A major push, including a petition for greater blockchain innovation in the United Kingdom has accelerated dramatically this week.

A targeted campaign from major cryptocurrency exchange Coinbase fueled this surge.

The online petition urges the government to craft a forward-thinking regulatory framework for blockchain technologies and stablecoins.

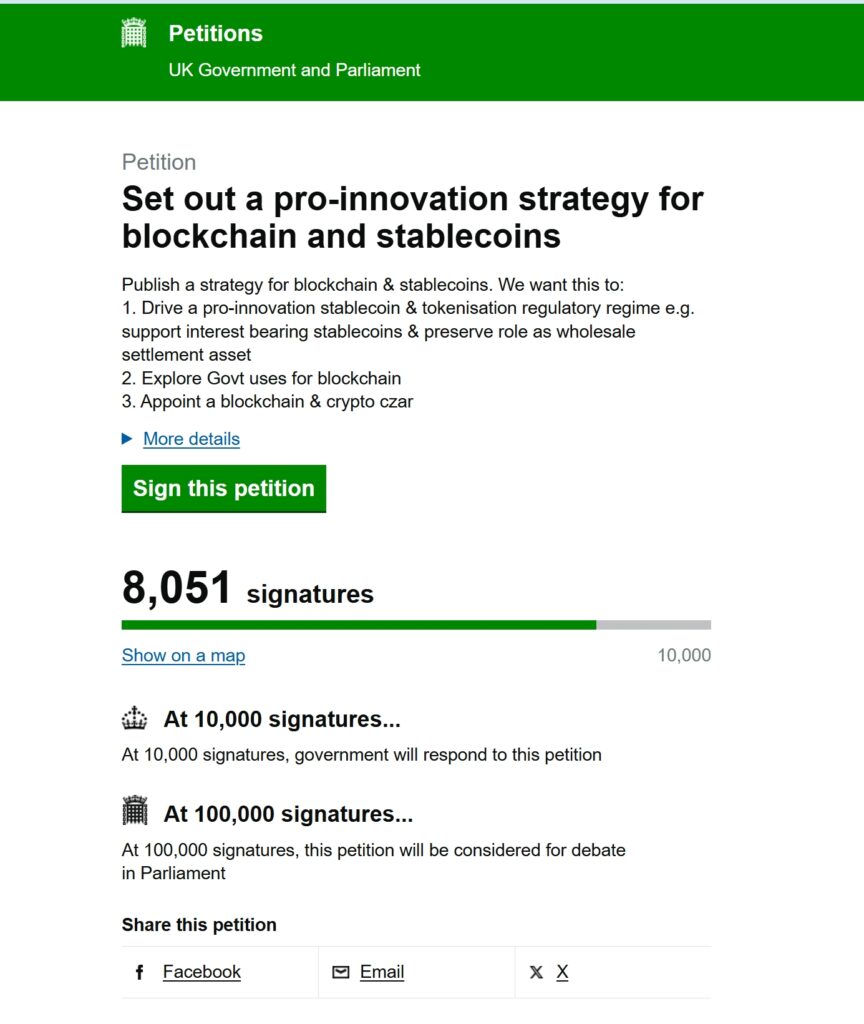

The petition has now amassed over 8,000 signatures, more than half of what is required for an official response from Whitehall.

A petition for greater blockchain innovation

Launched in July 2025 on the UK Parliament’s petition portal, the initiative languished until Coinbase mobilized its user base.

Social media posts circulating online captured the exchange’s urgent call to action.

Most captions read: “Help UK lead stablecoin innovation now.”

The effort has ignited fresh debate over the UK’s position in the global digital economy, with advocates warning that regulatory inertia could cede ground to more agile competitors.

The petition’s core demands are threefold.

They include establishing a clear regulatory regime for stablecoins and tokenization processes.

It promotes blockchain integration across government operations and installing a dedicated “blockchain czar” to steer national crypto policy.

Petitioners argue that stablecoins pegged to stable assets like the pound or dollar form the bedrock of a tokenized future economy.

They point to the United States’ recent pivot away from a central bank digital currency for private stablecoin alternatives.

“This is a question of national interest to preserve the competitiveness of London and sterling’s global standing,” the petition’s text declares.

Notable evolution in the UK’s regulatory outlook on Cryptocurrency

Back in 2024 officials from the Financial Conduct Authority (FCA) and Treasury signaled a strategic rethink.

On November 26, 2024, the FCA published its Crypto Roadmap at the City & Financial Global Tokenisation Summit in London.

This detailed timelines for discussion papers, consultations, and policy statements on stablecoins, staking, market abuse, and broader cryptoassets.

The move was seen as a direct bid to rival the European Union’s Markets in Crypto-Assets (MiCA) regime, which fully took effect in December 2024.

MiCA imposes stringent licensing, reserve requirements, and compliance mandates on crypto service providers.

Since the Brexit, the UK is unbound by any EU laws, including MiCA.

According to campaigners this independence presents a golden opportunity for policies to prioritize growth over the bloc’s more prescriptive approach.

The petition remains open for signatures until March 3, 2026. It needs 10,000 backers for a mandated government reply and 100,000 for potential parliamentary debate on blockchain innovation.