Metaplanet became the first non- US Bitcoin treasury to hold a whopping 17,132 Bitcoins. It has topped the 10 corporate Bitcoin treasury charts.

The company’s latest purchase involved acquiring Bitcoin at an average price of 17,520,454 Japanese yen per coin, which is approximately $118,145. This recent acquisition cost Metaplanet around $92 million. Metaplanet has spent $1.7 billion to buy Bitcoin with an average cost of $99,640 per Bitcoin.

According to Nansen data, Bitcoin was trading at $118,171, which is slightly above Metaplanet’s latest purchase price. Bitcoin’s value has increased by 0.75% over the last 24 hours. As per sources, the firm may use its Bitcoin reserves to establish a bank in Japan.

Metaplanet Climbs Non US Treasury Ranks

With this latest acquisition, Metaplanet has solidified its position as the largest Bitcoin treasury outside of the United States. According to data from BitcoinTreasuries.NET, Metaplanet is currently the only non-U.S. company among the top 10 largest corporate Bitcoin holders globally.

Metaplanet ranks at seventh position in the top Bitcoin treasury globally. This positions them behind the Trump Media & Technology Group, which holds 18,430 BTC, but ahead of Michael Novogratz’s Galaxy Digital Holdings, with 12,830 BTC.

Earlier this month, Metaplanet also announced that it is planning to launch a Bitcoin backed stock as investors find this an attractive proposition.

Metaplanet’s Bitcoin Road

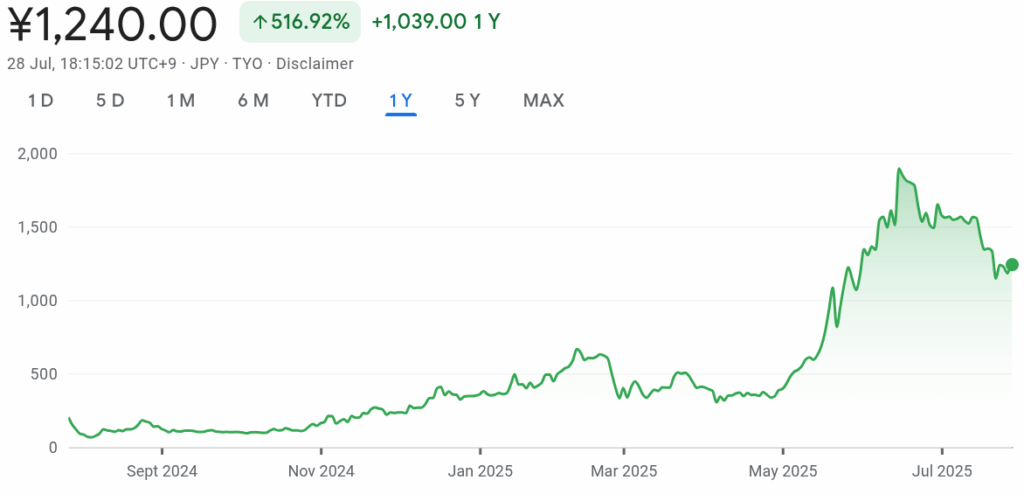

The firm’s decision to acquire Bitcoin for its treasury has proven to be fruitful as the firm’s stock price has also witnessed significant gains. The company’s shares have seen a substantial increase, rising by 517% over the past year and 246% since the beginning of the current year.

As of Monday, the stock price of Metaplanet was trading at $1240 Yen which approximates to $8.3

Source: TradingView

In an interview with Forbes Japan, Simon Gerovich, CEO, Metaplanet, said that he did not expect such rapid growth.

He said,

“In just a year, we became the country’s top-performing stock, with record trading volume and a ¥1 trillion market cap,“

Gerovich emphasized that the company isn’t merely mimicking Strategy; instead, they’re crafting a Japan-native model specifically designed for local regulations, taxation, and capital markets.

He further noted that the firm provides Bitcoin exposure that is fully compliant with Japan’s tax-free savings accounts, offering a unique and locally optimized approach.