Meme coins, driven by internet culture and social media buzz, are speculative crypto assets with little to no real-world utility. Their value often spikes due to viral trends or endorsements, like Elon Musk’s tweets about Dogecoin. While risky, they attract investors seeking quick returns or novelty.

In this article we will see how to buy memecoins. The red flags to observe, pros and cons of investing in memecoins and which crypto exchanges and wallets to use for storing your private key.

How To Invest In Memecoins Using A Centralized Exchange?

Centralized exchanges (CEXs) like Binance, Coinbase act as intermediaries, making it easier for beginners to buy, sell, and trade cryptocurrencies using fiat money (e.g., USD, EUR). They handle security, liquidity, and user interfaces, but remember: crypto investing is high-risk, prices are volatile, and you could lose your entire investment.

Step 1: First, you need to create an account on any of the reputed crypto exchanges of your choice. Consider opening an account on: Binance, OKX, Bybit or Coinbase.

Step 2: You need to verify the account. Go to the exchange’s website or download their app.

Sign up with your email, phone number, and a strong password. Enable two-factor authentication (2FA) immediately. Use an app like Google Authenticator, not SMS. Complete KYC (Know Your Customer) verification: Upload ID (passport/driver’s license), proof of address, and sometimes a selfie. This can take minutes.

Step 3: You must fund your crypto account with either fiat currency or you can buy USDT and then invest that in memecoins. Ideally most cryptocurrency exchanges require you to fund your crypto account with USDT.

Usually the minimum amount you need to invest in any cryptocurrency is 10 USD.

Step 4: Explore Trending Memecoins. Look for trading volume, buy and sell orders and overall volatility. Choose one memecoin that looks promising enough, and remember to only invest what you can afford to lose.

Also to maximise on the memecoin make sure you set a sell order at a limit price. Lets say you buy a memecoin at 50 cents and you want to sell the meme when it reaches 1 USD. So to do this simply submit a limit sell order at 1 USD.

How To Invest In Memecoins Using A Decentralized Exchange ?

Step 1: Set Up a Non-Custodial Wallet

You need a wallet to connect to the DEX and hold your funds securely

Recommended Wallets:

- Solana (most popular for memecoins): Phantom or Solflare. Download from official sites (phantom.app or solflare.com).

- Ethereum/Base: MetaMask (metamask.io).

- Multi-chain: Trust Wallet or Exodus for flexibility.

Steps:

- Download and install the wallet app/extension.

- Create a new wallet (for the security of your funds).

- Back up your 12/24-word seed phrase offline—losing it means losing your funds forever.

- Enable security features like biometric locks.

Step 2: Acquire Base Cryptocurrency

Fund your wallet with the native token of the blockchain where the memecoin lives (e.g., SOL for Solana memecoins).

- Options:

- Buy on a CEX (e.g., Coinbase, Binance) with fiat (USD/EUR), then withdraw to your wallet.

- Use on-ramps like MoonPay or Ramp directly in your wallet app (fees apply, ~2-5%).

- Start small: $50-100 SOL/ETH to test.

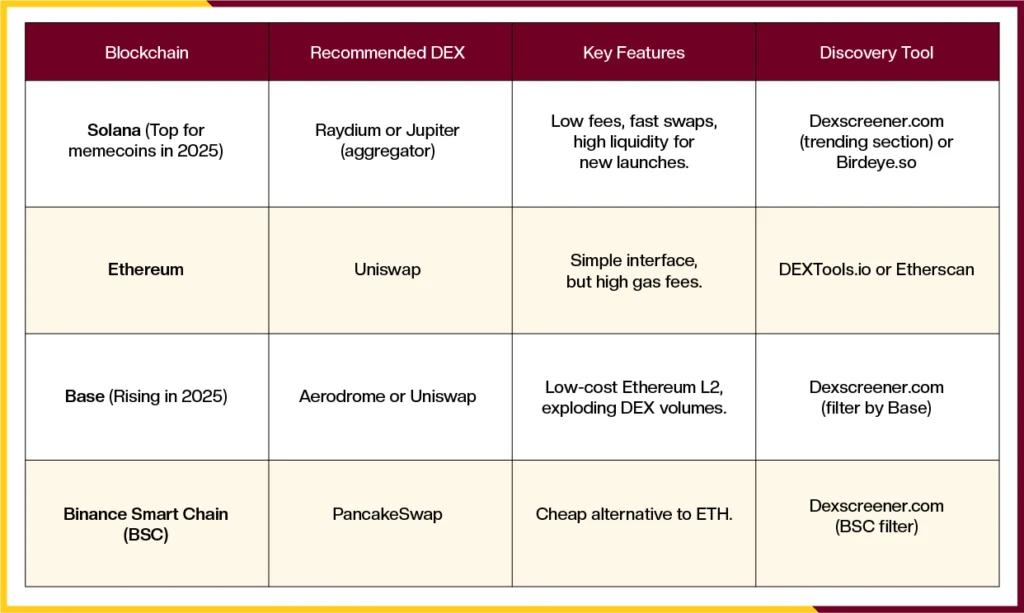

Step 3: Choose a DEX and Discovery Tool

Memecoins launch on specific chains, so pick a DEX accordingly. Use discovery tools to spot trending or new tokens.

Tip: In 2025, GMGN.ai is a top Solana aggregator for memecoin sniping (buying right at launch) with copy-trading features.

Step 4: Find and Research Memecoins

Don’t blindly buy—99% of new memecoins fail or rug.

Steps:

- Go to Dexscreener.com or DEXTools.io.

- Filter by “New Pairs” or “Trending” on your chosen chain (e.g., Solana).

- Look for:

- Market cap < $1M (early stage).

- Liquidity locked (check via RugCheck.xyz or token’s site—aim for 6+ months).

- Top holders: No single wallet >20% to avoid dumps.

- Community: Active Telegram/Discord (1K+ members), viral Twitter hype.

- Use tools like TokenSniffer for scam checks or follow KOLs (key opinion leaders) on X for calls.

- Red Flags: Unlocked liquidity, anonymous dev, excessive hype without utility.

Example: Spot a new cat-themed Solana memecoin trending on Dexscreener with $500K MC and locked LP.

Step 5: Buy the Memecoin

Connect and swap on the DEX.

General Steps (Using Phantom + Jupiter on Solana):

- Open Jupiter (jup.ag) in your browser or wallet.

- Connect your wallet (click “Connect” → select Phantom).

- Paste the memecoin’s CA into the “To” token field (it auto-imports).

- Select “From” as SOL (or your base token).

- Enter amount (e.g., 0.5 SOL).

- Adjust slippage (5-20% for volatile memecoins to avoid failed txns).

- Click “Swap” → Confirm in wallet.

- Wait 1-5 seconds; check balance.

For Ethereum/Uniswap:

- Similar, but wrap ETH to WETH first (Uniswap handles this).

- Set gas limit high during congestion.

Advanced: Use sniping bots like BullX for instant buys at launch, but they cost fees and add risk.

Step 6: Manage and Sell Your Position

- Monitor: Track price on Dexscreener; set alerts for 2x/5x gains.

- Sell: Reverse the swap (memecoin → SOL/ETH). Take profits early—e.g., sell 50% at 3x.

- Risk Management:

- Allocate <5% of portfolio.

- Use a dedicated “degen” wallet.

- Set stop-losses via bots if available.

- Taxes: Track trades (tools like Koinly); gains are taxable in most countries.

Wrapping Up

Investing in memecoins is a highly risky affair but it can also be profitable if only you choose the right ones. Ultimately, memecoin investing is not a get-rich-quick scheme but a high-risk endeavor that requires caution, a solid understanding of the market, and a realistic expectation that most new projects will fail.

By staying informed and prioritizing security, investors can navigate this space, but they should never forget that the line between a meme and a rug pull is often razor-thin.