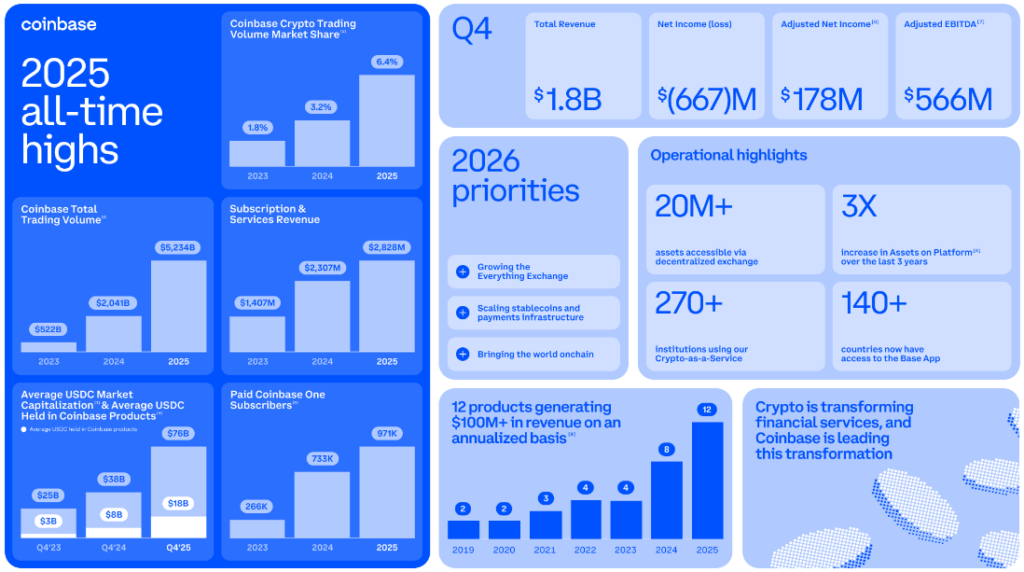

Coinbase just dropped their Q4 earnings, and after eight straight quarters of solid profitability, the company reported a massive $667 million net loss in Q4 2025.

This also happens to be their first red ink since Q3 2023.

The Q4 earnings numbers that everyone was watching closely came in weaker than expected:

- Earnings per share → 66 cents (analysts were looking for ~92 cents)

- Net revenue → $1.78 billion ↓ 21.5% year-over-year (missed $1.85B expectation)

The biggest hit to Q4 earnings came from trading

Transaction revenue crashed almost 37% year-over-year down to $982.7 million, while subscription & services revenue actually grew +13% → $727.4M.

The crypto market took a serious beating during the quarter. Bitcoin fell from its early October peak of $126,080 and ended December under $88,500. That’s roughly -30% in just a few months.

Even with this pretty ugly Q4 earnings report, something intriguing happened. COIN stock actually went up +2.9% in after-hours trading (reaching $145.18) after dropping 7.9% during the regular session.

Coinbase has shared their plans for Q1 of 2026. They’ve done $420M in transaction revenue so far, as of Feb 10, 2026. But they expect subscription & services revenue to drop quite significantly from $727M to $550M–$630M.

Despite the rough Q4 earnings, Coinbase called it a “strong year” both financially and operationally.

“In 2025, more than 12% of all crypto in the world was sitting on Coinbase,” CFO Aleshia Haas said.