DeFi Synthetix, the veteran perpetuals trading platform, is officially relaunching its flagship perp DEX right on the Ethereum mainnet today, after years away chasing cheaper fees elsewhere.

Now that’s a total 180, if you ask me. Founder Kain Warwick isn’t holding back on the hype.

“By the time perp DEXs became a thing, the mainnet was too congested, but now we can run it back,” he told media.

He’s convinced the Ethereum mainnet is primed for high-frequency trading action again, thanks to plunging gas costs and smart scaling tweaks.

It’s wild to think there hasn’t really been a proper perp DEX thriving on the Ethereum mainnet until now, Warwick pointed out. Back in the day, sky-high fees and clogged blocks forced everyone, including Synthetix to flee to layer-2 spots like Optimism in 2022, then Arbitrum and Base.

Warwick explained how transaction expenses killed market efficiency.

“The costs were just too high before,” he said.

But things have flipped dramatically on the Ethereum Mainnet

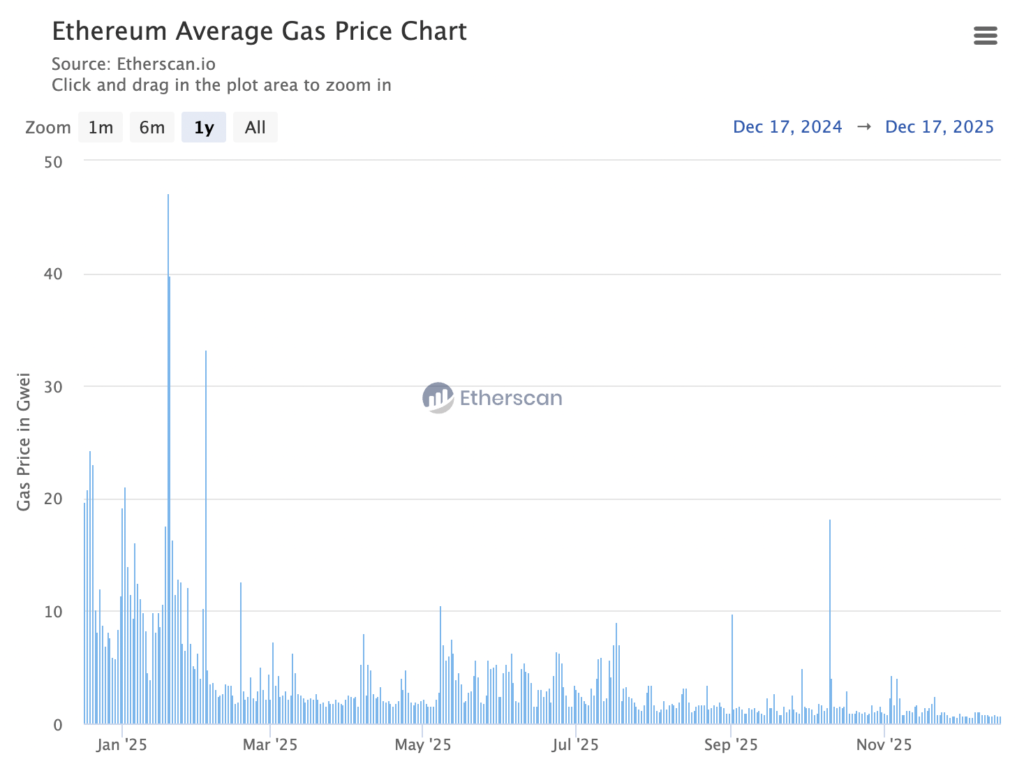

Fast forward to now, and average gas fees on the Ethereum mainnet are sitting ultra-low, down massively from a year ago, making complex infrastructure viable once more.

Warwick credits the combo of layer-1 upgrades (like the recent Fusaka boost) and layer-2 progress for this turnaround.

“You can actually run critical infrastructure on the Ethereum mainnet again,” he beamed.

And with most crypto liquidity, assets, and margin still parked on the Ethereum mainnet, it’s hands-down the smartest spot for a perp DEX.

He’s even predicting a rush of competitors following suit soon.

“It wouldn’t be a Synthetix launch if someone didn’t try and follow us within 20 minutes,” he joked.

The Ethereum mainnet can easily handle multiple perp platforms at once these days.

Looking ahead, Ethereum bulls like Anthony Sassano are eyeing even bigger capacity jumps in 2026, with gas limits potentially tripling or more.

Warwick called 2025 potentially the network’s strongest year since the Merge, praising the fresh focus on what builders actually need.