Here’s a look at the big moves that happened yesterday in the crypto world, including hope that regulatory clarity might be just around the corner in the US.

It so happened yesterday that Google searches for BTC going to zero Shot up

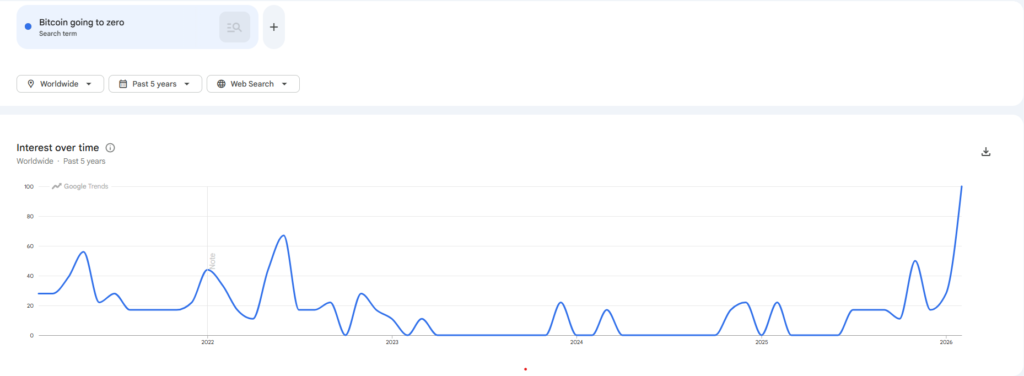

Meanwhile, Google searches for “Bitcoin going to zero” shot up to levels not seen since the FTX meltdown back in late 2022. Google Trends data backs it up that worldwide interest in that doom phrase spiked hard.

No surprise when you see Bitcoin’s wild ride: it peaked near $126,000 back in October 2025, but now it’s hovering around $67,000 (give or take a few hundred bucks depending on the feed). That’s a brutal ~47% drop from the top.

The Fear & Greed Index plunged deep into extreme fear territory around 9, echoing the Terra crash and FTX chaos. People are nervous, but these fear spikes have a habit of marking bottoms more often than not.

Robinhood’s Layer 2 testnet blew past 4 million transactions

Robinhood’s Layer 2 testnet blew past 4 million transactions in just its first week live. CEO Vlad Tenev was hyped on socials, posting about how developers are already jumping in to build on it.

This Arbitrum-powered setup (after months of quiet private testing) is built specifically for tokenized real-world assets and on-chain finance plays. “The next chapter of finance runs on-chain,” he said.

Four million tx in week one? Now that’s the kind of momentum that gets people excited.

All in all, what happened yesterday in crypto delivered a mix of policy hope, fear-driven dips, and serious builder energy. Crypto never sleeps, and right now it’s moving fast.