Aster (ASTER), a leading decentralized perpetuals exchange token surged 32.86% in 24 hours after its CEO confirmed testing of a new product, Aster Chain, currently in development. Features of the new chain include sub-second finality, native perp integration, low fees, and a token buyback program designed to raise the value of Aster tokens for investors.

Aster Chain: From Rumors to Testing Phase

Rumors of Aster’s blockchain went viral on X and on-chain sources confirmed it would go into testing. The goal is to enhance the ASTER ecosystem’s DeFi capabilities through Aster Chain, supported by endorsements, including CZ’s YZi Labs. This news comes just a day after Aster handled a 24-hour perp volume that surpassed Hyperliquid, which has already caused a fair bit of excitement across the markets.

Key features

- Sub-second transaction finality for speed.

- Native perpetuals for seamless trading.

- Buyback program to increase token scarcity.

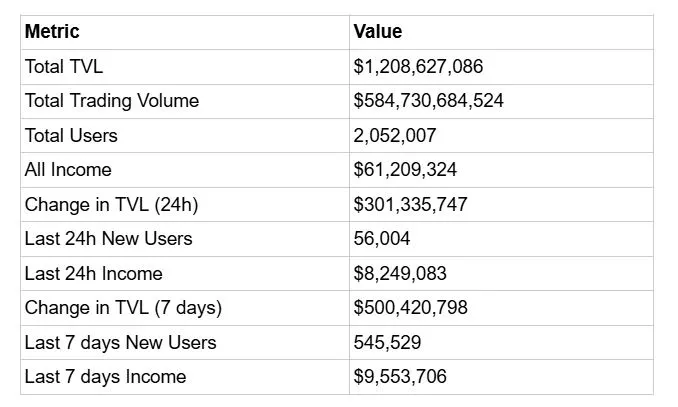

The total TVL for the network has marked a new milestone of exceeding $1.2B, with the inflow in the last 24 hours being $301M alone. For the past 7 days, over $500M in inflows highlights the rising investor confidence in the Aster ecosystem.

As the network grows, the user adoption aligns with the same and has now valued 56,000 new users in the last 24 hours and more than half a million in the past week.

Income metrics continue to support this trend. Daily income is at $8 million, with weekly income approaching $10 million, which is an indication of active participants engaging with the ecosystem as well. All of this suggests not only that the Aster ecosystem is demonstrating healthy liquidity growth, but also increasing user engagement for a vibrant and active Aster ecosystem.

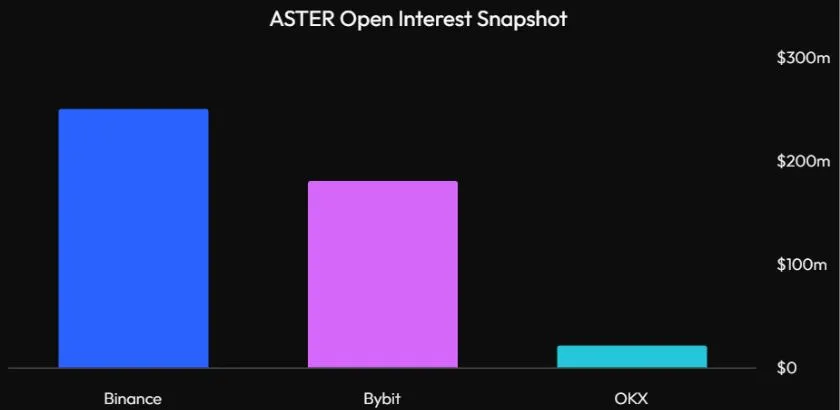

The ASTER Open Interest indicates a burst of activity in the Aster ecosystem across the main exchanges. Binance holds the highest open interest at a value of $249.44M. Bybit follows closely at $179.73M, and finally, OKX has an open interest of $21.41M.

ASTER Token Price: Bullish Trend

ASTER trades at $2.267 at the time of writing and marked a rise of nearly 30% in the past 24 hours, with market capitalization surging to $3.73B. The 4-hour RSI is at 77.47, suggesting that price has now entered the overbought region.

The current price trend shows:

- Uptrend with higher highs/lows.

- A breakout and closing in 1 day above $2.30 could hit $2.50+.

- The support zone stands at $1.995 if the price loses momentum.

Will ASTER do a new ATH or touch its support first? What do you think?