At the WebX Asia event held in Japan, Adam Back, the CEO of Blockstream emphasized that the current financial system is facing pressure as more mobile systems and currencies have come into existence.

Coin Medium was the media partner for the event and we have a detailed summary of his outlook towards Bitcoin and how his firm Blockstream is making a big impact for Bitcoin for business.

Pressures on the Current Financial System

Back opened by highlighting inefficiencies in traditional finance. In the U.S., issuing securities can take up to 10 days to sell and weeks to trade.

In Switzerland, regulated issuances or IPOs may drag on for 9 to 18 months.

The legal and technical frameworks underpinning these processes are outdated and slow, especially in a world where mobile-first platforms, digital assets, and global distribution demand speed and flexibility.

A Layered Approach to Financial Technology

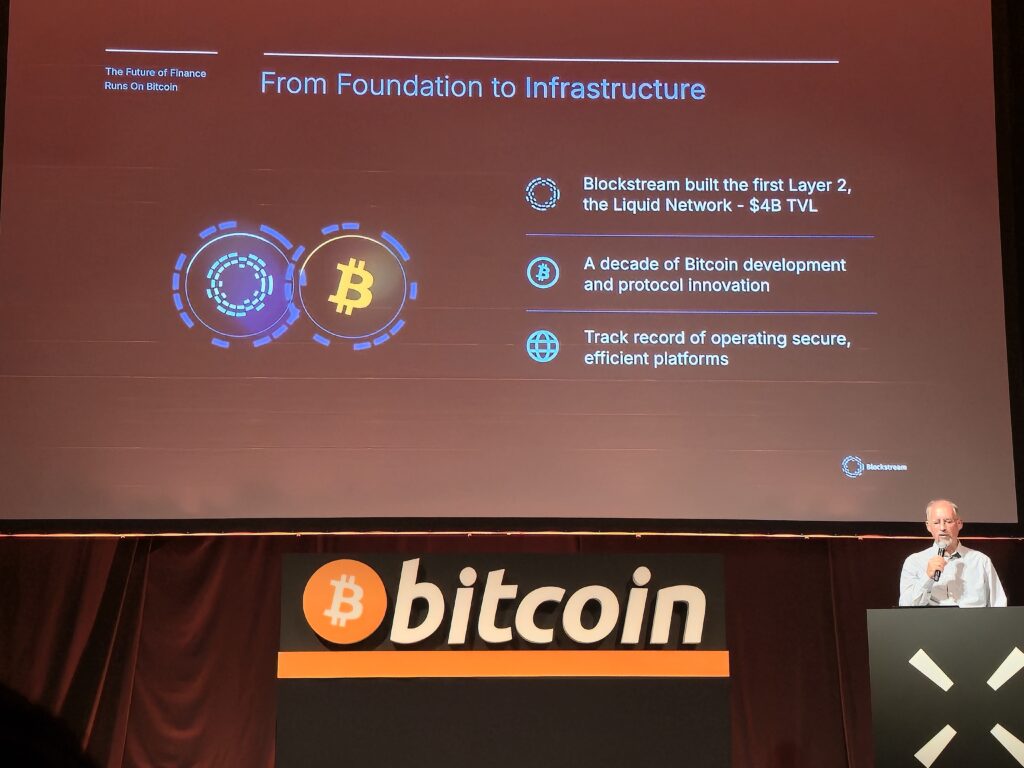

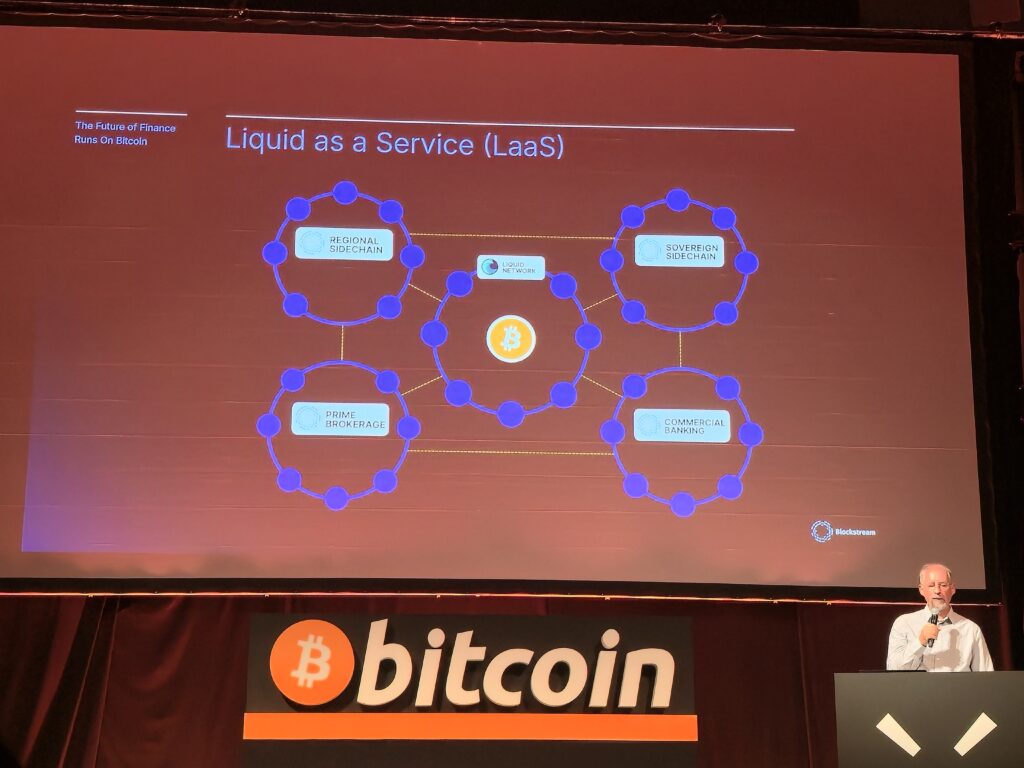

According to Back, Bitcoin is not just an emerging asset class but also a platform that can enhance existing financial system network mechanisms. Blockstream’s approach is a layered one, with Bitcoin as the foundational baseline.

Back highlighted the inefficiencies of traditional finance, noting that in the U.S., a $30 billion issuance can take 5 to 10 days to sell and 1 to 3 weeks to trade.

In Switzerland, a regulated issuance may take 3 to 6 months. He contrasted this with the Bitcoin ecosystem, which has grown from a $3.4 billion market cap a decade ago to $2.4 trillion today.

Blockstream sees Bitcoin as a “full stack offering system” with more capabilities than many realize.

Back highlighted that the company’s technology is built on a layered architecture:

- Bitcoin as the baseline: The core layer for financial instruments and payment-compatible technology.

- Liquid as a Layer 2: Liquid is a Bitcoin layer-2 solution that enables the issuance of securities and offers confidentiality for commercial purposes. It is an environment for issuing real-world assets, with approximately $4 billion worth of such assets already on the network.

The Future with Blockstream’s Simplicity

While Bitcoin’s network has a robust scripting system, it also has limitations. To address this, Blockstream has been developing a more flexible system called Simplicity for the last eight years.

Simplicity, which is now viable on the Liquid Bitcoin Layer 2, provides more programmability in a security-focused way.

The company is also enabling businesses to safely and securely custody both Bitcoin and tokenized assets.

Back believes that companies that capitalize on integrating Bitcoin into their financial systems first will reap the benefits. This includes the ability to move financial assets on dependable Bitcoin-related rails.