While most cryptocurrency sectors limped through 2025, a digital revolution was quietly reshaping how investors buy gold. Blockchain-based gold tokens did not just grow, but they exploded, leaving conventional exchange-traded funds struggling to keep pace, according to a report by crypto exchange CEX.io.

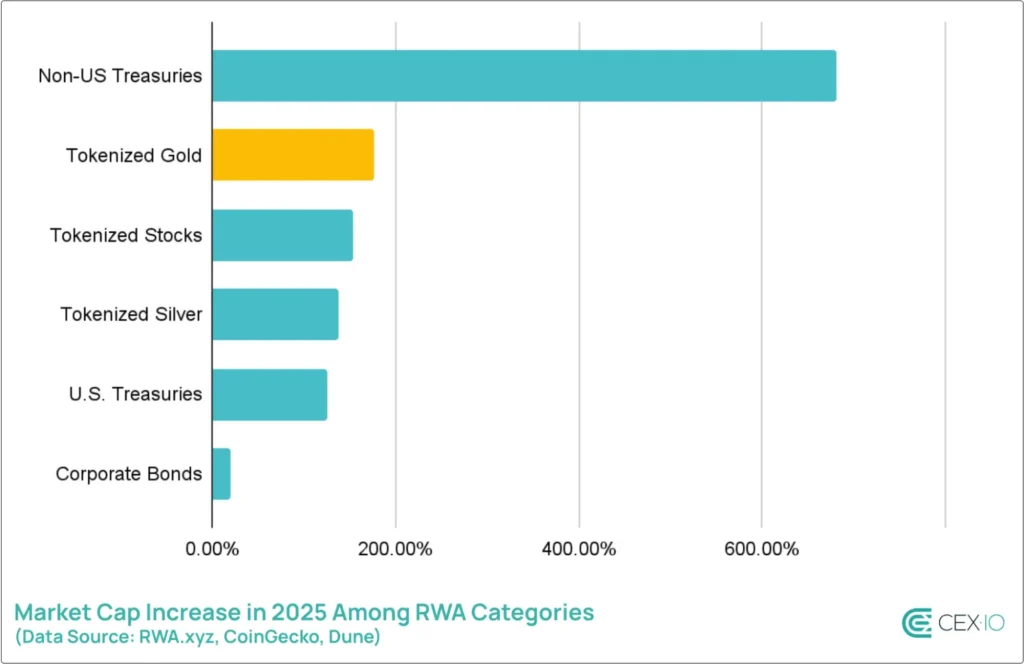

The numbers are striking. Decentralized finance eked out a 2% increase in the total value locked during 2025, but real-world assets jumped 184%. Among those assets, tokenized gold became the breakout star, grabbing nearly a quarter of all sector growth and running six times faster than lending platforms and nine times faster than bridge protocols.

This represents something bigger than a temporary trend. It is a fundamental rethinking of gold ownership itself. Investors are abandoning paper certificates and custodial arrangements for verifiable blockchain holdings that can be traded instantly across borders. And traditional financial institutions are watching as they face a choice: adapt quickly or watch market share drain away to faster digital competitors.

From Niche Product to Market Powerhouse

Tokenized gold’s market capitalization went from $1.6 billion to $4.4 billion over twelve months of 2025—a 177% climb that pulled in $2.8 billion of fresh capital. The holder base tells an even better story: it grew by more than 115,000 investors, 14 times faster than the year before and ahead of tokenized U.S. treasuries and corporate bonds.

The appeal comes down to accessibility. Most investment vehicles lock out ordinary investors with accreditation and other requirements. Tokenized gold is a solution to these barriers. Someone with a few hundred dollars can buy the same asset as a pension fund, simply by purchasing tokens backed by real gold.

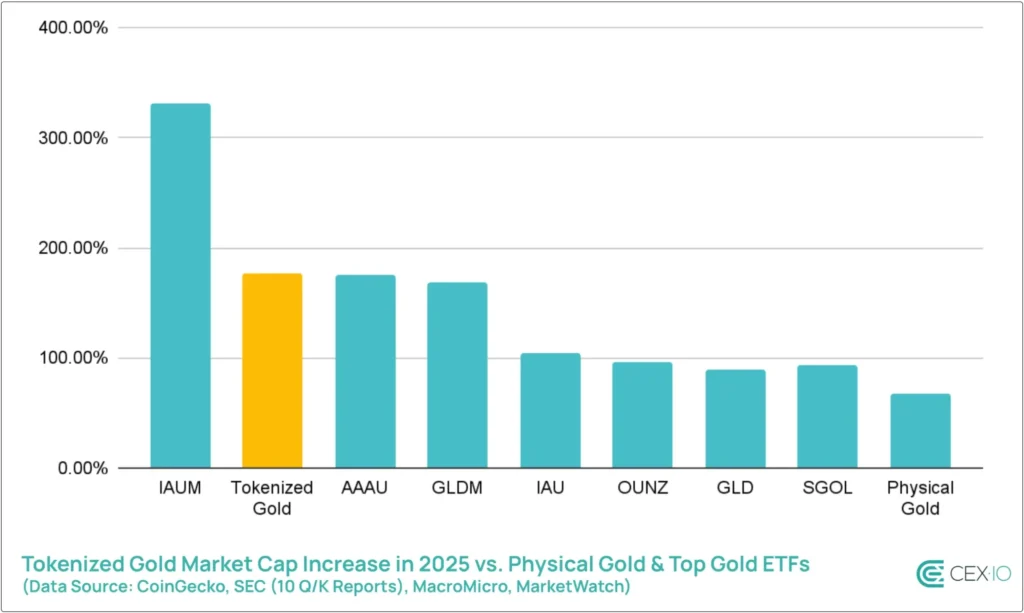

Challenging the ETF Giants

Taking into account the full year, tokenized gold reached $178 billion in trading volume in 2025. Compared to gold ETFs, this would place tokenized gold as the second-largest gold investment product globally by trading volume, ahead of every ETF except GLD, underscoring its rapid emergence as a major liquidity venue.

Three old tokenized products—XAUT, PAXG, and KAU—still control about 97% of the market. But newcomers are finding room also. Matrixdock Gold went from fewer than 1,000 wallets to more than 65,000 last year, proof that new entrants can gain traction despite the concentration at the top.

Some analysts wondered if tokenized gold would eat into stablecoin territory during market stress. October’s data suggests otherwise. When Bitcoin crashed from $122,000 to $106,000 during that month’s massive liquidation event, daily tokenized gold volume spiked 250%. Traders were looking for something between full crypto exposure and a complete exit to stablecoins. When Bitcoin found its footing again, tokenized gold volume dropped back down.

The asset now accounts for roughly 1% of Bitcoin and USDT volumes, up from a tenth of a percent at the start of 2025. This jump shows real adoption, as per the CEX.io report.

As gold prices continue to be bullish and regulations for tokenized assets become clearer, tokenized gold will further its scale of adoption. It seems that what began as an experiment to bridge traditional commodities with blockchain is becoming a core pillar of modern portfolio diversification.