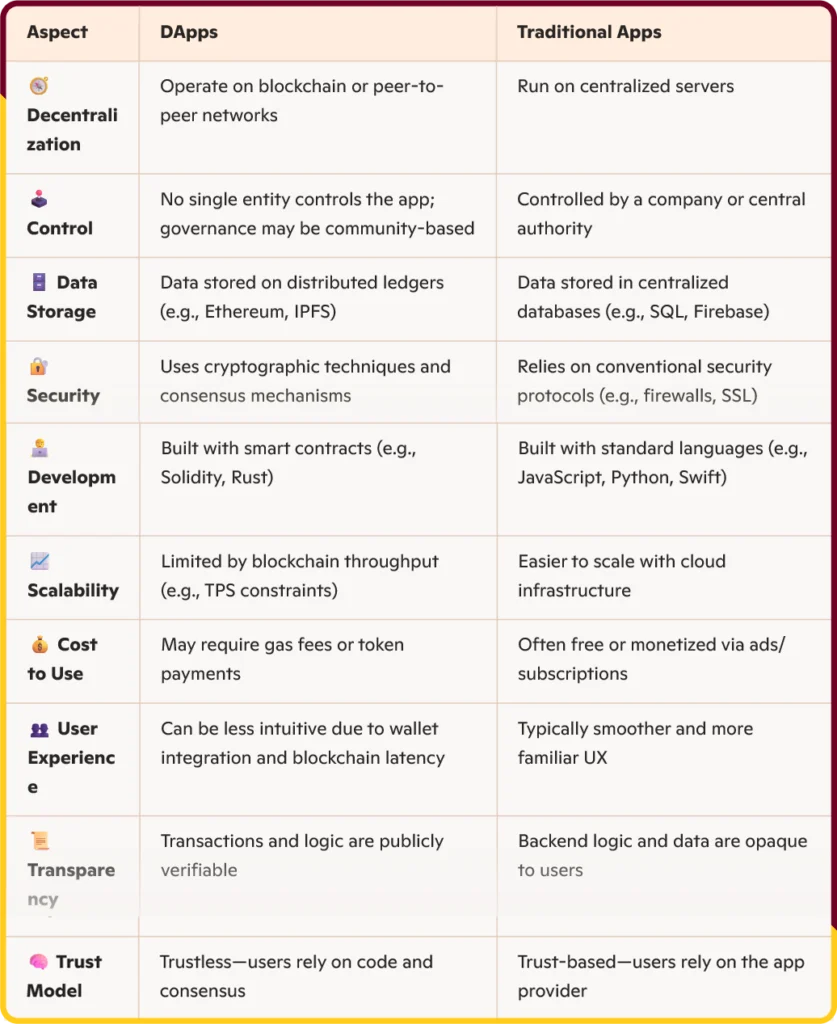

- How are DApps different from traditional apps in terms of control, data ownership, and intermediaries?

- What are some real-world DApps in finance, gaming, and content, and how are they changing user experiences?

- What benefits do DApps offer for transparency, ownership, and global access, especially for underserved users?

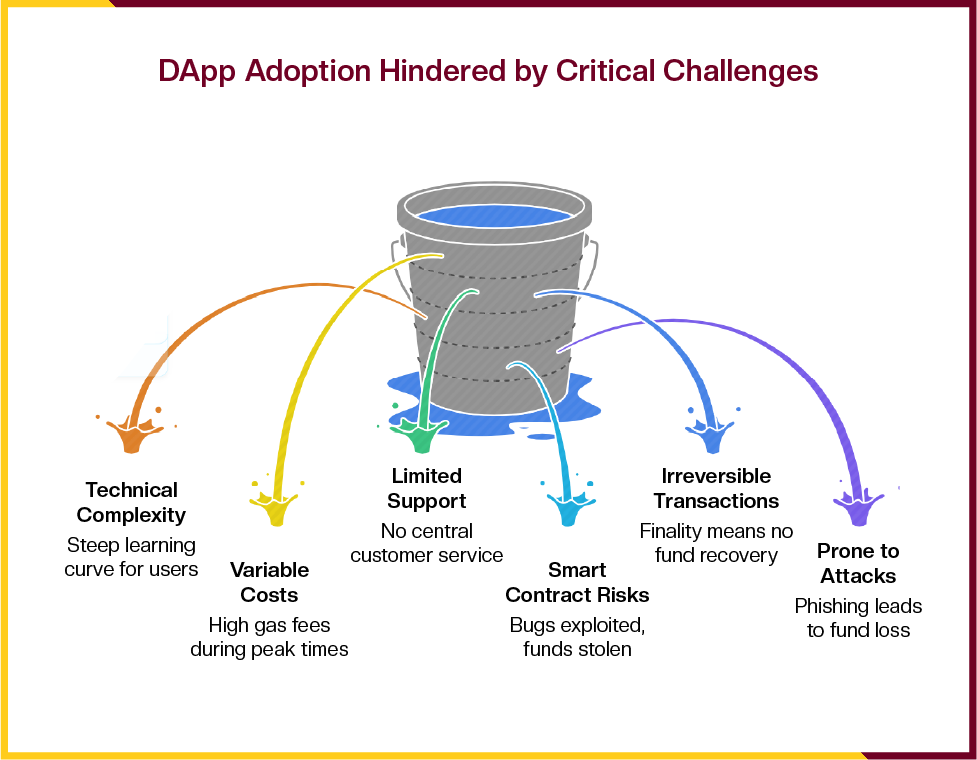

- What risks should users know before using DApps, such as smart contract flaws, fees, and lack of support?

- What are the basic steps to start using a DApp, and how can beginners avoid common mistakes?

Imagine using Facebook without Mark Zuckerberg controlling your data, or sending money without banks taking their cut. Welcome to the world of decentralized applications (DApps), the digital rebels quietly revolutionizing online interaction.

What’s more, these are not just experimental projects anymore. Millions of people use DApps daily to trade, game, create, and interact online in ways traditional apps cannot match.

What Exactly Is a DApp?

A DApp is software that runs on a blockchain rather than being controlled by a single company or hosted on a central server. Unlike traditional apps managed by a single organization, DApps operate on smart contracts, which are self-executing codes that automatically carry out programmed functions. These smart contracts enforce predefined rules but can be upgraded through community governance or proxy contracts. Similarly, DApps can evolve through updates, new features, or decisions driven by their user community. Built on decentralized networks like blockchain, DApps promote transparency, security, and user autonomy by eliminating dependence on centralized authorities.

For example, a traditional app like WhatsApp is controlled by Meta, which manages your messages, contacts, and the app’s availability. In contrast, a DApp’s operations are governed by smart contracts, ensuring transparency and preventing any single entity from unilaterally shutting it down, altering rules, or restricting access. The code resides on blockchains such as Ethereum, Solana, or BNB Chain, making it publicly accessible, persistent, and verifiable. Most DApps are open-source, enabling anyone to inspect or contribute to their code, fostering trust and collaboration.

DApps You Can Use Right Now

Financial DApps That Replace Banks

- Uniswap: A decentralized exchange where users swap cryptocurrencies directly via smart contracts, bypassing traditional intermediaries. You connect a wallet, select tokens to trade, and the blockchain executes the transaction instantly. Uniswap handles billions in monthly trading volume without centralized operators.

- Compound: An automated lending platform where users earn interest by depositing cryptocurrencies or borrow by providing collateral. Smart contracts adjust interest rates dynamically based on supply and demand, eliminating loan officers or paperwork.

- Aave: Similar to Compound, Aave offers lending and borrowing with additional features like flash loans (borrowing and repaying within one transaction). It creates a global, permissionless financial system through smart contracts.

Gaming DApps That Let You Own Digital Assets

- Axie Infinity: A pioneer in play-to-earn gaming, where players own their characters (Axies) as blockchain-based NFTs. Players can breed, battle, and trade Axies, with some in developing countries earning income through gameplay. Though its popularity peaked in 2021, it remains active with ongoing updates.

- CryptoKitties: One of the first viral DApps, CryptoKitties lets users collect, breed, and trade unique digital cats as NFTs. Each cat’s distinct traits are stored on the blockchain, ensuring permanent ownership.

- Gods Unchained: A blockchain-based trading card game where players own their cards as digital assets. Cards can be traded, sold for real money, or used across compatible games.

Marketplace DApps for Digital Assets

- OpenSea: The largest NFT marketplace, enabling artists and collectors to buy and sell digital collectibles, art, and more. Smart contracts handle transactions, allowing direct sales with lower fees than traditional art galleries.

- SuperRare: A curated platform for digital art, where each piece is a unique NFT with verifiable ownership and transaction history.

Social and Content DApps

- Steemit: A platform that rewards content creators and curators with cryptocurrency based on community votes. Unlike traditional social media, Steemit shares revenue with users.

- Mirror: A decentralized publishing platform where writers publish articles, sell subscriptions, or crowdfund projects. Writers retain control over their content and audience relationships, free from arbitrary platform rules.

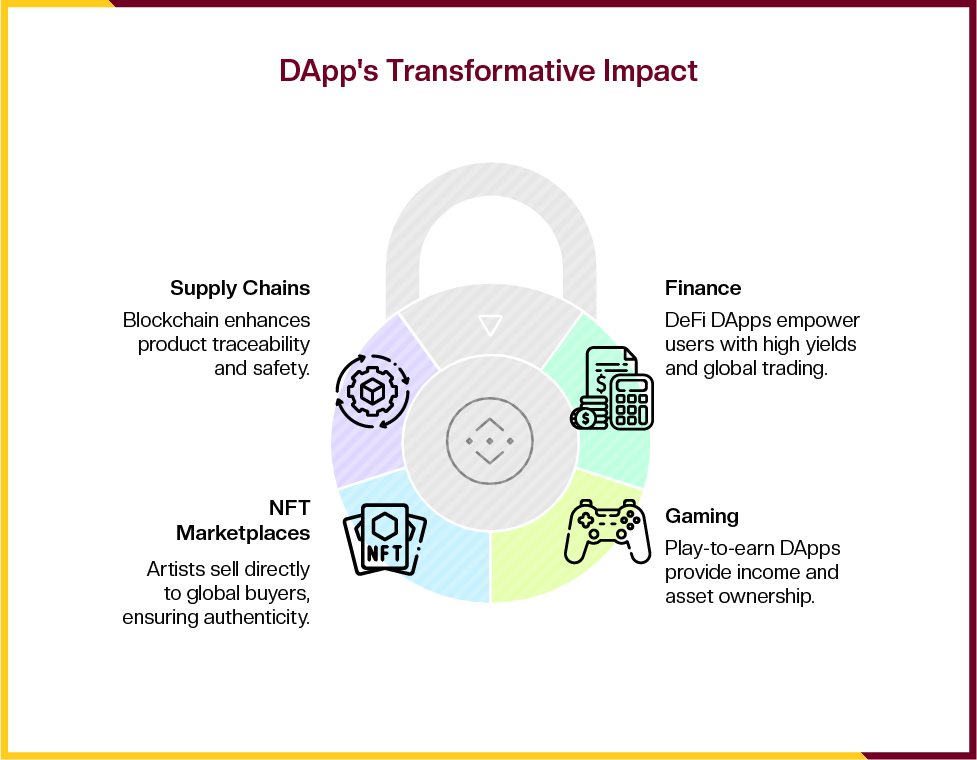

How DApps Are Making a Real Impact

The impacts of DApps are numerous and undeniable, leveraging blockchain to transform industries with transparent and intermediary-free solutions.

In finance, DeFi DApps like Aave empower users to earn high yields on crypto, secure loans without credit checks, trade globally 24/7, and earn fees by providing liquidity, challenging banks but risking smart contract flaws.

In gaming, play-to-earn DApps like Axie Infinity let players in job-scarce regions earn income, with blockchain ensuring asset ownership, though high transaction costs persist. NFT marketplaces like OpenSea enable artists to sell directly to global buyers, verifying authenticity via blockchain. In supply chains, solutions like Walmart’s Food Trust on Hyperledger Fabric trace products instantly, boosting safety, even if not fully decentralized. DApps drive financial inclusion, creative freedom, and trust, reshaping economies despite scalability and regulatory hurdles.

How to Actually Use DApps

- Get a Cryptocurrency Wallet: Use a wallet like MetaMask or Phantom Wallet to store cryptocurrencies and interact with DApps. Your wallet is your gateway to the DApp ecosystem.

- Acquire Cryptocurrency: Most DApps require cryptocurrencies like Ethereum (ETH) to pay for transaction fees (gas). Purchase crypto on exchanges like Coinbase or Binance and transfer it to your wallet.

- Connect and Use: Visit a DApp’s website, click ‘Connect Wallet’, and interact with its features (such as trading and gaming). Confirm transactions via your wallet.

Key Benefits for Common Users

- True Ownership: Your digital assets, game items, and content remain yours permanently, beyond any company’s control.

- Global Access: DApps are accessible to anyone with internet, regardless of location or banking status.

- Transparency: Blockchain transactions are public, allowing you to verify a DApp’s operations.

- Censorship Resistance: DApps run on decentralized networks, making them resistant to shutdowns by governments or companies.

- Direct Transactions: Interact peer-to-peer without intermediaries imposing fees or restrictions.

Risks and Limitations to Understand

- Technical Complexity: Using DApps requires understanding wallets, private keys, and blockchain basics. Errors can lead to permanent fund loss.

- Variable Costs: Gas fees fluctuate with network demand, making some DApps costly during peak times.

- Limited Support: With no central authority, DApps lack traditional customer service. Users must handle their own security and issues.

- Smart Contract Risks: Bugs in code can be exploited by hackers, potentially leading to fund theft.

- Irreversible Transactions: Blockchain transactions are final. Sending funds to the wrong address or falling for scams means no recovery.

- Vulnerability to Attacks: Phishing attacks targeting user wallets can result in fund loss. Always verify DApp URLs and never share private keys to protect against such threats.

- Risk Mitigation: To reduce risks, use DApps that have been audited by reputable firms, employ multi-signature wallets for added security, and interact with trusted exchanges that provide proof of reserves.

Investment Opportunities in DApps

Many DApps issue tokens that represent governance rights or platform utility:

- Governance Tokens: Platforms like Uniswap distribute tokens (such as UNI) that grant voting rights and fee shares.

- Utility Tokens: Gaming DApps use tokens for in-game purchases or actions, with value tied to the game’s popularity.

- Yield Farming: DeFi DApps reward liquidity providers with additional tokens.

However, DApp tokens are highly volatile, and regulatory uncertainties pose risks. Always research thoroughly before investing.

The Future of DApps

DApps are paving the way for a user-controlled internet. Future developments may include:

- User-friendly interfaces that simplify blockchain interactions.

- Faster transactions and lower fees through scaling solutions like layer-2 networks.

- Integration with traditional businesses and services.

- Regulatory frameworks balancing innovation and consumer protection.

Major companies are exploring blockchain integration, and governments are crafting policies to support safe adoption.

Should You Use DApps?

DApps appeal to those seeking ownership, privacy, and control over digital assets, especially if frustrated by traditional platforms’ fees or policies. However, they demand technical knowledge and responsibility — mistakes can be costly and irreversible.

Start with reputable DApps like Uniswap or OpenSea, using small amounts of cryptocurrency to learn. Join online communities to discover best practices and new applications.

DApps are already processing billions in value and serving millions globally. Whether you join now or wait for broader adoption depends on your comfort with risk and desire for digital autonomy. The opportunity exists today to engage in a shift from corporate-controlled apps to user-driven platforms prioritizing people over profits.