If there was one takeaway that echoed from Michael Saylor’s speech at the Coco Cola Arena, where the Binance Blockchain Week is underway, it was that “Volatility is vitality and that you can’t have the benefits of the crypto economy without the volatility; if it wasn’t volatile, it wouldn’t be useful.”

Saylor made a fitting case for Bitcoin, and an even stronger case for the many perpetual preferential equity that his company Strategy has brought to the market. He began by discussing how the Bitcoin market has evolved over the years, with its market cap now at $1.8 trillion, and noted that there are more than 300 million Bitcoin holders globally. His speech highlighted that the transformation cryptocurrencies are witnessing is embedded in the fact that the U.S. currently has a President who backs digital capital, and Bitcoin is the digital capital of the future.

This transformation is not limited to just a pro-crypto government but also the banking and financial institutions that have now taken note and have made a full 180-degree flip to embrace Bitcoin, lest they stand to lose out. “Bitcoin is the economic foundation, the Ethical foundation, and the technical foundation of this entire market,” he added.

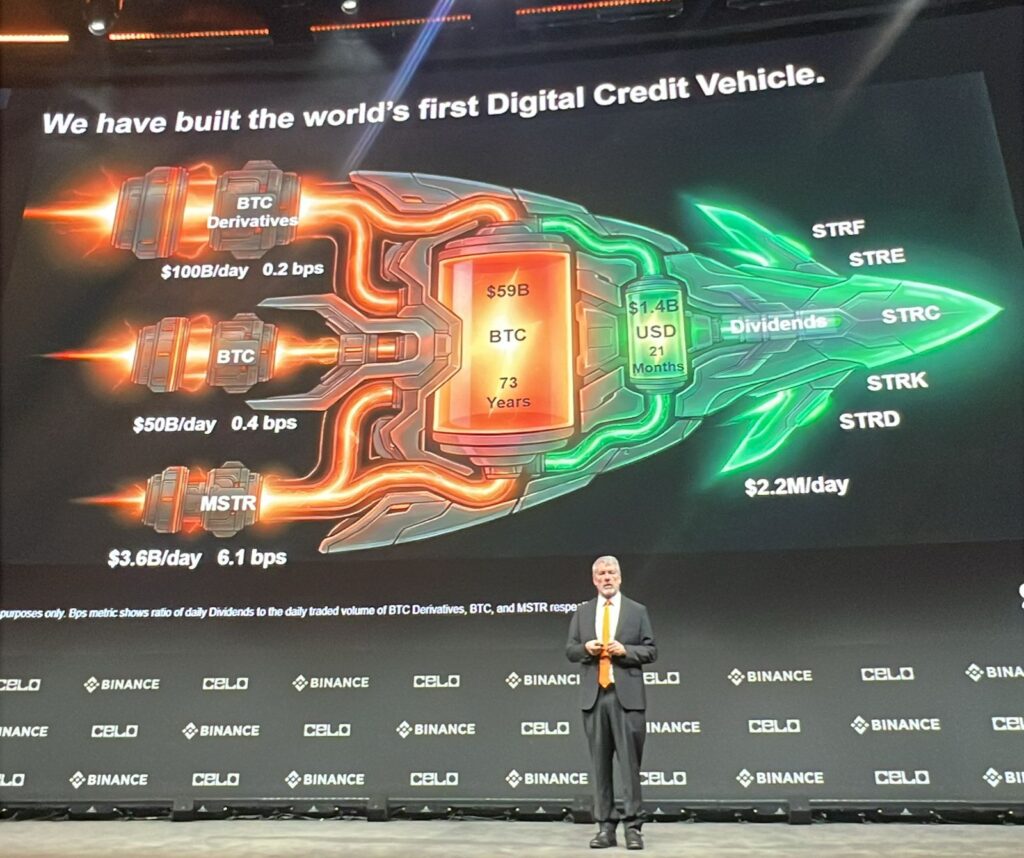

Making a case for the 5 different types of perpetual preferential equity that his company’s Strategy (MSTR) has to offer. Saylor said that people who aren’t “hyper bitcoin maximised, and would want more bitcoin, they can buy our equity”. Every year they’ve been increasing their bitcoin per share. Trying to answer the question that haunts him the most, on whether this equity has any value, Saylor responded saying his company is focusing on creating credit. “The equity has value because we’re able to create the credit. The more credit we sell, the more yield we generate, the higher the equity value will be.”

When asked whether this whole digital credit was simply a smokescreen, Saylor was quick to respond with an anecdote that “smoke comes from fire, so we need to harness the energy for the better.”

To the question on everyone’s mind, when would Michael Saylor sell his Bitcoin? The Strategy founder silenced the crowd by saying he continues to be a HODLer and is not getting rid of his Bitcoin despite the price swings.