Federal investigators have uncovered a massive financial crime operation that dwarfs the role of cryptocurrency in illicit transactions, revealing that traditional banking channels remain the primary avenue for money laundering worldwide.

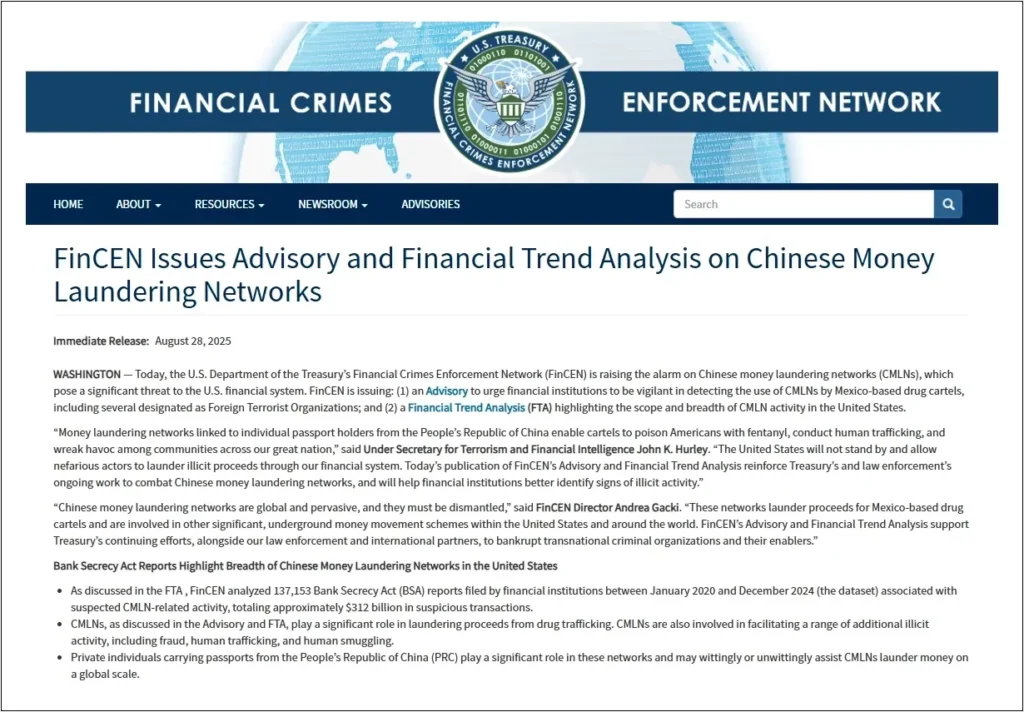

The U.S. Financial Crimes Enforcement Network (FinCEN) released explosive findings on Thursday showing Chinese money laundering networks moved $312 billion through American banks between 2020 and 2024. The watchdog analysed over 137,000 Bank Secrecy Act reports, revealing that criminal organizations processed an average of $62 billion annually through legitimate financial institutions.

According to the findings of FinCEN, cash from drug deals flows through sophisticated Chinese underground banking systems that help cartels clean billions, along with helping Chinese citizens evade their government’s strict currency controls.

The Financial Crimes Enforcement Network issued an urgent advisory on Thursday, warning U.S. financial institutions to watch for suspicious transactions linked to Chinese Money Laundering Networks that serve Mexico’s most powerful drug cartels, including the Jalisco New Generation Cartel and Sinaloa Cartel.

These networks represent one of the most significant money laundering threats facing the American financial system, according to the Treasury’s 2024 National Money Laundering Risk Assessment. The sophisticated operations exploit regulatory gaps between countries while serving the needs of two distinct criminal economies.

Chinese Networks Exploit U.S. Banks to Launder Billions for Cartels

The networks operate through compartmentalized cells built on trust rather than hierarchy, recruiting Chinese students, immigrants, and diaspora communities as unwitting money mules. Many recruits believe they are simply helping fellow Chinese citizens access U.S. dollars, not realizing they participate in laundering drug proceeds from fentanyl, cocaine, and methamphetamine trafficking.

FinCEN identified the threat’s dual motivation: Mexican cartels cannot easily deposit large amounts of U.S. currency in Mexican banks due to restrictions implemented in 2010, while Chinese citizens seek to circumvent their government’s $50,000 annual currency conversion limit through underground banking systems.

The networks facilitate near-instant “mirror transactions” where cartels deliver cash to U.S.-based Chinese operators who coordinate with Mexico-based counterparts to transfer equivalent peso amounts to cartel accounts. Meanwhile, the networks sell the laundered dollars to Chinese buyers who transfer Renminbi to China-based accounts, completing the cycle.

Federal prosecutors detailed the threat’s scope in “Operation Fortune Runner,” where a Los Angeles-based Sinaloa Cartel associate allegedly laundered over $50 million through Chinese underground banking between 2019 and 2023. The case revealed how networks purchase luxury goods, real estate, and electronics using drug proceeds before exporting items to China, Hong Kong, and the United Arab Emirates.

The advisory highlights specific red flags for banks, including Chinese nationals with unexplained wealth making large cash deposits, students receiving transfers labeled as tuition that exceed normal amounts, and businesses selling electronics without corresponding inventory purchases.

President Trump’s January designation of major cartels as Foreign Terrorist Organizations and Specially Designated Global Terrorists adds urgency to financial institutions’ reporting obligations. Banks must now reference “CMLN-2025-A003” when filing suspicious activity reports related to these networks.

The networks’ willingness to absorb financial losses and assume risks for cartels, combined with their global reach and coordination with Colombian peso brokers, makes them particularly dangerous to U.S. financial security.

Findings Undermine Crypto Criticism as Traditional Banks Dominate Illicit Finance

These findings challenge common political narratives about cryptocurrency’s role in financial crimes. Despite frequent criticism from lawmakers like Senator Elizabeth Warren, who has demanded “tougher regulations” on digital assets for money laundering concerns, traditional banking systems process vastly more illicit funds.

The numbers tell a stark story. While the entire cryptocurrency ecosystem recorded approximately $189 billion in illicit volumes over five years, according to Chainalysis, Chinese networks alone moved that amount through traditional banks in just over two years. The United Nations estimates global money laundering exceeds $2 trillion annually, with cryptocurrency representing less than one percent of total crypto volume, according to TRM Labs.