In a headline making move, leading Kraken crypto exchange has just raised a staggering $800 million across two funding rounds, bringing their valuation to a whopping $20 billion.

This fresh capital injection makes the exchange a powerhouse ready to conquer new horizons in the digital asset space.

The Kraken crypto exchange’s leadership revealed the funds came in two tranches. The spotlight shone brightest on a $200 million strategic investment from U.S. market-making titan Citadel Securities.

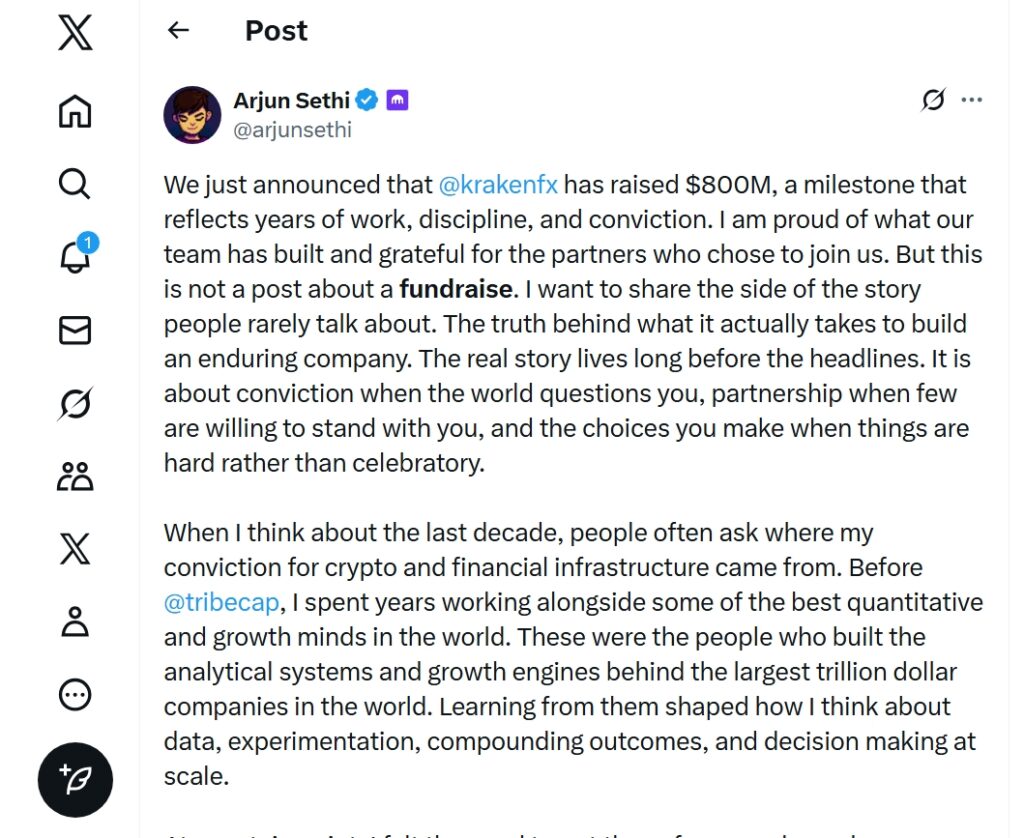

Via: Arjun Sethi

The partnership also brings Citadel’s top-tier expertise in liquidity provision, risk management, and market structure insights straight to the Kraken crypto exchange to power its operations.

A “significant commitment” also came from the family office of Kraken Co-CEO Arjun Sethi.

“With this additional capital, we will continue scaling our global operations, deepening our regulated footprint and expanding our product suite; both organically and through targeted acquisitions,” the exchange said.

Already a global player with operations in multiple countries, the Kraken is doubling down on enhancements to its services while eyeing explosive growth in emerging hotspots across Latin America, Asia Pacific, Europe, the Middle East, and Africa.

Whispers of a Kraken Crypto Exchange IPO Grow Louder

Despite everything, the crypto market is still abuzz with a potential Kraken IPO. Over the years, the company has hinted or faced speculation about going public, with co-founder and former CEO Jesse Powell once predicting a 2022 debut back in 2021.

Rivals like Coinbase made the leap over four years ago, but Kraken has played it cool. In a recent interview with Yahoo Finance, Co-CEO Arjun Sethi emphasized that the Kraken crypto exchange isn’t rushing the process, even as U.S. regulations turn more crypto-friendly.

“We’re financially sound and well-capitalized with private funding,” Sethi said.