Hey there, friends in crypto! Happy weekend, and let’s take a quick look at what happened in crypto on February 7, 2026. It was a real mix of Bitcoin mining difficulty drama, a fresh banking win, and another clampdown from China.

Bitcoin Mining Difficulty Takes Steepest Fall Since 2021

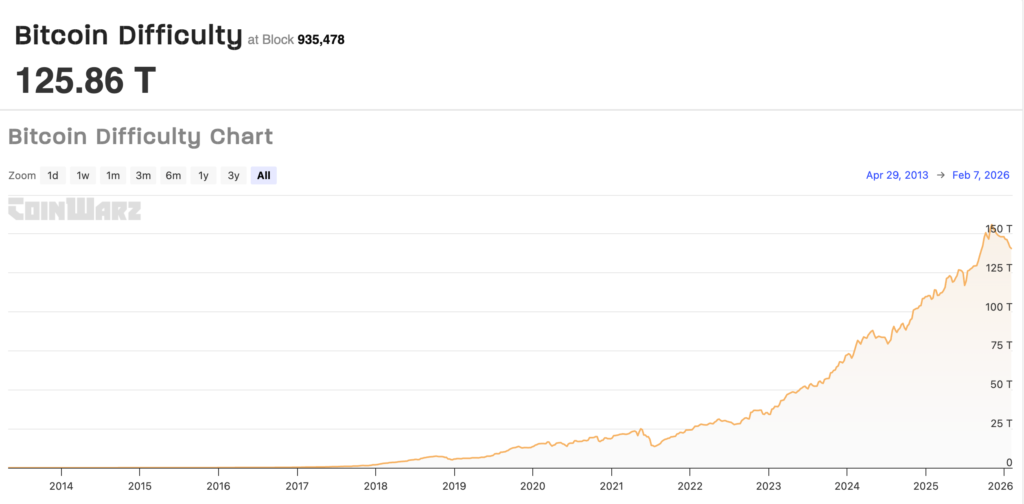

Whoa, talk about a shake-up! Bitcoin mining difficulty just plunged over 11.1% in one go, the biggest single drop since China’s massive 2021 crackdown kicked miners out.

Right now, it’s sitting at around 125.86 trillion, per CoinWarz data, and block times have sped up from over 11 minutes down to about 9.47 minutes. That’s some serious breathing room for miners after a rough patch.

This BTC mining difficulty fall didn’t come out of nowhere. We’ve got Bitcoin’s price tanking hard (down over 50% from recent highs to the $69k zone), plus that brutal winter storm slamming U.S. energy grids and knocking hashrate offline temporarily. Miners were feeling the squeeze, and the network adjusted accordingly to keep things balanced.

Looking ahead, projections show Bitcoin mining difficulty bouncing back up to roughly 132.9 T by the next tweak around February 20.

Erebor Snags First New U.S. Bank Charter in Trump’s Second Term

On a brighter note, Erebor Bank just scored the first new national bank charter under President Trump’s second term.

The OCC gave the green light, letting this crypto-savvy startup operate nationwide, as the Wall Street Journal broke the news.

Backed by Andreessen Horowitz, Founders Fund, Lux Capital, 8VC, and even Elad Gil, Erebor comes loaded with about $635 million in capital. Founded by Palmer Luckey, it’s targeting startups, venture-backed companies, and high-net-worth folks who got burned after Silicon Valley Bank’s collapse in 2023.

This feels like a real step forward for bridging in crypto and traditional finance.

In Crypto Yesterday, No More Unapproved Yuan Stablecoins or RWAs

The People’s Bank of China, alongside seven other regulators, dropped a joint statement banning any unapproved issuance of yuan-pegged stablecoins or tokenized real-world assets (RWAs) from domestic players or foreigners.

No entity can mint Renminbi-linked stablecoins without explicit okay from the authorities, and that slams the door on offshore loopholes too.

They’re folding RWA tokenization right into their risk radar, calling unauthorized asset-to-token conversions potentially illegal. It’s all part of keeping speculative stuff out while pushing their own digital yuan (e-CNY) front and center.

So there you have it, a classic weekend in crypto. What a rollercoaster!