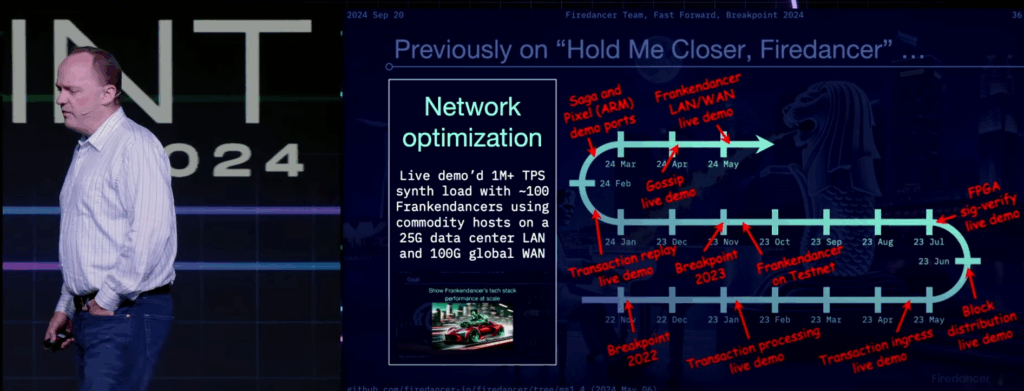

- Firedancer is an independent client validator designed by Jump trading in collaboration with Solana foundation. .

- The client is designed to increase TPS, reduce latency and enhance the network efficiency.

- Agave is the main validator client on Solana and handles over 90% of the network transactions. Firedancer’s Frankendancer is still in its transitional phase and it combines Agave’s infrastructure with its own.

Solana’s firedancer is the highly anticipated next-generation validator client, promising a massive boost in speed, but it might not reach its full potential on the very network it was designed for. The technical limitations within Solana are pushing developers to explore alternative environments to truly unleash Firedancer’s capabilities. Earlier this month, Solana’s block capacity was up by 20%

Solana’s Firedancer Compared To Ferrari

Douglas Colkitt is currently building Frankendancer – a hybrid validator. Frankendancer’s hybrid design enables a smooth transition to Firedancer’s upgrades, ensuring network stability isn’t compromised during adoption.

Colkitt says,

“If you have two clients running on the same network, you can only go as fast as the slowest client because otherwise the network risks halting.”

Solana’s strength comes from its globally distributed validators, which boost security by preventing single points of control. This geographic spread also enhances censorship resistance and makes the network more resilient to outages or attacks.

Solana’s Firedancer: Real-World Test Outside The Chain

Colkitt stepped in ‘DeFI Summer’ and he worked with an automated market maker on Ethereum and popular blockchain roll ups. He eventually left the Ethereum ecosystem, explaining that “the Ethereum chains weren’t sufficient for what we wanted to do.

Despite Solana’s relative youth (its first block was produced in March 2020), traditional financial institutions are still hesitant to adopt newer blockchain platforms. Colkitt noted that banks remain primarily comfortable within Ethereum-compatible ecosystems.

He also pointed out that projects like Hyperliquid are pushing the envelope for blockchain infrastructure.

He commented on Hyperliquid,

“Hyperliquid owns 90% plus of the market in decentralized perpetuals trading,” But that kind of ultra-low latency, high-throughput trading experience just doesn’t reliably work on Solana today because of block times and network stability.”

Fogo, which launched its testnet this Tuesday, leverages Solana-based technology, including the Solana Virtual Machine (SVM), to compete with high-speed chains like Hyperliquid. This makes Fogo compatible with existing Solana projects.

It currently operates on Frankendancer, with plans to fully transition to Firedancer when it’s ready, which will unlock the validator client’s complete potential. Colkitt estimates this transition could happen by the end of this year, with Fogo’s mainnet launch targeted for September.

Solana’s Firedancer Versus Other Chains’

Next-generation, low-latency networks like Fogo and Hyperliquid are pushing boundaries to meet the speed demands of modern trading.

Projects like MegaETH also promise near-instant transactions for emerging sectors such as decentralized physical infrastructure networks, which require real-time execution.

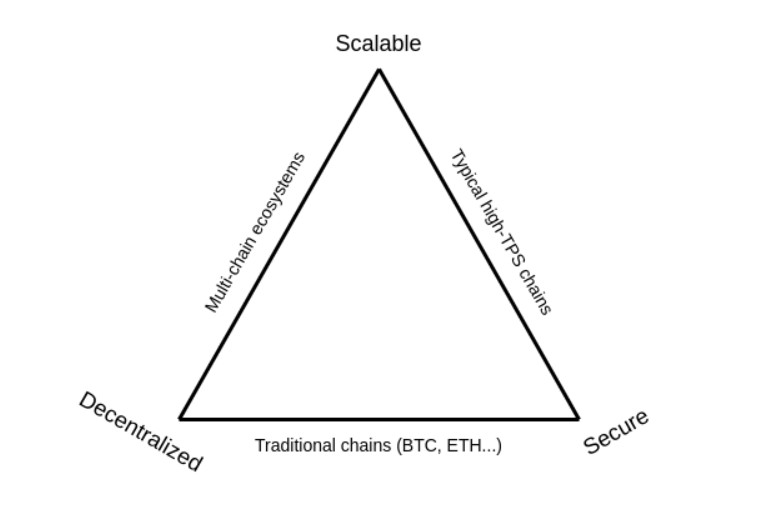

These chains are all united by a willingness to make trade-offs, specifically by reducing decentralization to achieve greater scale—a core concept in Vitalik Buterin’s scalability trilemma.

Colkitt explained that they have set client validators across global key cities like Tokyo, London, and New York.

He explains the logic behind this set up,

“By co-locating validators closer together geographically, we can push Firedancer to achieve much faster block times than Solana’s globally distributed validator set allows.”

Firedancer’s true capabilities will likely never be fully realized on Solana itself, as Solana’s commitment to a global validator set and decentralization acts as a constraint.

However, Solana isn’t stagnant; its recently unveiled 2027 roadmap aims to bring the blockchain closer to traditional finance standards, indicating ongoing efforts to improve performance within its existing framework.