Despite turbulent market swings for the past few weeks, Fundstrat Global Advisors’ managing partner, Tom Lee, is standing out with his contrarian view. Lee says a crypto market rebound could be on the horizon once the recent rally in precious metals cools off. Speaking on CNBC’s ‘Power Lunch’ on Monday, he highlighted how current economic conditions, like a weakening U.S. dollar and the anticipated Federal Reserve easing, could propel digital assets higher.

He acknowledges that crypto has lacked the typical upside or leverage tailwind because much of the investor capital has been diverted toward safe-haven metals instead. “When gold and silver take a break, then in the past, that would lead to a Bitcoin and Ethereum surge afterwards,” Lee explained, drawing on historical patterns where capital rotates from commodities back to riskier assets like crypto once metals stabilize.

This outlook comes against the backdrop of a stupendous rally that precious metals have been witnessing. Gold shattered records by hitting an all-time high of $5,100 per ounce on Monday, marking a 17.5% (YTD) increase. Silver has outperformed even more dramatically, soaring to $110 per ounce. This is a staggering 57% rise since January 1, 2026. We can attribute the precious metal rally to various tailwinds. These tailwinds include an uncertain geopolitical environment, threats of trade tariffs, and a weakening U.S. dollar. These factors have all pushed investors to play it safe.

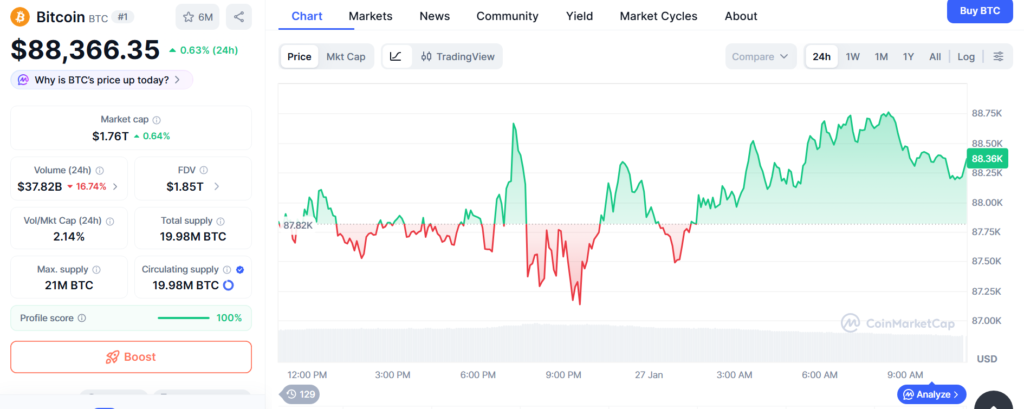

There is almost an inverse correlation between the boom in metals and the doom for cryptos. Bitcoin is down 30% from its October 2025 peak and has slipped below that $90,000 mark in the last week of January. The largest cryptocurrency is now staring at support levels of $86,000 and is currently trading at $88,207 at the time of publication. Ethereum, on the other hand, is trading at $2,940, up 1.6% in the last 24 hours.

Lee also touched on structural crypto fundamentals. He noted lingering effects from last October 10th sell-off that disrupted key market participants, but he says that fundamentals have strengthened since then. Interestingly, Lee’s firm BitMine purchased 20,000 ETH (~$58 million) even as prices slid, reinforcing their conviction in Ethereum’s long-term outlook. According to Lee, with network growth and adoption strengthening, crypto fundamentals will see a turning point, suggesting prices will catch up once external pressures ease.