The crypto world is taking some serious punches right now, and the bad news just keeps rolling in. From regulators cracking down across borders to treasury holders staring at eye-watering unrealized hits, it’s a rough patch that’s got everyone talking.

Bad News One: UK’s regulator files action against HTX exchange

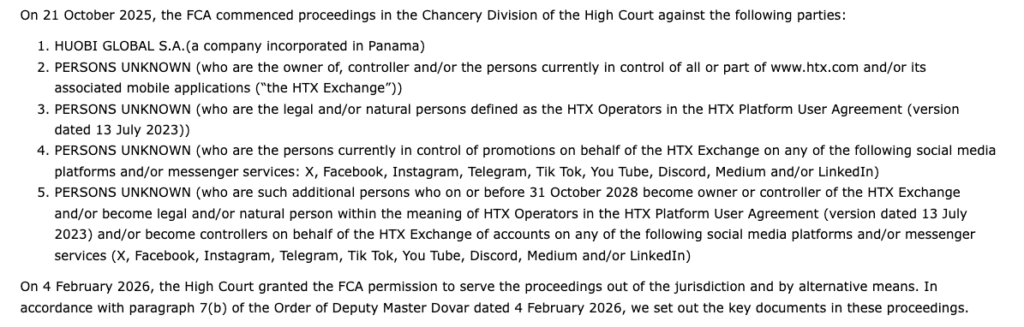

First up in the bad news department is that the United Kingdom’s Financial Conduct Authority (FCA) has launched full-on High Court proceedings against crypto exchange HTX (you know, the one formerly called Huobi Global).

They allege HTX is illegally pushing crypto services and promotions straight at British consumers, blowing right through the strict financial advertising rules.

The FCA says this comes after repeated warnings the exchange ignored, with ads popping up on their site and across social media.

Under the tougher FinProm Regime rolled out in 2023, this kind of thing isn’t tolerated anymore, and the FCA is making an example.

Then there’s more bad news piling on for Solana fans

Publicly listed companies treating SOL like a shiny treasury asset are collectively nursing over $1.5 billion in unrealized losses.

We’re talking about firms in the US holding more than 12 million SOL tokens, roughly 2% of the entire supply, based on what they paid versus today’s prices hovering around $83-84.

The heaviest damage shows up with names like Forward Industries, Sharps Technology, DeFi Development Corp, and Upexi racking up over $1.4 billion of those disclosed paper losses alone.

Some haven’t fully spilled their acquisition costs, so the real figure could sting even worse.

Good news coming from Dubai

But hold on! Amid all this bad news, there’s a bright spot lighting up from Dubai. Zand Bank is teaming up deeper with Ripple to make sending money abroad actually feel futuristic and frictionless.

They’re linking Zand’s AEDZ (the digital dirham stablecoin) with Ripple’s RLUSD (their US dollar-backed one) to slash times, cut costs, and smooth out cross-border flows like never before.

So imagine you deposit regular dirhams or dollars into your Zand account (or a partner app), and instant digital stablecoins land in your wallet.

Want to send cash overseas? Just zip those stablecoins over Ripple’s lightning-fast blockchain settlement in seconds. The receiver flips them back to local fiat at their end.

The partnership also covers quick conversions between AEDZ and RLUSD, near-instant settlements, rock-solid custody for digital assets, and better liquidity tools for businesses.

More on that story is here.

In a market drowning in bad news, this kind of real-world utility from the UAE is exactly the kind of progress that keeps the bigger picture exciting.