Just days after reaching an all-time high of $124,400, Bitcoin experienced a sharp decline to $112,900, a nearly 9.2% drop that surprised many investors and triggered renewed debate within the crypto community. According to Glassnode’s latest report, this sudden pullback may signal a weakening of Bitcoin’s historically strong post-halving momentum.

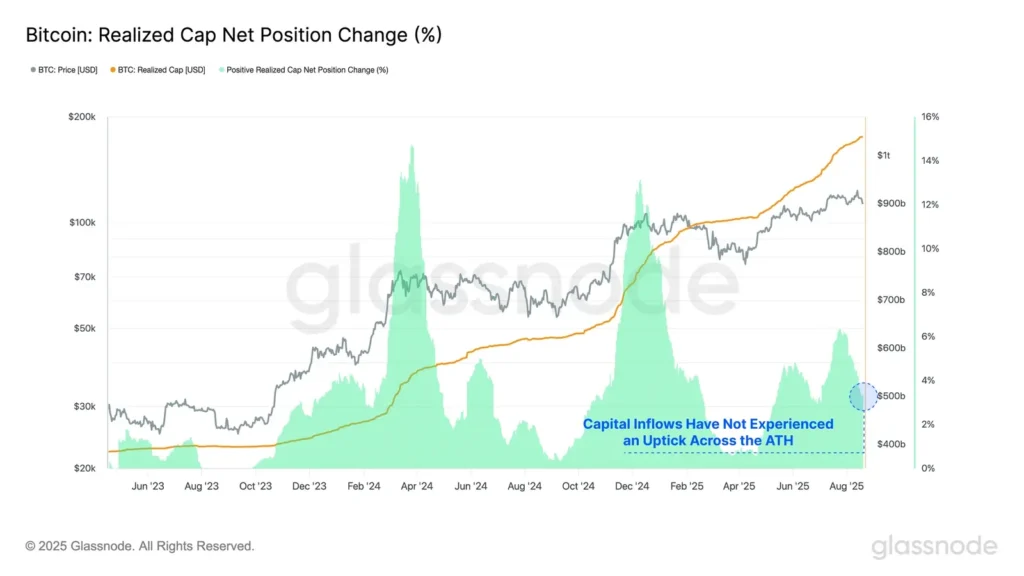

The report highlights slower cash inflows compared to previous cycles, with new investment growth dropping from 13% to just 6% monthly. This cooling demand, combined with rising market leverage and increased selling at a loss, suggests that Bitcoin’s recent price surge is facing growing resistance and raises questions about the sustainability of its rally and whether the traditional four-year halving cycle still holds.

Investors seem hesitant to pour fresh money into the cryptocurrency at these high prices, leading to slower cash inflows compared to previous surges, the report notes.

When Bitcoin first crossed $100,000 in late 2024, new investments flowed in at a strong 13% monthly rate, according to the analysis by Glassnode. Now, that growth has cooled to just 6% per month, signalling less excitement from buyers. This slowdown suggests investors are more cautious about jumping in at current levels.

The report notes a decline in profit-taking compared to earlier peaks this year. In 2024, when Bitcoin surged past $70,000 and later $100,000, and again at $122,000 in July 2025, many investors locked in gains by selling, yet the market absorbed the supply with ease. This time, however, even with fewer sellers, Bitcoin is struggling to push higher, suggesting demand may be weakening.

Rising Losses and Leverage Show the Fragility in Bitcoin Markets

As prices dip, some investors are selling at a loss, with daily losses reaching $112 million, per Glassnode’s findings. This is normal for temporary dips in Bitcoin’s ongoing upward trend. Bigger sell-offs, like those during August 2024’s currency market shifts or March-April 2025’s trade policy concerns, saw much heavier losses. For now, most investors remain confident, but rising losses could signal growing unease.

In the futures market, where traders use borrowed funds to speculate on Bitcoin’s price, open positions currently total $67 billion, reflecting significant market leverage. According to Glassnode, the recent price decline wiped out $2.3 billion in these positions, marking one of the largest losses in recent weeks. It also highlights the vulnerability of the highly leveraged markets to even modest price movements.

While some traders closed losing positions with $74 million near the recent peak and $99 million during the sell-off, these amounts are smaller than losses seen during earlier periods of volatility this year. This indicates that many participants were able to exit their trades in a more controlled manner rather than being forced out by sudden and large losses.

Speculation Shifts to Altcoins as Bitcoin Matures

Other cryptocurrencies, like Ethereum, Solana, XRP, and Dogecoin, are drawing attention too. Their combined futures bets hit a record $60.2 billion over the weekend, nearly matching Bitcoin’s total. However, following a recent price dip, these altcoins also experienced a significant $2.6 billion decline in futures positions, highlighting increased market volatility and heightened sensitivity to price swings in these coins.

Daily losses in altcoin futures markets skyrocketed to $303 million, which is more than double those in Bitcoin futures. Glassnode’s report highlights this as a clear sign of intensified speculative activity, with traders heavily leveraging positions on Ethereum, Solana, XRP, and Dogecoin amid Bitcoin’s slowing post-halving surge. This frenzy for higher-risk altcoins is driving amplified market volatility, exposing investors to significant liquidation risks and reflecting a shift in sentiment as capital chases potentially bigger returns beyond Bitcoin’s more mature market. The scale and speed of these losses underscore just how sensitive and precarious altcoin markets have become in the current cycle.

Ethereum is grabbing the spotlight, now accounting for 43.3% of futures bets compared to Bitcoin’s 56.7%, one of its highest shares ever. Trading activity in Ethereum futures has soared to 67% of the total, a record high, according to Glassnode. This shift shows investors chasing riskier opportunities, especially since Ethereum attracts big institutional money.

Examining previous market cycles, Bitcoin’s price peaks during the 2015-2018 and 2018-2022 periods occurred approximately 2 to 3 months later than the current point in this cycle. While historical trends don’t guarantee future outcomes, this timing is an important reference.

For the present cycle, Bitcoin’s supply held in profit has remained consistently high for 273 days — the second-longest stretch ever recorded. Meanwhile, long-term holders have realized more profits since the latest cycle peak than in almost all previous cycles, second only to the 2016-2017 cycle, indicating significant profit-taking by experienced investors.

These signs suggest Bitcoin is in a late stage of its current run, but every cycle has unique twists. Investors wonder about a few things. Will the traditional four-year cycle hold, or is something new unfolding? The months ahead will provide answers. For now, common investors should stay cautious, monitor renewed buying interest, and watch speculative bets in Bitcoin and other coins, as outlined in Glassnode’s report.