (FETH) – Created by one of the biggest names in finance, this ETF gained attention for helping large institutions enter the Ethereum market safely.

Ethereum ETFs show how far crypto has come in just a few years. What was once seen as a risky experiment is now finding its place inside traditional finance. As more of these funds appear, they’re not just giving investors new options, they’re proving that blockchain is slowly becoming part of everyday investing.