- What steps are required to create and verify a Coinbase account?

- How does Coinbase ensure the security of user accounts and assets?

- What are the payment methods accepted by Coinbase, and how are account limits determined?

- What educational resources does Coinbase offer to help new users learn about cryptocurrency?

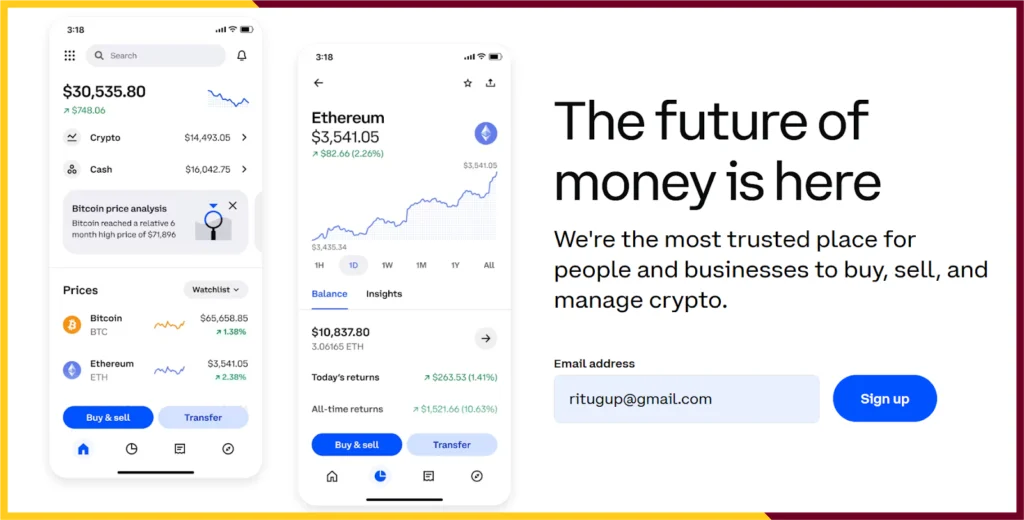

The world of cryptocurrency is slowly moving from the fringes of finance into its mainstream, and Coinbase has established itself as one of the most trusted platforms for buying, selling, and storing digital assets. Whether you are looking to invest in Bitcoin, explore Ethereum, or diversify into altcoins, setting up a Coinbase account is the first right step into this exciting world of crypto.

It’s worth understanding why millions of people choose Coinbase as their crypto platform. The company, founded in 2012, has built its reputation on security and ease of use. Unlike some exchanges that seem designed for Wall Street veterans, Coinbase presents itself with a clean interface and helpful explanations at every turn.

The platform is publicly traded on the NASDAQ, which adds an extra layer of legitimacy and regulatory oversight. It is also insured, which means an investor’s USD balance (not crypto holdings) has FDIC protection up to $250,000. For crypto assets, Coinbase maintains insurance coverage against theft and cybersecurity breaches. However, this does not protect against losses from a user’s own account being compromised through phishing or password theft.

Signing up for Coinbase is quite straightforward, as the platform has clearly invested in creating a user experience that welcomes newcomers while still offering the depth that experienced traders need.

The Account Creation Process: Step by Step

Before you get started, make sure you have:

- A valid email address or mobile phone number

- Access to your email or phone for verification

- A government-issued ID (for identity verification)

Visit the Coinbase Website

Go to the official Coinbase website at www.coinbase.com. Always make sure you are on the official site to protect yourself from phishing scams. On the homepage, click the “Get started” or “Sign up” button located in the top-right corner of the page to begin creating your account.

Coinbase needs two simple registration steps:

- Email registration

- Mobile phone registration

Verify your email and phone number

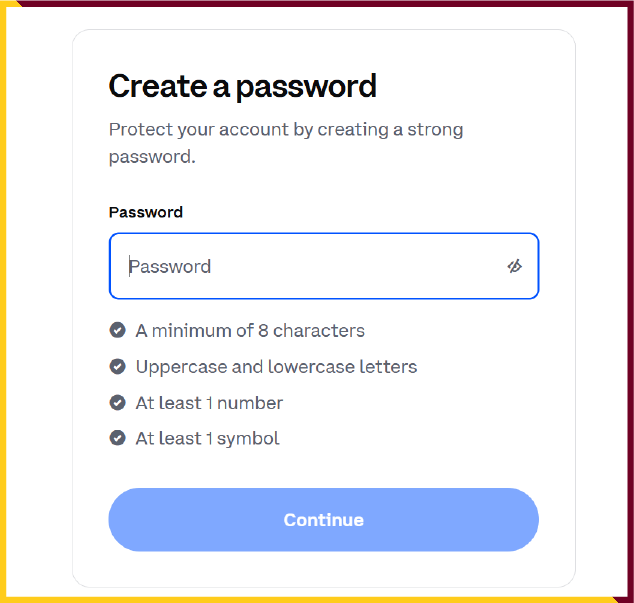

After entering your email address, Coinbase will prompt you to create a strong and unique password. This is an important step to keep your account secure. Choose a password that combines uppercase and lowercase letters, numbers, and special characters. Once you have entered your information, Coinbase will send a verification email to the address you provided.

Providing Personal Information

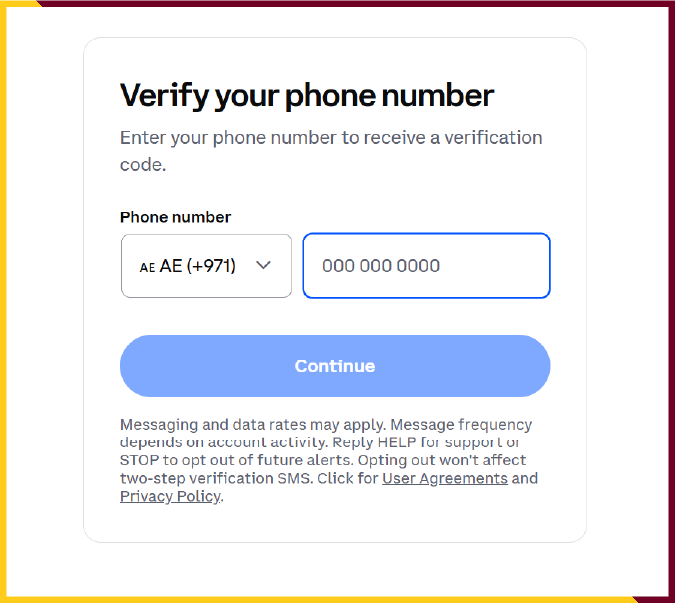

After email verification, Coinbase asks for more detailed information. This is where the platform’s regulatory compliance becomes evident. You will need to provide your phone number, and a verification code will be sent to it as well.

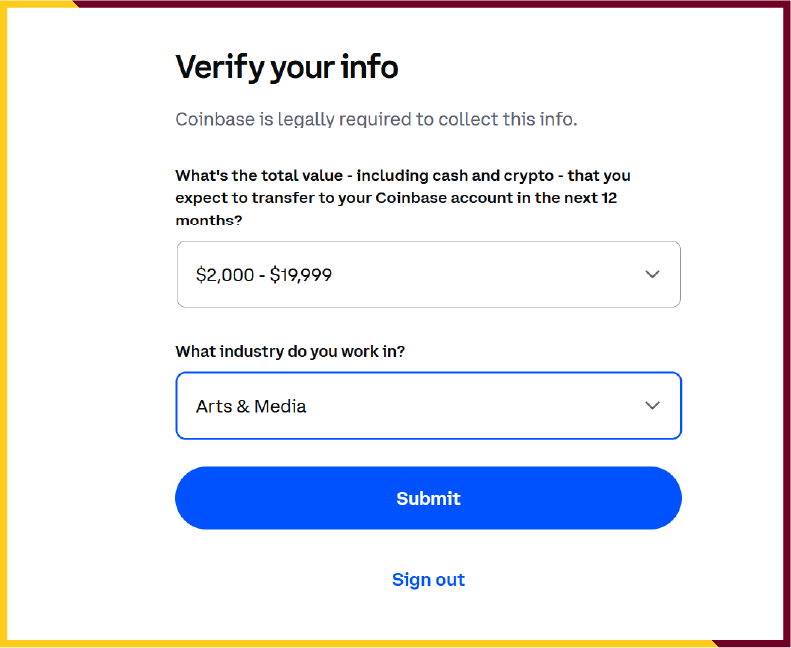

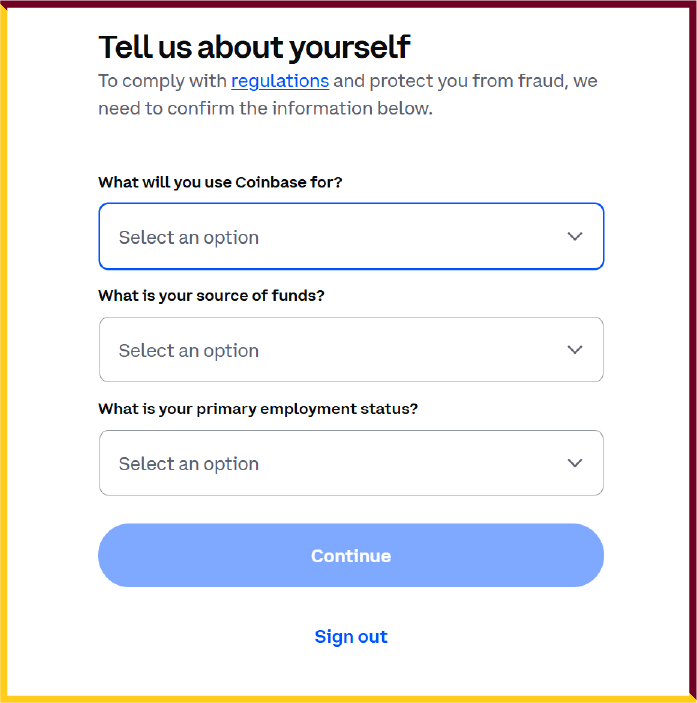

Provide Additional Information

After verifying your phone number, Coinbase will ask for a few additional details to better understand your profile and comply with financial regulations. You may be asked questions such as:

- How much will you invest?

- The industry or field you work in?

- How do you intend to use Coinbase? (for example, trading, investing, or payments)

- Your primary source of funds?

Providing accurate information ensures your account setup goes smoothly and helps Coinbase maintain a secure and compliant trading environment.

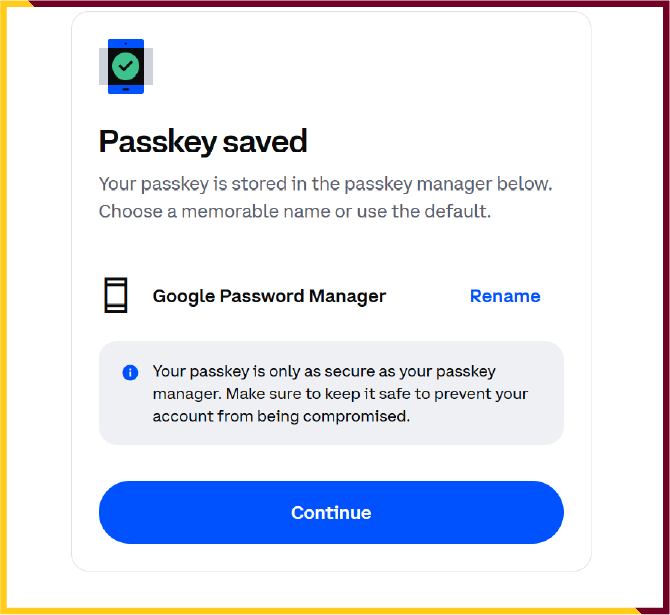

Once you have submitted these details, Coinbase will guide you through creating a passkey (an advanced authentication method) to further safeguard your account. A passkey is a more secure login method, making it harder for unauthorized parties to gain access. Using a passkey in combination with your password adds an extra layer of protection, helping keep your investments safe from phishing or account takeover attempts.

Verify Your Identity

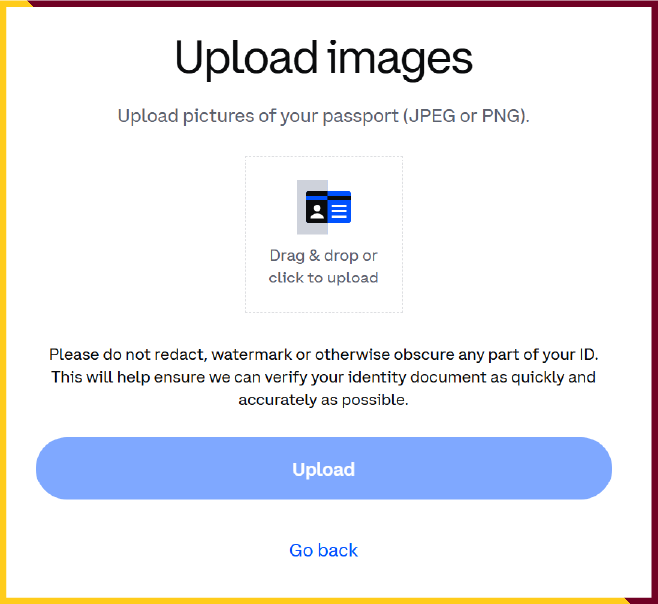

Once the passkey is created, you are required to complete an identity verification process (KYC). The exact documents you will need depend on your country or region of residence.

For example, users in the United Arab Emirates (UAE) are typically asked to verify their identity using a passport. In other regions, Coinbase may accept other forms of government-issued identification, such as a national ID card or driver’s license.

During verification, simply follow the on-screen instructions to upload clear photos of your document and, in some cases, a quick selfie for facial verification. This step usually takes just a few minutes to complete and helps ensure your account’s security and compliance with regulatory standards.

The verification process usually takes just a few minutes, though Coinbase mentions it can occasionally take up to 48 hours during high-volume periods. In my case, I received approval within three minutes.

Setting Up Your Security Features

Once your identity is confirmed, Coinbase immediately guides you toward setting up additional security measures. The platform strongly recommends enabling two-factor authentication beyond just SMS codes.

Setting up the Google Authenticator is recommended, which generates time-based codes on the phone. This provides significantly better security than SMS, which can be vulnerable to SIM swapping attacks: a method hackers use to intercept the phone number and messages.

You will also want to add a payment method before you can start buying crypto. Coinbase accepts bank accounts, debit cards, and wire transfers. Linking a bank account requires logging into your bank through Coinbase’s secure connection with Plaid, a third-party service that handles financial data connections for many apps.

Instant bank verification works for most major banks, but some smaller institutions require manual verification through microdeposits—two small deposits that Coinbase sends to your account, which you then confirm on the platform within a few days.

Understanding Your Account Limits

New accounts start with daily and weekly purchase limits that vary based on your payment method and account history. These limits increase over time as you build a transaction history and maintain your account in good standing.

Initially, you might see limits around $1,000 per day for debit card purchases, with higher limits for bank transfers. These restrictions exist to protect both you and Coinbase from fraud, but they can feel constraining if you are eager to make substantial purchases right away.

Making Your First Purchase

With everything set up, you qre ready to buy your first crypto. The Coinbase interface makes this remarkably intuitive. The main dashboard shows current prices for major cryptocurrencies, with their 24-hour price changes clearly displayed.

Click “Buy/Sell” at the top of the page, select the cryptocurrency you want to purchase, enter the amount in either USD or the crypto denomination, and choose your payment method. The platform shows you exactly how much crypto you will receive, including all fees, before you confirm the transaction.

Coinbase’s fees are higher than some competitors—typically around 0.5% to 2% depending on your payment method and transaction size—but you are paying for convenience, security, and a user-friendly interface. For larger trades, Coinbase Pro (now integrated as “Advanced Trade”) offers significantly lower fees, though with a steeper learning curve.

The Learning Resources You Should Not Skip

One feature that is very impressive about the platform is Coinbase Learn. The platform offers educational content about different cryptocurrencies, blockchain technology, and safe trading practices. Even better, some of these educational modules reward you with small amounts of cryptocurrency for completing them.

The Coinbase mobile app is an excellent companion for anyone managing cryptocurrency on the go. It offers nearly all the same capabilities as the desktop platform but feels more intuitive for quick price checks or small trades. Users can set up price alerts and monitor their portfolios. Logging in is fast and secure thanks to Face ID and fingerprint authentication.

Your Crypto Journey Begins

The platform has clearly put significant effort into making this process as frictionless as possible while maintaining the security standards necessary for a financial institution.

Remember that opening the account is just the beginning. Take time to explore the platform, read the educational materials, and start small as you learn. Cryptocurrency investing carries real risks, and no platform, no matter how user-friendly, can eliminate the fundamental volatility of digital assets.

But with your Coinbase account set up, you now have access to one of the most established and secure gateways into the cryptocurrency ecosystem. Whether you are planning to be an active trader or a long-term holder, you have taken the first step into what many believe is the future of finance.