- What are cryptocurrencies and how they work on blockchain.

- How are cryptocurrencies different from traditional financial assets and what are the pros of cons of using crypto.

- Key Benefits of using cryptocurrencies in retail, digital payments and businesses.

Dubbed as the “internet’s magic money”, a cryptocurrency is not just Bitcoin. A cryptocurrency is in reality a peer-to-peer system allowing anyone, anywhere to send and receive payments. Unlike physical cash exchanged in person, cryptocurrency transactions are digital entries in an online database, recorded on a public ledger. Funds are stored in digital wallets.

Brief History of Cryptocurrencies

If you think Bitcoin is the first crypto currency then you are in for a surprise. The first cryptocurrency was eCash, developed by David Chaum. The cryptocurrency failed to trigger widespread adoption and ultimately failed. However, it laid the groundwork for developing the groundwork to build cryptographically backed cryptocurrencies.

In 1998, Wei Dai described “b-money,” a conceptual anonymous, distributed electronic cash system, and Nick Szabo proposed “Bit Gold,” an electronic currency system that required users to complete “proof-of-work” functions. These concepts, though never fully implemented, were direct precursors to Bitcoin.

In 2008, the financial institution collapsed and it led to the creation of Bitcoin. A pseudonymous person or group of people created Bitcoin.

What Are The Characteristics Of Cryptocurrencies?

Cryptocurrencies possess several distinguishing characteristics that set them apart from traditional currencies. Following are some notable features of cryptocurrencies.

Borderless & Trustless

Cryptocurrencies are inherently global, allowing cross-border transactions without intermediaries like banks, making them faster and often cheaper. Their “trustless” nature means participants rely on cryptographic protocols and network consensus mechanisms, not central authorities, ensuring security and integrity.

Decentralized

Unlike fiat currencies controlled by governments or central banks, cryptocurrencies operate on decentralized networks, typically blockchains. No single entity dictates their supply, value, or transactions. Instead, a distributed ledger, maintained by network participants, verifies and records all activities.

Immutable & Portable

Once recorded on the blockchain, transactions are virtually unalterable, ensuring a tamper-proof history. Cryptocurrencies are also highly portable, stored digitally and accessible anywhere with an internet connection, facilitating easy transfers and use.

Secured with Cryptography

Advanced cryptographic techniques underpin cryptocurrency security. They protect transaction details, control the creation of new units, and verify asset transfers, making blockchains highly resistant to fraud and hacking.

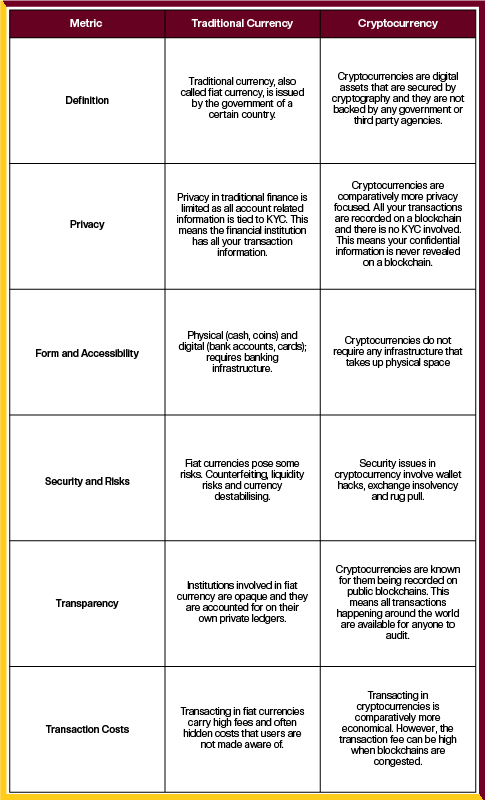

What Is The Difference Between Cryptocurrencies And Fiat Currencies?

To understand what qualifies as a currency, consider Aristotle’s framework, which defines three essential functions:

- Medium of Exchange: A currency must be widely accepted for goods and services, simplifying trade.

- Store of Value: It must retain value over time, allowing savings without significant loss.

- Unit of Account: It must serve as a standard measure for pricing and economic calculations.

Crypto assets differ vastly from traditional currencies. Also it is important to note that cryptocurrencies have been around for only 27 years. E-cash was the first cryptocurrency to come into existence.

Bitcoin was founded in 2008 and Ethereum was founded in 2015.

Whereas,fiat currencies like the US Dollar, Japanese Yen were invented in 1792 and 1871.

Interestingly, the first ever fiat currency to come into existence was the Jiaozi. It began as a type of promissory note issued by private merchants in the Sichuan province of China during the early Song Dynasty (around the 11th century).

Following are the key differences between fiat currency and cryptocurrency

How Do Cryptocurrencies Work?

Cryptocurrencies work on decentralized networks like blockchain technology. It used sophisticated cryptography and a consensus mechanism that functions like clockwork. We will learn more about it in the section below.

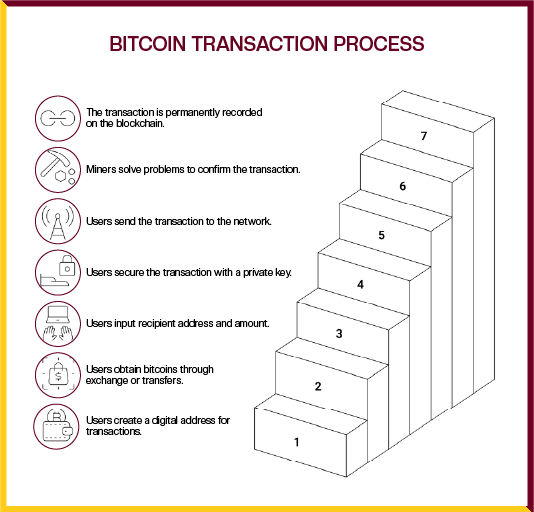

Let’s understand how a Bitcoin transaction works.

A Bitcoin transaction involves the use of wallets that support bitcoin, sender and receiver and miners who approve transactions on the blockchain.

Let’s say User wants to send User 1 Bitcoin. (PS: She needs to have a little more than 1 Bitcoin in her wallet as there is a transaction cost that incurs with it. She uses her Bitcoin wallet (software or hardware) to create a transaction.

The user inputs the Bitcoin wallet address and signs a message. This message has all the details, including the amount being transferred to User and the transaction id (also called as transaction hash)

Now, this transaction is broadcasted to the network for validation from the network participants. Next, these transactions are accumulated in a place called mempool. A mempool, short for “memory pool,” is a waiting area for unconfirmed cryptocurrency transactions on a blockchain network.

From the mempool, miners choose the transaction they wish to mine. After choosing the transaction, the miner performs a computational task to be able to qualify for mining a block on the blockchain. If the miner is able to match the mining difficulty, then the miner can add the block to the blockchain. When the block is mined (status: success) then User’s transaction has gone through and User has received 1 BTC.

What Are The Different Types of Cryptocurrencies?

The world of cryptocurrencies is vast and constantly evolving, with thousands of different projects, each with unique functionalities. Here’s a breakdown of the main types and categories:

1. Cryptocurrencies (or Coins)

These are designed to function primarily as a medium of exchange, a store of value, and a unit of account, much like traditional fiat money. They typically operate on their own independent blockchains.

- Bitcoin (BTC): The original and most well-known cryptocurrency, often referred to as “digital gold” due to its limited supply and role as a store of value.

- Altcoins: This term refers to any cryptocurrency other than Bitcoin. Many altcoins emerged to address perceived limitations of Bitcoin, offering faster transaction times, different consensus mechanisms, or specific use cases. Examples include:

- Litecoin (LTC): Often called “digital silver,” designed for faster transactions and lower fees than Bitcoin.

- Monero (XMR) & Zcash (ZEC): These are privacy coins, focusing on enhanced anonymity for transactions by obscuring sender, receiver, and/or amount.

- Payment Cryptocurrencies: Cryptocurrencies specifically designed for efficient, low-cost transactions & cross-border payments. (e.g., XRP, Stellar (XLM)).

2. Tokens

Unlike coins, tokens are built on top of existing blockchain platforms (like Ethereum, Binance Smart Chain, etc.) and leverage the underlying blockchain’s infrastructure. They often have specific functions within their respective ecosystems.

- Utility Tokens: These tokens grant holders access to specific products, services, or features within a decentralized application (dApp) or platform. They are essentially digital coupons or licenses. (e.g., Basic Attention Token (BAT) for Brave browser rewards, ETH (which also functions as a “gas” token on Ethereum)).

- Security Tokens: These represent ownership in an asset or company and are often subject to traditional securities regulations. They can offer rights like dividends or voting power.

- Governance Tokens: These allow holders to vote on proposals and decisions that influence the development and direction of a blockchain project or decentralized autonomous organization (DAO). (e.g., Maker (MKR), Uniswap (UNI)).

- DeFi Tokens (Decentralized Finance Tokens): These are integral to decentralized finance protocols, which offer financial services like lending, borrowing, and trading without intermediaries. (e.g., Aave (AAVE)).

- Memecoins: These cryptocurrencies are typically inspired by internet memes or pop culture, often created as light-hearted social experiments. Their value is largely driven by community sentiment and viral trends. (e.g., Dogecoin (DOGE), Shiba Inu (SHIB)).

- NFT: They stand for non-fungible tokens, a unique digital asset that represents ownership of a specific item or piece of content. An NFT is “non-fungible” because each one is unique and cannot be replicated or swapped one-for-one. Think of it like a one-of-a-kind painting: you can’t just trade it for another painting and expect to have the same thing.

3. Stablecoins

Stablecoins are designed to minimize price volatility by pegging their value to a stable asset, typically a fiat currency (like the US dollar), or commodities (like gold). This makes them useful for trading, remittances, and as a store of value in volatile crypto markets.

- Fiat-backed Stablecoins: Backed by reserves of fiat currency held in traditional banks. (e.g., Tether (USDT), USD Coin (USDC)).

- Commodity-backed Stablecoins: Pegged to tangible assets like gold. (e.g., Pax Gold (PAXG)).

- Algorithmic Stablecoins: Rely on algorithms and smart contracts to maintain their peg by adjusting supply and demand. (e.g., Dai (DAI)).

- Frax: This is a different type of stablecoin that uses a unique hybrid model to maintain its stablecoins’ pegs. It achieves stability through a combination of collateral, such as USDC and USDT, and algorithmic adjustments controlled by the protocol.

4. Central Bank Digital Currencies (CBDCs)

These are digital currencies issued and regulated by a country’s central bank. Unlike decentralized cryptocurrencies, CBDCs are centralized and represent a digital form of a national fiat currency. They aim to modernize payment systems and enhance financial inclusion. (e.g., China’s e-CNY).

Frequently Asked Questions

What is a cryptocurrency?

A cryptocurrency is a digital or virtual currency that uses cryptography for security and operates on a decentralized network, typically a blockchain. It allows peer-to-peer transactions without intermediaries like banks, federal government or third party brokers.

How do cryptocurrencies work?

Cryptocurrencies operate on decentralized networks like blockchain, where transactions are recorded on a public ledger. Users send and receive funds via digital wallets, and transactions are verified by network participants (e.g., miners) using cryptographic techniques and consensus mechanisms.

What is the difference between cryptocurrencies and traditional currencies?

Traditional currencies (fiat) are issued by governments, stored in banks, and often involve intermediaries, while cryptocurrencies are decentralized, digital-only, and recorded on public blockchains. Examples of fiat currencies are United States Dollar, Japanese Yen and Pound Sterling.

Cryptocurrencies offer greater privacy, transparency, and lower transaction costs but carry risks like wallet hacks. Examples include Bitcoin, Ethereum, USDT & USDC.

What was the first cryptocurrency?

The first cryptocurrency was eCash, developed by David Chaum in the 1990s. Although it failed to gain widespread adoption, it inspired later cryptocurrencies like Bitcoin.

What are the main types of cryptocurrencies?

- Coins: Independent cryptocurrencies like Bitcoin and Litecoin, designed as a medium of exchange.

- Tokens: Built on existing blockchains (e.g., Ethereum), including utility, security, governance, and DeFi tokens.

- Stablecoins: Pegged to assets like fiat or commodities to minimize volatility (e.g., USDT, USDC).

- CBDCs: Centralized digital currencies issued by central banks (e.g., China’s e-CNY).

What are the key characteristics of cryptocurrencies?

- Borderless & Trustless: Can be sent globally without intermediaries, relying on cryptographic protocols.

- Decentralized: No central authority controls the network.

- Immutable & Portable: Transactions are permanent and easily accessible via digital wallets.

- Secured by Cryptography: Ensures security and integrity of transactions.

What are the benefits of using cryptocurrencies in retail, digital payments, and businesses?

- Lower Transaction Costs: Often cheaper than traditional payment methods, especially for cross-border transfers.

- Fast Transactions: Near-instant global transfers without banking delays.

- Accessibility: Anyone with an internet connection can use cryptocurrencies, promoting financial inclusion.

- Transparency: Public blockchains allow auditable transactions.

- Security: Cryptographic protection reduces fraud risk.

- Decentralized Control: Businesses can operate without relying on centralized financial institutions.

What are the pros and cons of cryptocurrencies?

Pros:

- Greater privacy (no KYC required for many transactions).

- Decentralized, reducing reliance on banks or governments.

- Faster and cheaper cross-border transactions.

- Transparent public ledger.

Cons:

- High volatility and price fluctuations.

- Risks of wallet hacks, exchange failures, or scams (e.g., rug pulls).

- Limited regulatory oversight, leading to potential legal uncertainties.

- Lack of widespread adoption in some regions.

How can I invest in cryptocurrencies?

To invest, research the cryptocurrency’s business model, mechanics, founders, market scope, motivation, and momentum.

Choose a reputable exchange (e.g., Binance, Bybit, Kraken) by evaluating its age, user base, security, transparency (proof of reserves), fees, and supported cryptocurrencies. Use digital wallets to store funds securely.

What is a blockchain, and how does it relate to cryptocurrencies?

A blockchain is a decentralized, immutable digital ledger that records transactions across a network of computers.

Cryptocurrencies use blockchains to securely store and verify transaction data, ensuring transparency and security without a central authority.

Are cryptocurrencies safe to use?

Cryptocurrencies are generally secure due to cryptographic protections, but risks include wallet hacks, exchange insolvency, and scams. Using reputable exchanges, securing private keys, and enabling two-factor authentication can mitigate these risks.

What is a crypto wallet, and why is it important?

A crypto wallet is a software or hardware device that stores private and public keys used to send, receive, and manage cryptocurrencies. It’s essential for securely accessing and managing your funds on the blockchain.

What are miners, and what do they do?

Miners are network participants who validate and confirm transactions by solving complex computational problems (proof-of-work). They add transactions to the blockchain and are rewarded with cryptocurrency (e.g., Bitcoin).

Why are stablecoins useful?

Stablecoins maintain a stable value by being pegged to assets like fiat currencies or commodities, making them ideal for trading, remittances, and hedging against crypto market volatility.

How do I choose a cryptocurrency exchange?

Consider the exchange’s age, user base, reputation, security measures (e.g., proof of reserves, insurance), fees, supported cryptocurrencies, user interface, customer service, and compliance with local regulations. Examples include Binance, Coinbase, and Kraken.

Can cryptocurrencies be used for everyday purchases?

Yes, many retailers and online platforms accept cryptocurrencies like Bitcoin and Ethereum for payments. Stablecoins are particularly useful for everyday transactions due to their low volatility.

What is the role of Bitcoin in the cryptocurrency market?

Bitcoin is the first and most well-known cryptocurrency, often seen as a store of value (like “digital gold”). It set the foundation for other cryptocurrencies and remains the largest by market capitalization.

What are memecoins, and are they a good investment?

Memecoins (e.g., Dogecoin, Shiba Inu) are cryptocurrencies inspired by internet memes, driven by community sentiment and viral trends. They are highly speculative and volatile, making them riskier investments compared to established coins like Bitcoin or Ethereum.

What are Central Bank Digital Currencies (CBDCs), and how do they differ from cryptocurrencies?

CBDCs are digital currencies issued and regulated by central banks, representing a digital version of fiat currency. Unlike decentralized cryptocurrencies, CBDCs are centralized and controlled by governments.

How can I stay safe while using cryptocurrencies?

- Use reputable exchanges with strong security and transparency.

- Store funds in secure wallets (preferably hardware wallets for large amounts).

- Enable two-factor authentication.

- Be cautious of phishing scams and unverified projects.

- Regularly back up your wallet’s private keys or seed phrases.

Is cryptocurrency a good investment?

Cryptocurrency is a high risk and high reward investment. Many investors have gained a lot from crypto while many ended up in losses.