The World Liberty Financial crypto token was created in October 2024 by the Trump family and its partners, including Zach Witkoff, son of President Trump’s Middle East envoy

An entity connected to the Trump family now holds roughly $5 billion in World Liberty Financial’s ($WLFI) governance token, following a major token unlock on Monday.

The company, which the Trump family endorsed in September 2024, unlocked 24.6 billion $WLFI tokens as part of a scheduled release to establish an initial circulating supply. This move briefly pushed the token’s price to $0.40 before it settled around $0.21.

The Trump family’s stake, held by DT Marks DEFI LLC and “certain family members,” consists of 22.5 billion $WLFI tokens. The token unlock effectively valued their holdings at approximately $5 billion, based on the price at the time of publication.

This cryptocurrency project, along with other Trump-related ventures like the Official Trump ($TRUMP) memecoin and a Bitcoin mining company, has faced criticism from lawmakers who suggest these financial ties could be used to influence U.S. government policies.

Open Interest in Trump-Tied $WLFI Derivatives Nears $1 Billion

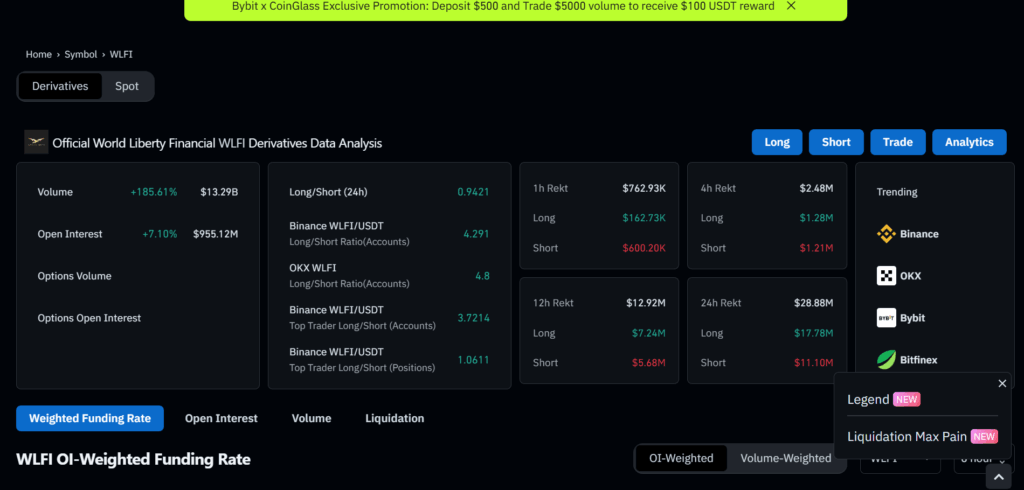

Leading up to the token unlock, open interest in derivatives contracts for the World Liberty Financial ($WLFI) token soared to nearly $950 million. This figure, which tracks the number of outstanding contracts, indicates strong investor interest and a high volume of speculative trading.

Trading volume for $FbtWLFI derivatives also saw a massive jump, rising over 535% in a single day to reach $4.54 billion, making it the fifth most-traded crypto derivative in the last 24 hours.

The token’s price has fluctuated, trading around $0.34, down from a peak of over $0.40 a week ago. This activity suggests that traders were positioning themselves ahead of the scheduled unlock of about 5% of the token’s supply.

Crypto Funds Attract $2.5 Billion in Inflows Despite Market Downturn

Despite recent price drops in Bitcoin and Ether, cryptocurrency investment products saw a significant rebound last week, attracting nearly $2.5 billion in inflows. This surge, reported by CoinShares, follows a period of outflows and signals renewed investor interest in digital asset funds.

Exchange-traded products (ETPs) led this trend, accounting for $2.48 billion of the inflows. This indicates growing institutional and retail interest in structured crypto investment vehicles, even as the broader market remains volatile.Interestingly, this capital influx occurred while the prices of the two largest cryptocurrencies were falling.

Bitcoin ($BTC) dipped below the $108,000 mark after peaking at $113,000, while Ether (ETH) fell below $4,300 after starting the week above $4,600.