A London listed firm Satsuma Technology PLC has successfully raised £163.6 million with Bitcoin settlements.

The decentralized AI infrastructure and corporate Bitcoin treasury strategy raised $217.6 million USD through its second secured convertible loan note offering.

The amount exceeded its minimum target by roughly 64%.

The fundraising closed with the round led by ParaFi Capital and supported by major digital‑asset investors including Pantera Capital, DCG, Arrington Capital, Kraken, BTC Opportunity Fund, and Borderless Capital.

Notably, investors subscribed £96.9 million of the total in Bitcoin, contributing exactly 1,097.29 BTC in lieu of cash.

This marks the first instance of a London-listed company accepting Bitcoin as payment in a subscription process, representing a pioneering moment for crypto‑native capital structures in the UK.

Satsuma CEO Henry K. Elder described the fundraising as a “landmark validation” of the firm’s strategic vision.

He emphasized that the willingness of investors to subscribe via Bitcoin demonstrated confidence in Satsuma’s ability to fuse innovation with execution.

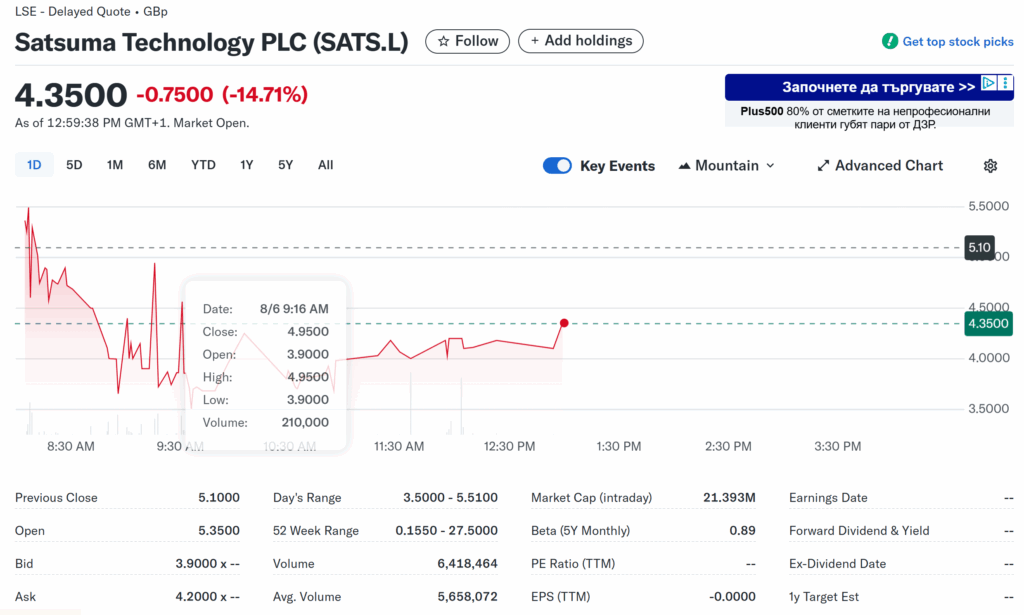

Satsuma shares drop 14% after the announcement. Source: Yahoo Finance

Satsuma Technology’s Strategic Allocation and Use of Funds

A portion of the proceeds will underwrite Satsuma’s expansion in decentralized infrastructure, including hiring developers and scaling its AI and blockchain capabilities

At least three months of working capital will be retained in cash.

The remaining funds are entrusted to Satsuma Technology Pte Ltd, the company’s Singapore subsidiary, for addition to its BTC holdings.

Satsuma Technology: The Future Outlook & Developments

Satsuma Technology has not outlined public long‑term goals for further BTC accumulation beyond this tranche. But the successful execution of this convertible offering may pave the way for future hybrid capital structures involving crypto assets.

As regulatory clarity advances and corporate adoption grows, Satsuma’s model may serve as a template for others aiming to merge decentralized AI development with crypto treasury management.

This financing milestone marks a defining moment in the convergence of corporate strategy, decentralized AI innovation, and crypto‑asset treasury management.

The move also positions Satsuma at the forefront of a new wave in corporate finance.