A lot of people all over the world are excited to get into cryptocurrency. They hear about big profits and new chances, but a lot of them don’t understand the basics. What is a crypto wallet? is one of the first questions beginners ask.

- The main differences between hot and cold wallets, as well as their pros and cons.

- The most common threats to crypto wallets are phishing, malware, and man-in-the-middle attacks.

- Ways to keep your crypto safe, like two-factor authentication (2FA), seed phrase storage, and multisig wallets.

A crypto wallet is not the same as a regular wallet that holds money. It keeps your private keys safe, which are what you need to get to your digital coins. You can’t send, receive, or safely store your cryptocurrency without a wallet.

There are two types of wallets: hot wallets and cold wallets. It’s important to know the difference between them because it will affect how safe your money is in the crypto world.

You should know that crypto coins aren’t really kept in your wallet like cash in your pocket. The coins stay on the blockchain, which is like a big public record of all the crypto transactions. Your wallet doesn’t hold the coins; it holds the keys that let you use them. Your wallet is like your own way to get to the blockchain.

What is a hot wallet?

A hot crypto wallet is a digital wallet that is connected to the internet. This makes it easy to access and use, especially for people who want to trade or send crypto often. These hot wallets include mobile apps, desktop software, and browser extensions.

The biggest advantage of a hot wallet is it allows you to quickly check your balance, make payments, or swap tokens with just a few taps. That’s why hot wallets are very common among everyday users and crypto beginners.

The downside is that hot wallets are online, and they are more vulnerable to hacking. If someone gains access to your device, they can literally steal your funds. Experts often recommend keeping small amounts of crypto in hot wallets and storing larger amounts in more secure places like cold wallets.

What is a cold wallet?

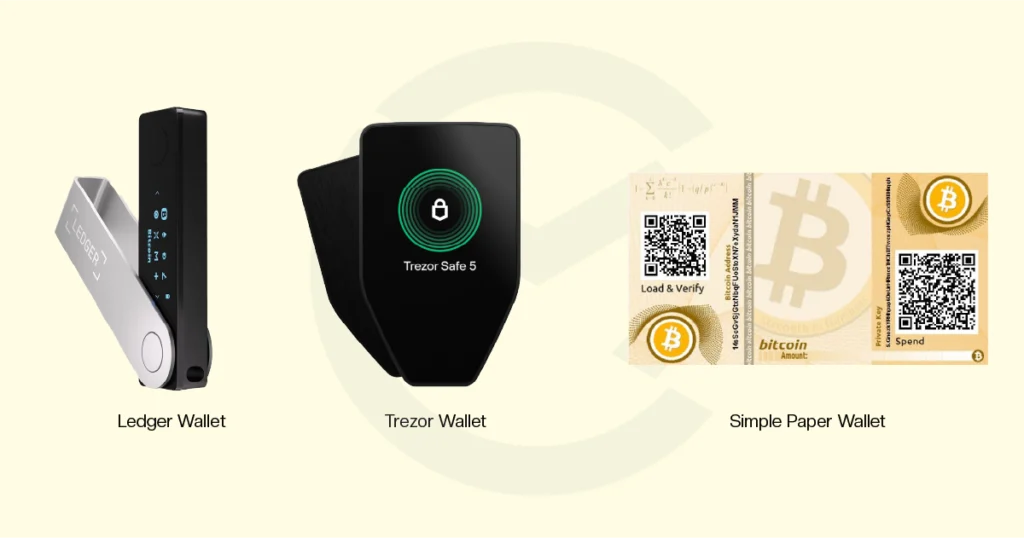

A cold wallet is a type of wallet that is not connected to the internet. This makes it much safer from online attacks. Cold wallets store your private keys offline, usually on a hardware device like a USB stick or even a piece of paper.

Other Words You’ll Hear Around the Crypto World

Public Key:

This is like your crypto email address. It’s a long string of numbers and letters that you can safely share with others. People use your public key to send you cryptocurrency.

Private Key:

It’s more like your password. It gives you full control over your crypto. It’s the type of keys that you don’t share with anyone, because If someone gets it, they can steal all your coins. Your wallet uses this key to “unlock” your crypto and a full access to whoever has it.

What Does The Term Seed Phrase Mean?

It’s a list of 12 or 24 random words that acts like a master key to your wallet. It’s the way to get your lost private key back. You can get your money back if you lose your wallet or device by using the seed phrase.

Custodial Wallet:

It’s more like a normal bank. A third party, like a crypto exchange, keeps your private keys in this wallet for you. It’s simple to use, but you can’t really control your assets because you’re relying on someone else to take care of them. The crypto community often says, “Not your keys, not your coins.”

Non-Custodial Wallet

A wallet where you have access to the private keys. You are now the full owner of your crypto, but you are also fully responsible for it. No one can help you get it back if you lose access.

What are the common threats that crypto wallet holders face?

Hacking is not the only concern that hot wallet users face; other common threats include:

- Phishing: that’s where fake emails or websites trick users into giving up their private keys through fake advertisements that are pushed directly to them.

- Malware: Is more upgraded version scams, which can secretly be installed on the victim device and steal their login information.

- Man-in-the-middle attacks: where hackers intercept data being sent between a user and the wallet service. A perfect example for that would be a public Wi-Fi connection or if a device is infected with spyware. In some cases, the hacker can steal your login details or redirect your crypto to their own wallet without the victim knowing. Cold wallets are mitigating these attacks.

- Fake apps or browser extensions: Some users accidentally install apps or browser extensions that look like legitimate crypto wallets but are actually designed to steal information.

On the other hand, cold wallets offer better protection against online hacks, but they also come with risks. Users could lose the device, or, just like hot wallets, the seed phrase could be damaged, lost, or incorrectly recorded

The common thing between the two wallets is that in both cases, a single small error can lead to the loss of all your crypto.

How can investors stay safe from wallet attacks?

Since there are several ways scammers target crypto holders, the question that naturally comes up is, how can investors protect themselves? Investors can be safer by taking a few simple but important steps. One simple step is to only keep small amounts in hot wallets and use extra security tools to make them even safer.

One of the best ways to protect yourself is to turn on two-factor authentication (2FA), which adds an extra layer of security. Even if a hacker gets the password, they won’t be able to get into the wallet without a second code that is usually sent to the user’s other device. It’s also safer to use devices you trust and not make transactions over public Wi-Fi, where cyberattacks happen more often.

The seed phrase is another important layer of security. Always keep it in a safe place that isn’t connected to the internet. It’s much safer to write it down and keep it in a locked safe than to save it on a phone or computer. Before sending a lot of crypto, it’s also a good idea to test the transaction process with a small amount to make sure it works.

Multisignature (multisig) wallets are even safer for people who have more cryptocurrency. To finish a transaction with these wallets, more than one person or device must agree. This makes it less likely that a single point of failure will lead to theft.

The key to managing digital assets is a crypto wallet, but they also come with a lot of responsibility. It can make a big difference knowing the risks and taking the right steps, whether you choose the convenience of a hot wallet or the security of a cold one. The threats grow as the crypto world does. That’s why it’s important to stay informed, alert, and careful. In the end, the safety of your cryptocurrency depends on both the wallet you use and the things you do to keep it safe.