Crypto payments have hit a new milestone in the US, with nearly 40% of US merchants already accepting them at checkout, according to a new survey by PayPal.

American shoppers are voting with their wallets, and are hungry for this option, pushing businesses to step up.

PayPal shared these findings on Tuesday, drawing from a detailed National Cryptocurrency Association survey run in October with over 600 key decision-makers across various industries.

Crypto payments are taking off

The numbers tell an exciting story: close to nine in ten merchants report getting questions from shoppers about crypto payments.

A fresh survey backed by PayPal reveals that almost four in ten US merchants now welcome cryptocurrency right at the point of sale.

May Zabaneh, PayPal’s VP and GM for Crypto, said, “What we’re seeing in this data and in direct talks with our customers is that crypto payments have moved past the testing phase.”

“They’re becoming part of regular buying and selling. Shoppers want quicker, more flexible ways to pay, and when businesses open the door to crypto, they quickly spot the real advantages.”

84% of those surveyed expect crypto payments to go fully mainstream within the next five years.

Both buyers and sellers stand to gain

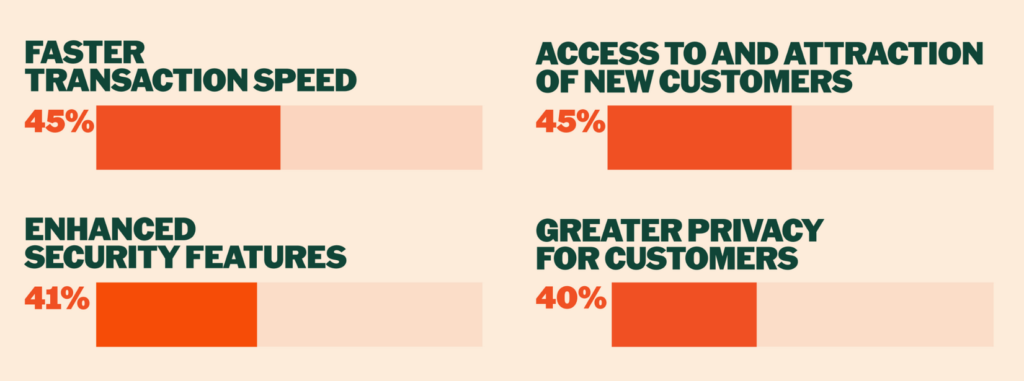

Cryptocurrency brings the promise of faster settlements, lower costs, clearer transaction trails, and beefed-up security compared to old-school methods.

PayPal has been fueling this momentum since launching its crypto checkout tool back in July, letting US merchants handle payments in over 100 different cryptocurrencies seamlessly.

Adoption shines brightest among big enterprises, though midsized businesses clock in at 32% acceptance and small companies at 34%. Big names like Starbucks, Walmart, and Home Depot are already in the game, showing how mainstream this is getting.

For merchants who accept it, crypto payments aren’t just a side note. As a matter of fact, they make up a solid 26% of total sales on average. That proves when the choice is there, customers jump on it.

Younger generations are leading the charge. Millennials and Gen Z use crypto the most in hospitality, travel, digital products, and gaming, which top the adoption charts.

There still remains one big hurdle

PayPal points out that the infrastructure is still a big hurdle. They believe crypto payments need to feel as effortless as swiping a credit card. In fact, 90% of merchants said they’d give it a shot if the setup matched traditional payment ease.

Stu Alderoty, president of the National Cryptocurrency Association and Ripple’s chief legal officer, echoed similar sentiments.

“The data shows interest in crypto isn’t the issue; it’s understanding how it works in real life.”