- Top crypto mining firm MARA Holdings just reported $238.5 million in revenue for Q2 2025. It is a 64% jump from $145 million. .

- MARA Holdings, Inc. posted revenue of $238.5 million in Q2 2025, surpassing analyst forecasts of $223.7 million.

- The company’s net income soared 505% year-over-year to $808 million, a sharp turnaround from a $200 million loss in Q2 2024..

MARA Holdings’ Q2 revenue report is outstanding, demonstrating that Bitcoin mining can be highly profitable with advanced infrastructure.

The company’s revenue of $238.5 million exceeded analyst expectations of $223.7 million, while its net income surged 505% year-over-year to $808 million, a sharp turnaround from a $200 million loss in Q2 2024.

The income surge was primarily driven by a $1.2 billion unrealized gain from Bitcoin ( at $118,184) appreciation, with its value increasing 31% over the three months ending June 30.

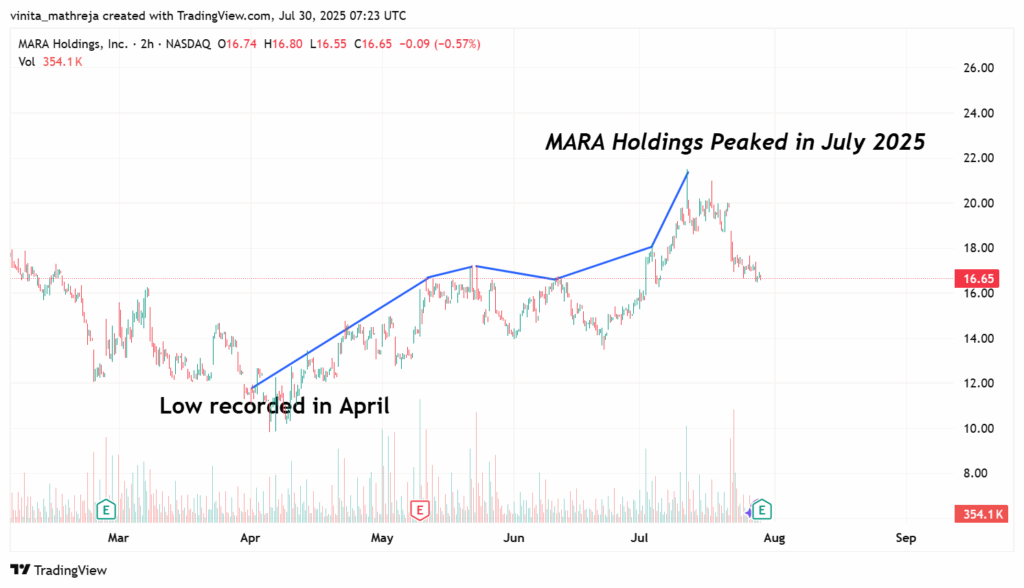

MARA Holdings Share Price Witnesses an Uptick

Following the earnings announcement, MARA Holdings (MARA) shares initially jumped as much as 7.5% to $17.82 in after-hours trading on Tuesday, before settling slightly lower at $17.22.

MARA ended Tuesday’s trading session down 3.2% at $16.61. Its stock has risen 58% since a mid-April low but has mostly moved sideways throughout much of this year.

Source: TradingView

MARA Holdings: Second Largest Corporate Bitcoin Treasury to Date

MARA announced that its Bitcoin treasury exceeded 50,000 BTC shortly after Q2, securing its position as the second-largest public corporate Bitcoin holder, trailing only MicroStrategy.

In Q2, MARA mined 2,358 BTC, a 3% increase from the 2,286 BTC produced in Q1. Its energized hashrate rose 6% to 57.4 exahashes per second (EH/s) from 54.3 EH/s in the prior quarter.

The mining firm’s Bitcoin holdings surged 170% to 49,951 BTC, valued at approximately $5.3 billion by the end of June. As of now, the firm’s Bitcoin treasury is worth $5.87 billion, second only to MicroStrategy’s 607,770 BTC, valued at $71 billion.

Shifting Focus Towards AI Growth

MARA unveiled partnerships with Google-backed TAE Power Solutions and LG-backed PADO AI to co-develop grid-responsive, load-balancing platforms for advanced AI infrastructure.

Fred Thiel, CEO, MARA Holdings commented on this shift,

“Our vertically integrated mining operations, large BTC treasury, budding international energy partnerships, and early AI infrastructure investments each contribute distinct and measurable value,”

The company aims to reach 75 EH/s by the end of the year and is capitalizing on opportunities in the expanding AI and data center market.