Let’s dive straight into the hottest crypto development from Valentine’s Day!

First off, big crypto development coming from the Netherlands

The Dutch House of Representatives just pushed forward a proposal slapping a hefty 36% capital gains tax on savings, stocks, and cryptocurrencies.

Now this isn’t your typical tax on profits you actually cash out; it hits unrealized gains as well, meaning you could owe big even if you haven’t sold a single satoshi.

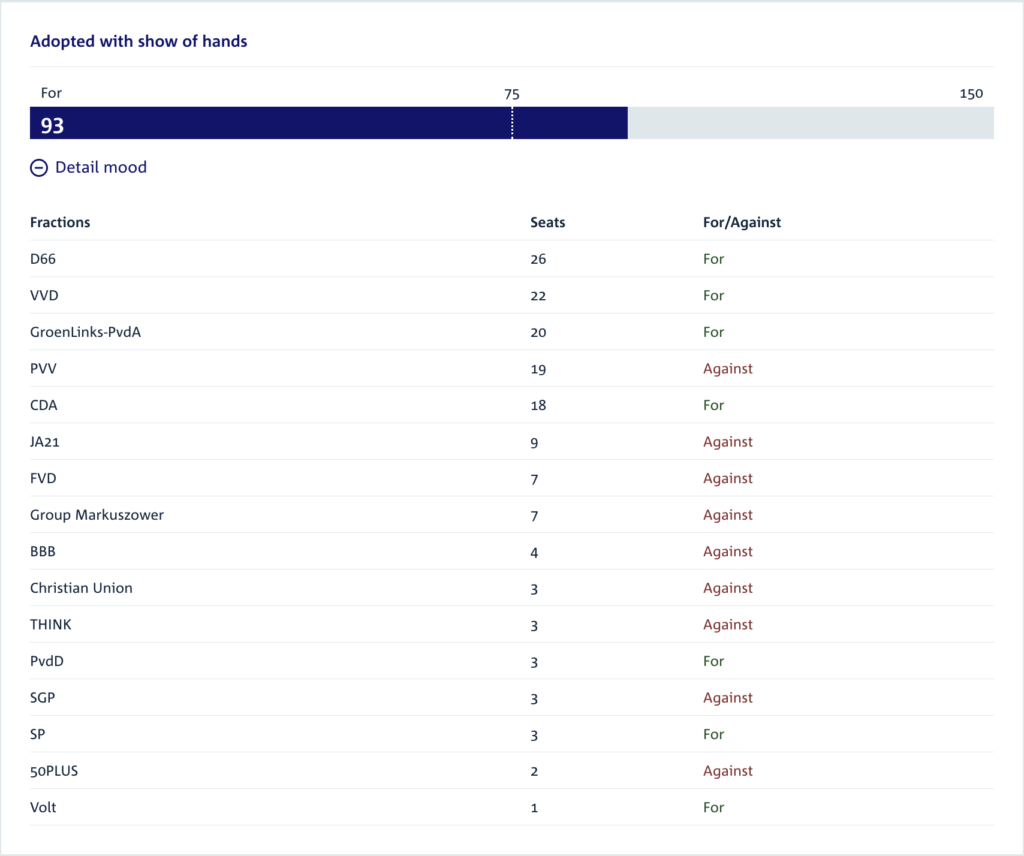

With 93 votes in favor (well over the 75 needed), unfortunately, it’s moving ahead, though the Senate still has to weigh in before it kicks in around 2028. A lot of people are already raising red flags, though, warning this could spark serious capital flight.

Investors are eyeing friendlier spots with lighter tax rules to protect their stacks. If the bill passes, the Netherlands might see a real exodus as people chase better environments for crypto development and growth, especially in Europe.

White House crypto adviser Patrick Witt is calling for calm in the stablecoin debate

White House crypto adviser Patrick Witt says banks shouldn’t panic over crypto platforms offering yield on stablecoins and that it’s not a threat to their core business. In fact, Witt believes both sides can meet in the middle, and banks could even jump in to offer similar products, opening new doors for everyone.

Patrick Witt believes this tension is temporary, and crypto developments will find ways to coexist and thrive with traditional finance.

Another big crypto development from the US

Trump Media & Technology Group just filed with the SEC for two fresh ETFs tied directly to major cryptocurrencies. We’re talking about a Truth Social Bitcoin (BTC) and Ether (ETH) ETF, plus a Truth Social Cronos (CRO) Yield Maximizer ETF.

Partnering with Crypto.com for custody, liquidity, and staking services, these could give everyday investors easy access to both capital growth and income plays in crypto development.

The team behind it, including Yorkville America Equities, is positioning these as a full-spectrum platform for digital investing.

Sure, it’s still under SEC review with a 0.95% fee on the table, but if greenlit, this could be a massive step forward for mainstream adoption and innovation in crypto development.

What a wild ride in just one day! From tax headaches in Europe to high-level calls for collaboration and bold new ETF filings, yesterday was full of activity.

Stay tuned for more on Coin Medium.